The Burrow

Car insurance policies are designed to provide cover for if the worst happens. For example, if you find yourself the unlucky victim of a car accident or your car gets stolen, you can lodge a claim with your insurer to be compensated for any loss or damages.

However, there are also specific things that your insurer won’t provide cover for. As car insurance experts, we wanted to shed light on some of the general exceptions that could lead to a claim being denied. It’s good to keep in mind, though, that each policy varies and will have different limits and restrictions. We suggest reading the Product Disclosure Statement (PDS) before making your purchase, where detailed information on your inclusions will be specified.

So, what may not be covered? Well, one of the biggest things that could affect your ability to claim is your driving behaviour. If you get into an accident, and it is determined that it was due to illegal driving behaviour (such as drink driving or speeding), your insurer may not cover the claim. That’s because, when an insurance company agrees to provide you cover, they are working under the assumption that you will be operating safely and in accordance with road rules. Not abiding by these conditions of cover could contradict what you agreed to (as per your PDS). This may cause your insurer to deny your claim.

With this in mind, we were curious to know just how many people could be at risk of having their claim denied, based on their driving behaviour. That’s why we conducted a survey of more than 2,260 Australians and North Americans, where we asked about their understanding of common road rules. Our results show where each country’s most knowledgeable drivers live and that you might want to be extra careful when crossing the road – particularly in Maryland or South Carolina, USA!

We asked our survey respondents to correctly identify three simple road rules:

Maryland and South Carolina really stuck out, by being the most common US states for people to admit they don’t know. Here’s how that looks next to the US average.

We initially asked about the legal limits surrounding safely passing a cyclist on the road. Out of all the states we asked, legislation in 15 of them note that they do not have any safe passing distances for cyclists, while Pennsylvania is the only state with a 4 feet wide berth needed.1 The remaining states have a 3 feet minimum safe distance.2 Worryingly, our results show that just under three fifths (58.45%) of the US population don’t even know if there is a minimum distance between an overtaking vehicle and a cyclist.

Cyclists can feel safest in Maine, where just less than half (47.92%) of people surveyed knew to keep 3 feet when overtaking, while in both North Carolina and Indiana only 5.88% people (respectively) were able to correctly identify the rule. Also, only one fifth of the Pennsylvanian population knew to keep a 4 feet wide berth when overtaking a cyclist, whereas half of the state’s population did not know that there was a legal minimum distance.

