The Burrow

With an income protection insurance policy, you could receive up to 70% of your pre-tax income in the form of monthly payments if you find yourself unable to work due to injury or illness and meet the required eligibility criteria.

When you’re in a situation where you are unable to work and retain a steady income stream, this can be an immense help for getting you back on your feet, continuing to pay bills on time and maintaining your existing lifestyle.

As experts in income protection insurance, we like to understand how an average income situation looks week-to-week and how spending habits can vary between people. That’s why we ran a survey to see what people spend in an average pay cycle. We’ve surveyed Australians and Americans to discover how much they spend on non-essential items each month, as well as how much they save, how quickly they spend each pay check, and how often they have to dip into their savings before payday or rely on credit. From here, we are able to theorise just how difficult of a situation you could be in if you found yourself unable to work and maintain a sensible financial safety net.

So, buckle up, because it’s going to be an interesting ride…

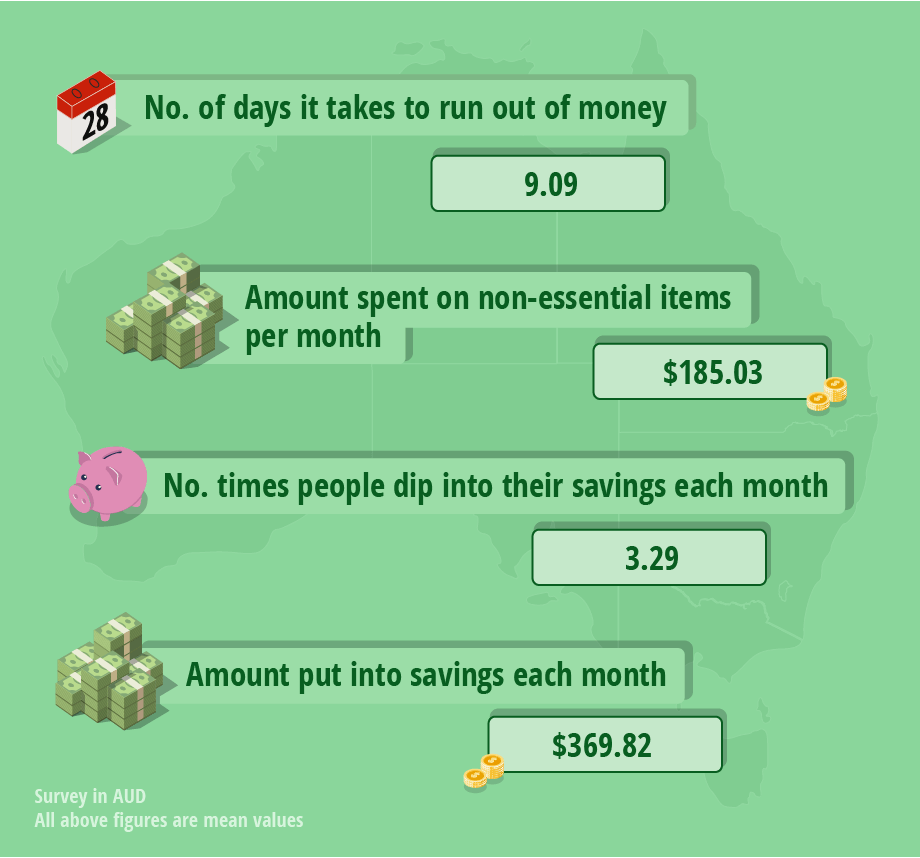

Once Australians have their paycheck, it takes an average of just 9.09 days for them to spend it all. On average, each person puts approximately AU$369.82 into their savings every month, but then will need to dip into it roughly 3.29 times before the next payday. Approximately $185.03 is spent on non-essential items every month, with the most popular being eating out or takeout, clothes, shoes and accessories as well as cigarettes and alcohol.

