The Burrow

What are our biggest health concerns?

There are many things that can weigh on our minds when it comes to our health. It could be a certain condition affecting us or a loved one, a family history of illness, or even cancer. Other concerns could be the cost of affording healthcare or having to endure a long waiting list. Sometimes it could be multiple issues at the same time.

To find out what some of our most prominent concerns are, the health insurance experts at Compare the Market ran a survey, asking over 3,000 adults across Australia, the USA and Canada what their biggest health concerns are.

Here’s what they told us.

A clear leading concern across all three nations was a potential cancer diagnosis. In the USA, as many as 41.6% of respondents listed it as a concern, followed by 39.4% expressing the same worry over the risk of someone they care about being diagnosed with cancer.

Canadians responded with a similar breakdown. The number one health concern in Canada was the risk of someone I care about falling ill with a serious disease, at 45.7%, and the risk of being diagnosed with cancer was the second-biggest issue for 44.4% of respondents.

It was slightly different for Australians, where the risk of a loved one getting a serious disease was the number one issue, according to 49.2% of respondents, followed by a loved one’s cancer diagnosis at 48.5%. A personal cancer diagnosis was the third-biggest medical concern, as noted by 48.1% of Australians surveyed.

On the other hand, the issue of least concern for Australians and Canadians was not being able to afford necessary healthcare. In the USA, it was long waiting lists for an appointment or surgery.*

| Which health concerns are you worried about? | Australia | USA | Canada |

| The risk of someone I care about falling ill with a serious disease | 49.2% | 38.1% | 45.7% |

| The risk of someone I care about being diagnosed with cancer | 48.5% | 39.4% | 44.1% |

| The risk of being diagnosed with cancer | 48.1% | 41.6% | 44.4% |

| The risk of falling ill with another serious disease | 42.1% | 37.5% | 41.3% |

| The risk of significant physical injury to someone I care about | 38.7% | 37.8% | 34.4% |

| Long waiting lists for a necessary surgery/medical appointment | 36.9% | 14.3% | 36.2% |