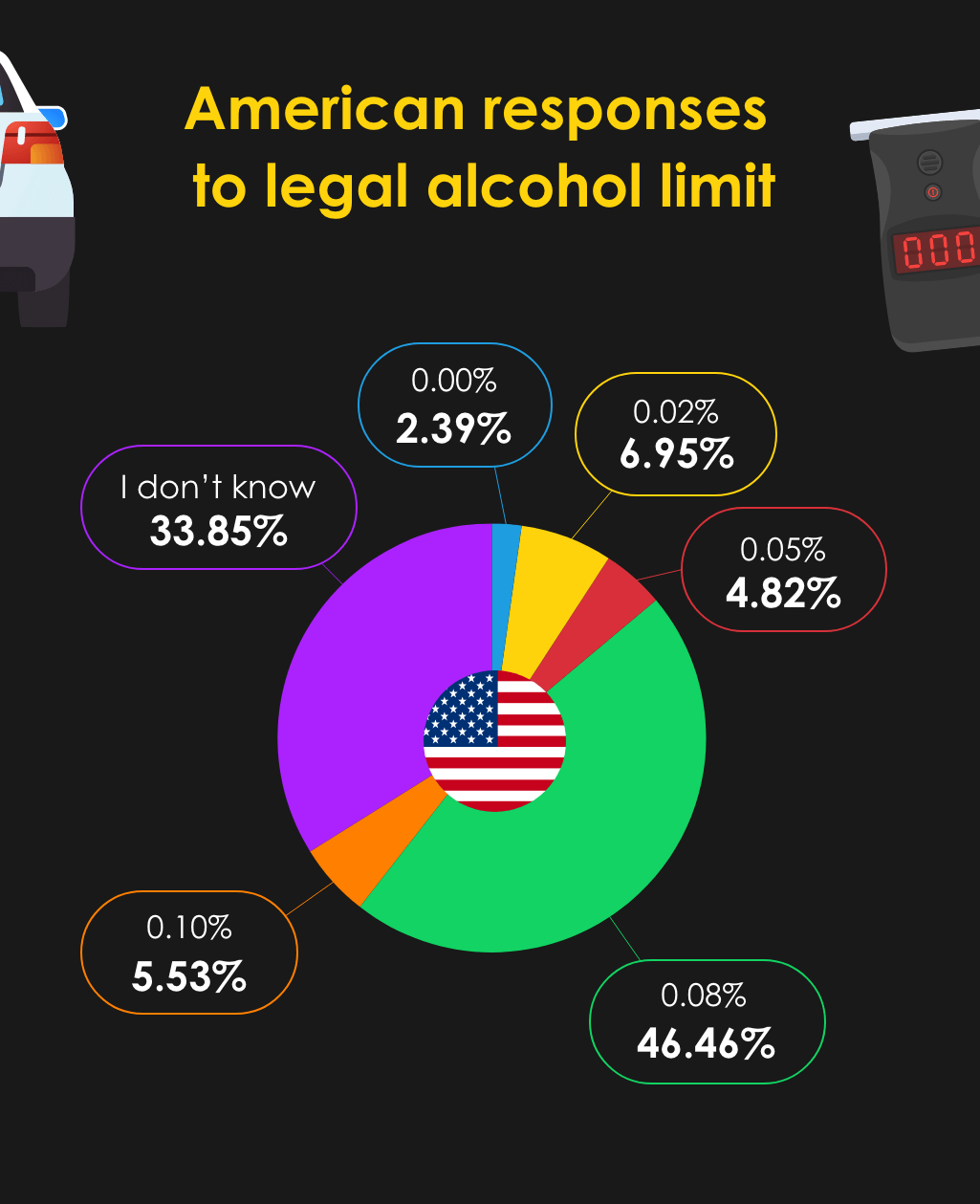

Next, we asked about the legal blood alcohol content (BAC) level that you can have while driving on your full licence. While most states agreed that the limit is 0.08% (or 0.08 grams of alcohol for every 100 millilitres of blood), Utah has a stricter law with a BAC of 0.05%.3 Almost half the population surveyed (46.46%) know about the 0.08% limit, however less than a quarter (23.53%) of Utah residents know that they have a stricter law.

A third of Americans might also be hitting the road tipsy on the regular with as many people admitting that they don’t know the legal blood alcohol level. This number jumps dramatically with just less than half (49.02%) of both South Carolina and Virginian drivers being the worst offenders (i.e., not knowing). The most informed drivers come from Idaho, where almost two thirds of residents indicated that they are aware of the blood alcohol limit.