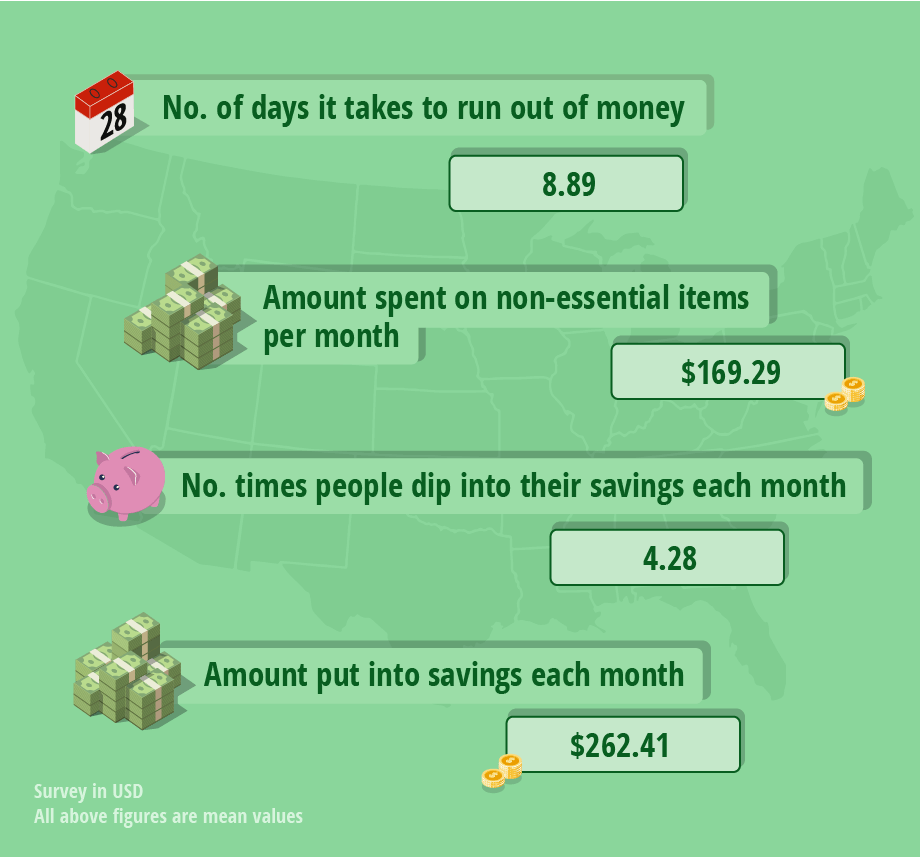

For Americans, it takes just 8.89 days after payday for them to run out of money, meaning they dip into their savings approximately 4.28 times every month. Not only that, but Americans also put less into their savings each month (US$262.41) than Australians, and spend more on non-essential items (when comparing the figure in the same currency).

Worryingly, almost 30% of Americans spend their paycheck in less than six days of getting it. When it comes to spending money on non-essential items, most people splurge on takeaways and eating out, followed by clothing, and then cigarettes and alcohol.

Over 15% of Americans can’t afford to put any savings away, and nearly 35% of people can only afford to put away a maximum of US$100 a month. For 4.25% of Americans, it’s not unusual to dip into their savings every day to cover the cost of their spending on non-essential items.