| My stress levels impacting my health | 36.8% | 29.8% | 34.3% |

| The risk of significant physical injury to myself | 34.5% | 35.2% | 31.7% |

| Not being able to afford the healthcare I need | 32.6% | 22.8% | 23.9% |

| None of the above | 12.8% | 18.8% | 12.3% |

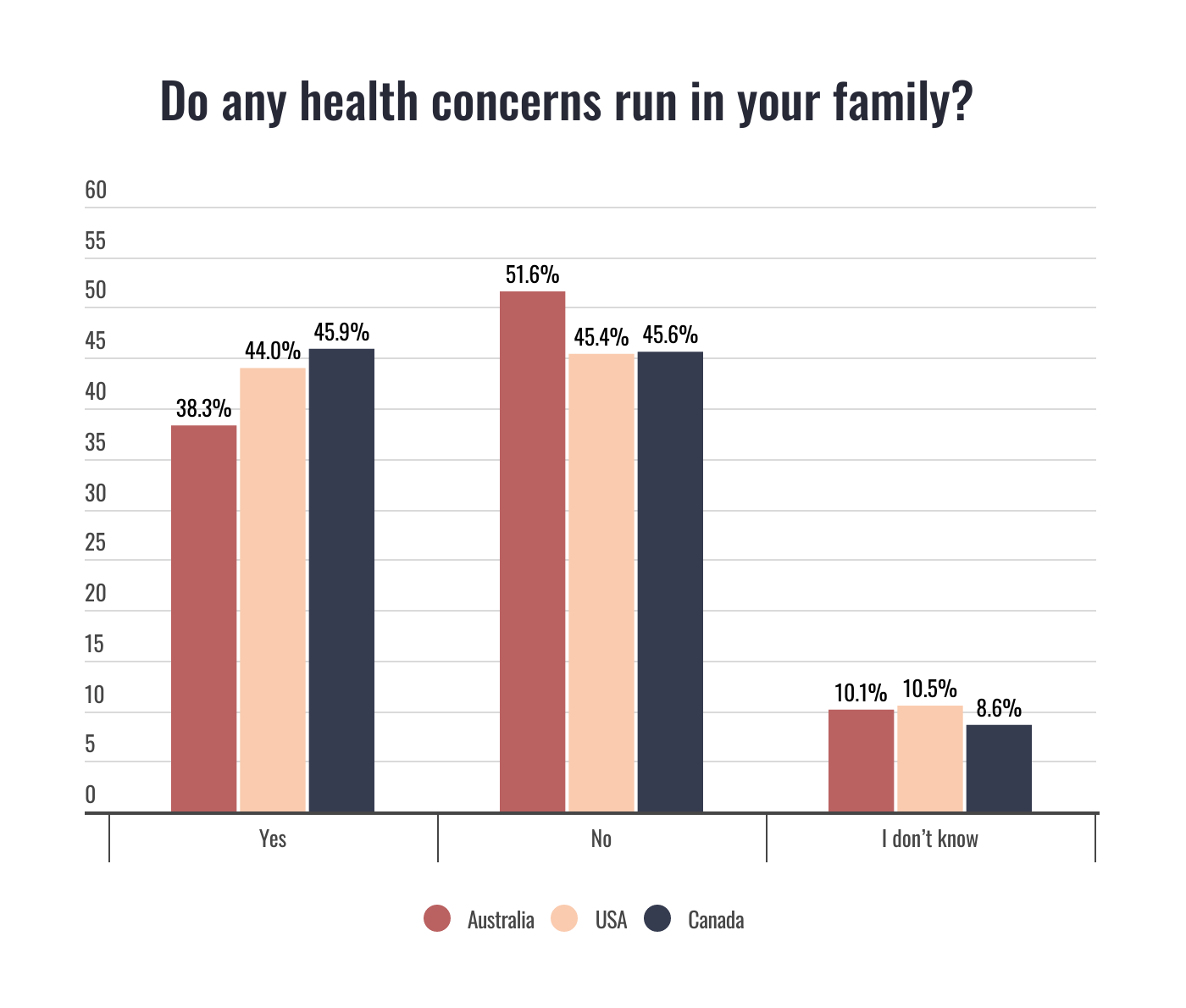

For all those respondents who had at least one health concern, Canadians were the most likely to say they had a family history of that health issue. Almost half of Canadian respondents said their health concern runs in the family (45.9%), with American respondents not far behind at 44%.

On the other hand, Australians who have a medical concern are less likely to have a family history of it. Only 38.3% of Australians said their family history included their specific health concerns, while 51.6% said there was no family history

Compare the Market’s Head of Health Insurance, Lana Hambilton, notes that with the top concerns often being about loved ones receiving a cancer diagnosis or serious illness, it’s not surprising that a family history is front of people’s minds.

“Just under half of all respondents in our survey said their health concerns run in the family,” says Ms Hambilton.

“We do know that a family history of cancer or certain illnesses can mean future generations could be more at risk. It could be prudent to talk to your family members or healthcare professional about any family history so you can be better prepared.”

There are a range of people we could turn to when we first experience symptoms or become aware of a health issue. For most of us, the first person we turn to is the doctor, as shown in the survey results.

In fact, both Australians and Canadians were most likely to turn to a doctor (50.8% and 45.5% respectively), with the next most popular options being an internet search engine like Google (15.8% for Australia and 19.7% for Canada), with family the third-most popular option (15.4% and 16.7% respectively).

The top three results in America were the same but in a slightly different order. Doctors and General Practitioners (GPs) were the top pick at 47.7%, followed by family at 16.8% and ‘Doctor Google’ at 16.5%.