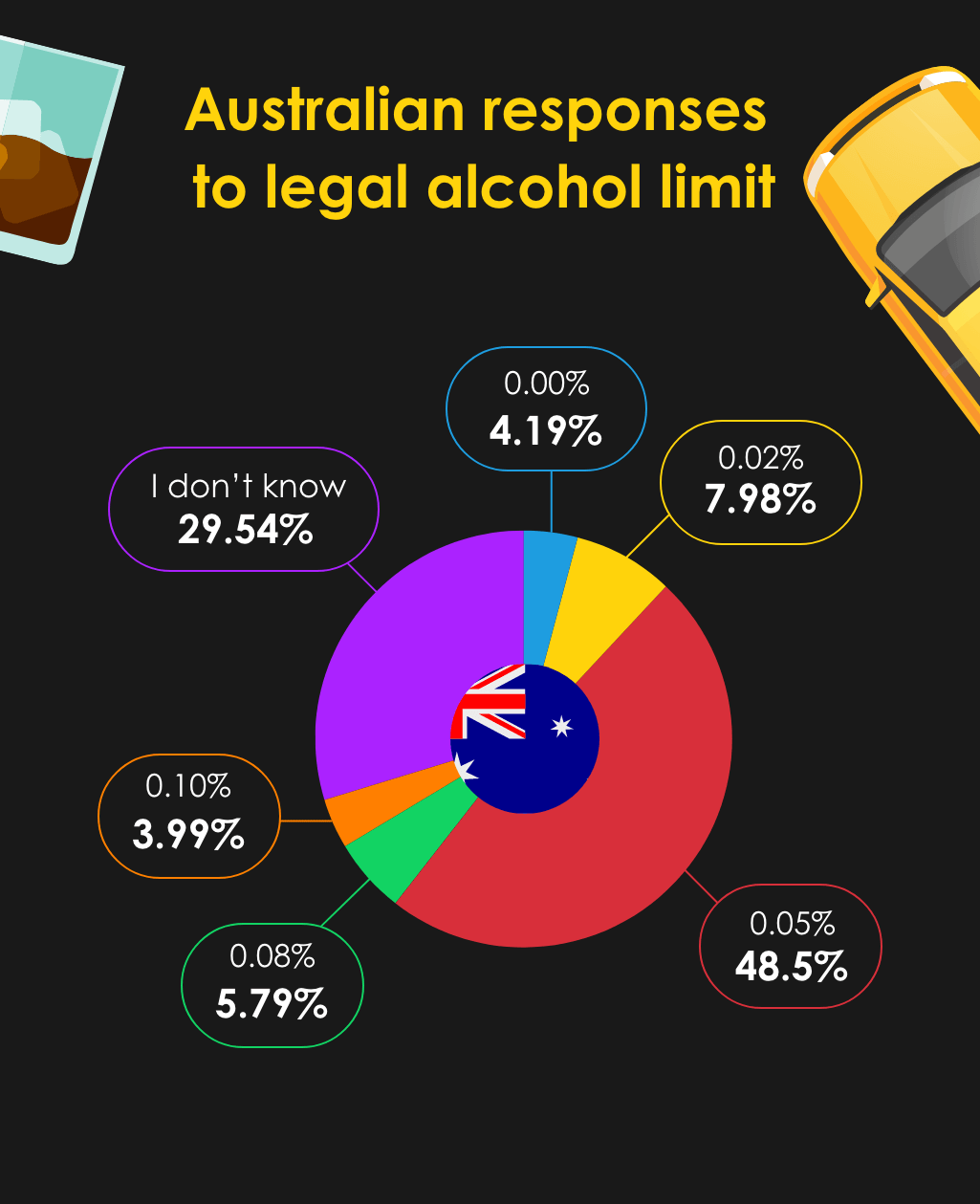

We also asked Australians about the legal blood alcohol content limit, and almost equally, only 48.5% of Aussies could correctly identify the legal limit at 0.05%.4 Concerningly, almost 30% of Australian drivers surveyed admitted to not knowing the legal limit.