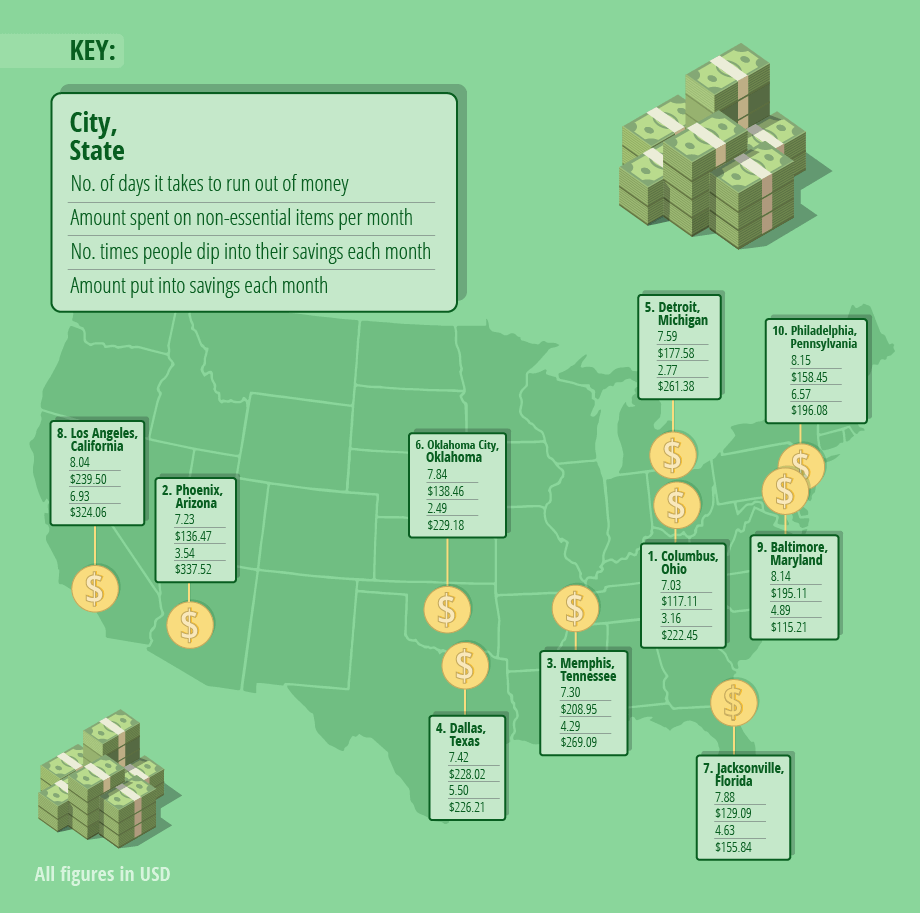

For residents of Columbus, Ohio, monthly paychecks only tend to last around 7.03 days, with Phoenix, Arizona; Memphis, Tennessee; and Dallas, Texas not far behind.

Citizens of Los Angeles, California spend the most on non-essential items out of those in the top 10 biggest spending cities, at US$239.50 per month.

At the other end of the spectrum, Fort Worth residents, Texas, are the savviest with their spending, splurging just US$106.15 per month on non-essentials – the lowest of all cities – closely followed by residents of Seattle, Canada and Columbus, Ohio.

When it comes to saving, San Antonio, Texas is all over it, putting away an impressive US$631.96 each month; followed by Las Vegas residents, who put away just under US$40 less a month. In contrast, those in Louisville, Kentucky put away the least amount of money a month (US$114.40), followed by Baltimore, Maryland and Charlotte, North Carolina.

Residents of Houston, Texas dip into their savings the most, transferring money out their savings accounts around 7.82 times a month, followed by Los Angeles and Philadelphia. Indianapolis residents are much savvier, accessing their savings only around 1.44 times a month to cover the cost of their non-essential splurges, with San Francisco also dipping into their savings less than twice a month.

Whilst it’s nice to treat yourself to that new dress or not cook in favour of a takeaway, if you find you’re taking more money out of your savings than you’re putting in, it’s time to make some changes. These three tips can help you to start seeing your savings rise.

Before your payday, calculate your necessary outgoings: this means mortgage/rent and any bills, as well as money for food shopping, the gym, etc. Once you’ve worked out how much you need to set aside, you can then divide up the rest between saving and spending – making sure that you actually set your saving money aside, instead of accidentally spending it!

Once you’ve worked out how much you can afford to put into your savings each month, set up a standing order on each payday so that your designated amount is automatically transferred into a separate savings account. With it not being physically available for you to spend on non-essentials, you’ll start to forget you had that extra money – meaning you’ll be pleasantly surprised when you see how much your savings have grown!

Whilst it’s great to save, if you deprive yourself of all nights out, takeaways and holidays, you’ll start to resent it. If you can afford to, set yourself a pot of money aside each month that you can dip into for those non-essential extras. Just $50 will cover the cost of a couple of meals out and give you something to look forward to!

Of course, you never expect the worst to happen, but it’s always better to be safe than sorry. Income protection can help you maintain a wage should you have to stop working, provided the reason is included within your plan, so you don’t have to worry about having more outgoings than incomings.

A survey of 503 Australians and a survey of 1,510 Americans were carried out by Censuswide in September 2021.

Brought to you by the experts at comparethemarket.com.au