| Who do you consult for a health concern? | Australia | USA | Canada |

| Online search engine | 15.8% | 16.5% | 19.7% |

| A friend | 4.5% | 4.5% | 3.7% |

| Partner | 13.2% | 13.7% | 13.1% |

| General Practitioner (GP) / Doctor | 50.8% | 47.7% | 45.5% |

| Family | 15.4% | 16.8% | 16.7% |

| Other | 0.2% | 0.8% | 1.3% |

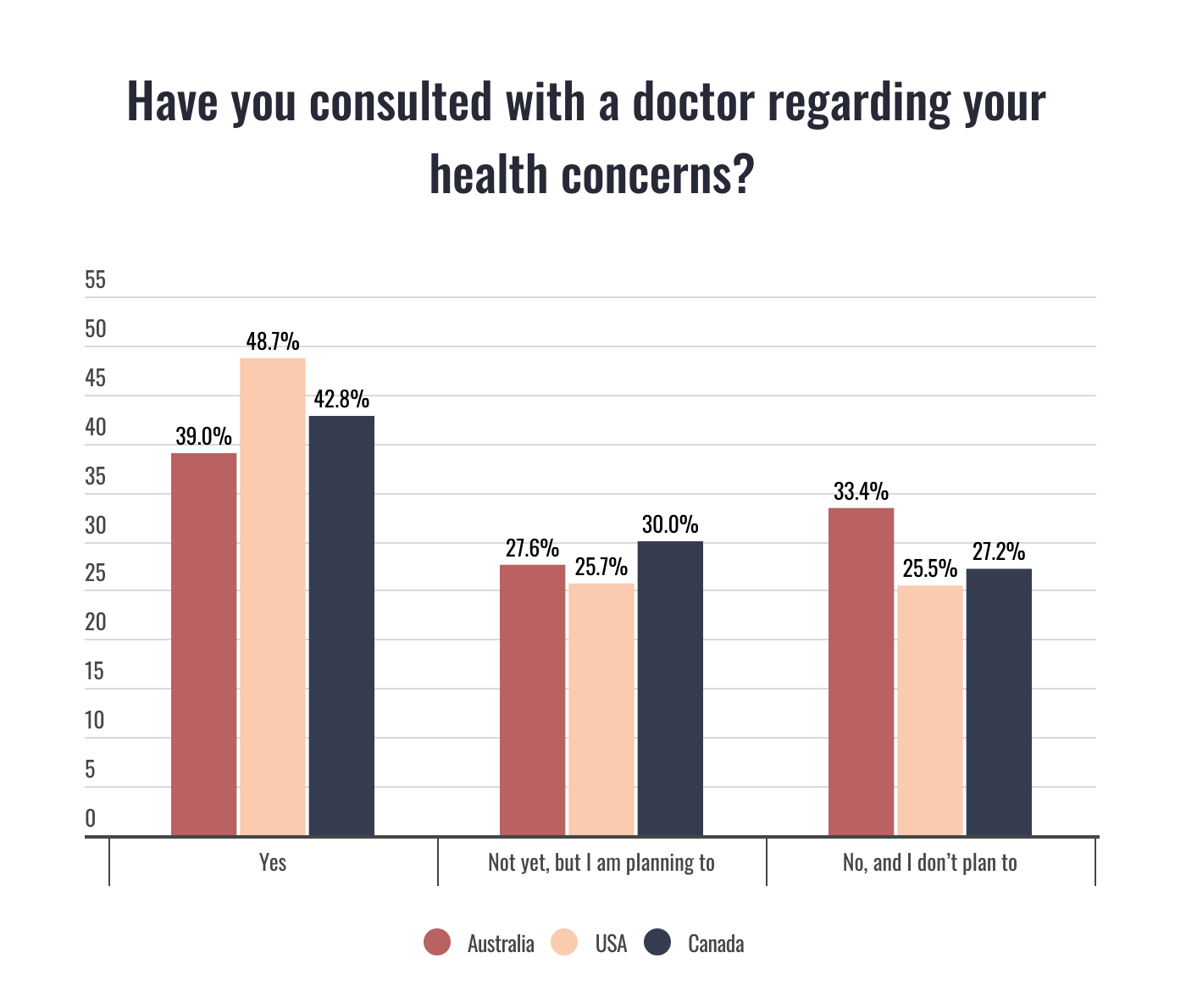

However, not everyone who has an issue actually plans to consult a doctor about it at all. In Australia, more than one-third (33.4%) of respondents said they hadn’t been to the doctor for a medical concern and never planned to, compared to 25.5% of Americans and 27.2% of Canadians.

More than half of all those surveyed hadn’t yet been to the doctor, and the amount who were planning to see a doctor was very close to the amount who didn’t plan to do so, as shown in the table below.

Ms Hambilton notes that not only is it critical to see a GP to begin treatment for any health issues, but it’s also crucial if you want to use health insurance to help cover private treatment.

“In Australia, health insurance providers will only cover treatment that is medically necessary, and they will need a GP or qualified health professional to sign off on a treatment plan so they can cover treatment as set out by the customer’s policy,” Ms Hambilton explains.

Our survey also asked respondents: “If you were admitted into hospital for a significant injury or illness, how long could you afford to stay, based on out-of-pocket costs?”

Canadians had the highest proportion who said they could stay as long as they needed to (29.3%). Interestingly – despite a largely derided healthcare system – more Americans said they could go as long as they needed to than Australians, though only just (22.2% of Americans as opposed to 21.6% of Australians).

As for those who said they couldn’t afford even one night in hospital, Americans had the highest proportion at 15.4%, compared to 11.9% of Canadians and 11.5% of Australians.

Considering other time frames, Australians were more likely to be able to afford a few nights or a few weeks, while Americans were more likely to say they could afford to stay a week or multiple months.

| How long could you afford to stay in hospital? | Australia | USA | Canada |

| Not even one night | 11.5% | 15.4% | 11.9% |

| A few nights | 20.3% | 16.2% | 15.2% |

| A week | 9.3% | 9.5% | 9.3% |

| A few weeks | 11.2% | 8.6% | 9.1% |

| Months | 5.2% | 6.8% | 5.0% |

| As long as I would need to | 21.6% | 22.2% | 29.3% |

| I’m not sure | 21.0% | 21.3% | 20.3% |

Private health insurance in Australia is designed to help cover out-of-pocket expenses for surgery and ancillary (out-of-hospital) services, with the exact type of treatment covered depending on what your specific policy covers.

In Australia, there is the public health system and private health system, and there will be different out-of-pocket costs in each depending on what type of setting (hospital or clinic) you’re in.

“If you’re in a private Australian hospital, Medicare covers 75% of the Medicare Benefits Schedule (the MBS – a list of fees for different healthcare services) fee, and 100% of the fee for treatment in a public hospital,” Ms Hambilton explains. “For private hospital treatment for example, there is an out-of-pocket cost, and health insurance can help cover that gap. This helps you pay for treatment in a private hospital, which helps you avoid the waiting list for elective surgery in the public system, and you have greater say in who treats you and where you get treated, depending on what’s available.”

“Many health funds have agreements with different hospitals and surgeons to help reduce any out-of-pocket costs that health insurance doesn’t cover,” says Ms Hambilton. “It’s a good idea to get in touch with your insurance provider and ask for a list of specialists and hospitals they work with to help reduce costs to you.”

Compare the Market commissioned PureProfile to survey 1,004 Australian, 1,005 Canadian and 1,006 American adults in April 2023.