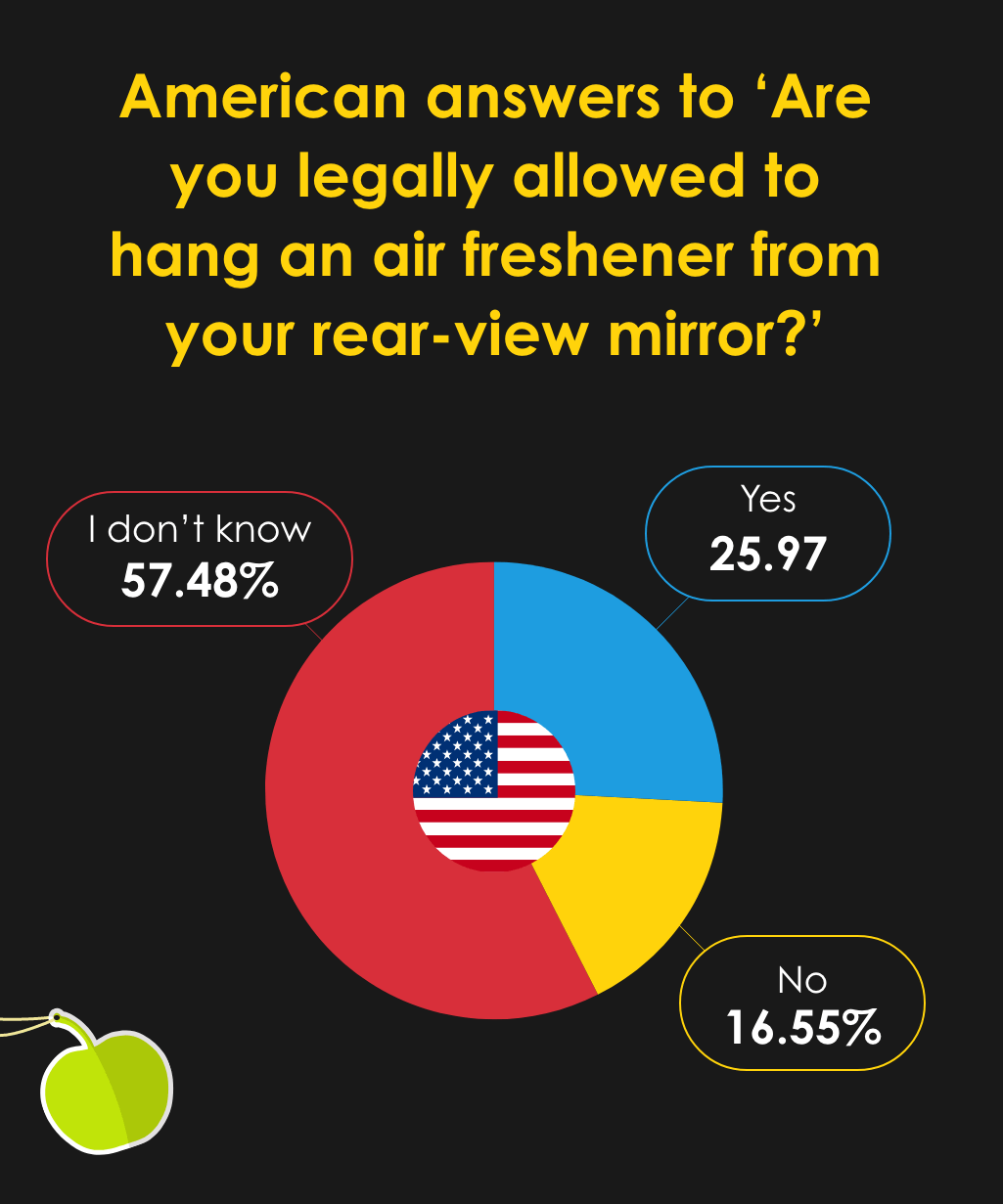

Fluffy dice may be a retro car staple but they can pose a dangerous distraction. When looking at state laws, most states say it is illegal to have items that obstruct the view (either the front windscreen or the back), but the interpretation of that law pertaining to air fresheners is still up for debate.More than half (57.48%) of Americans were unsure about the legality of hanging air fresheners.

Oregon drivers were the most confused about the law concerning air fresheners with 3 in 4 people not knowing their state’s stance, whereas 42% of Kentucky drivers, the highest of any state surveyed, were adamant that they were allowed to hang air fresheners in their car. Minnesotans were more conservative, with over 40% of drivers sure that they were not allowed to have their favourite air freshener hanging.

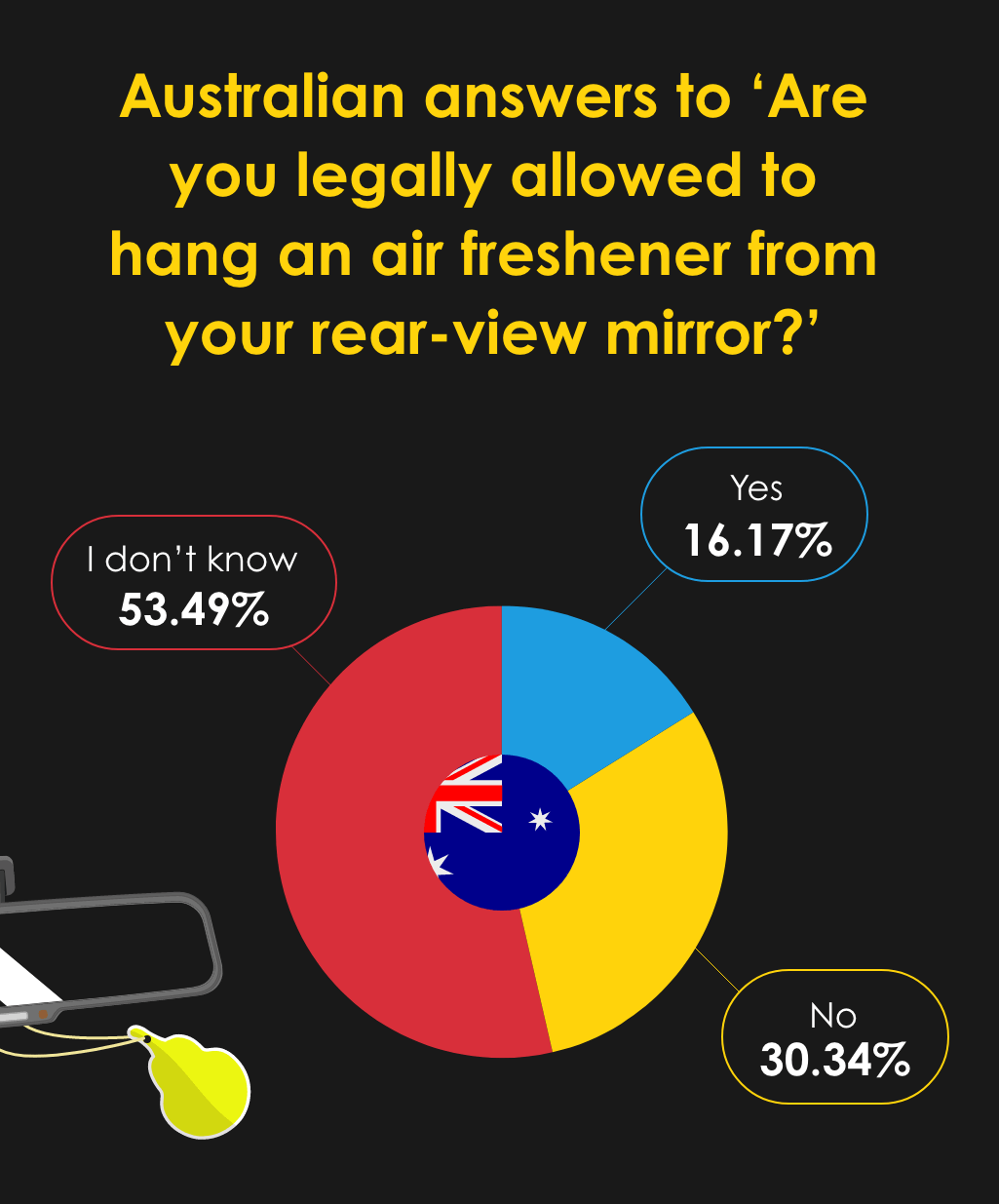

Australians (53.49%) were equally confused about the legalities. Like America, there are no specific rules that spell out whether air fresheners are allowed, but it is covered under the Australian Road Rules regarding driving with a clear view of the road.5

One thing that is clear (besides our windscreens) is that most people need to brush up on their road rules across both nations. Maryland and South Carolina drivers, in particular, could do with a few more nights reading up on their state driver manuals. And while we feel validated in knowing the rules, as most of us have years if not decades behind the wheel, it’s important to know the actual rules that we should be adhering to while on the road.

Compare the Market commissioned Google Surveys to survey 501 Australian adults and 2,260 American adults throughout October and November 2021.

Disclaimer: Responses from Alaska, Hawaii, New Hampshire, Rhode Island and West Virginia were not included in the above survey as there were not enough participants from these states to collect statistically significant data.