The Burrow

They say prevention is the best cure, and second to that is early intervention. However, with the cost-of-living crisis currently squeezing wallets everywhere, how are people managing necessary healthcare appointments?

As experts in health insurance, we wanted to see how people are being affected, and whether they are delaying important surgeries or healthcare appointments because of the cost. To answer this, we surveyed more than 3,000 adults across Australia, Canada and the United States of America and asked if they have had to delay or cancel medical treatment, as well as other questions about their health and insurance coverage.

Here are the results.

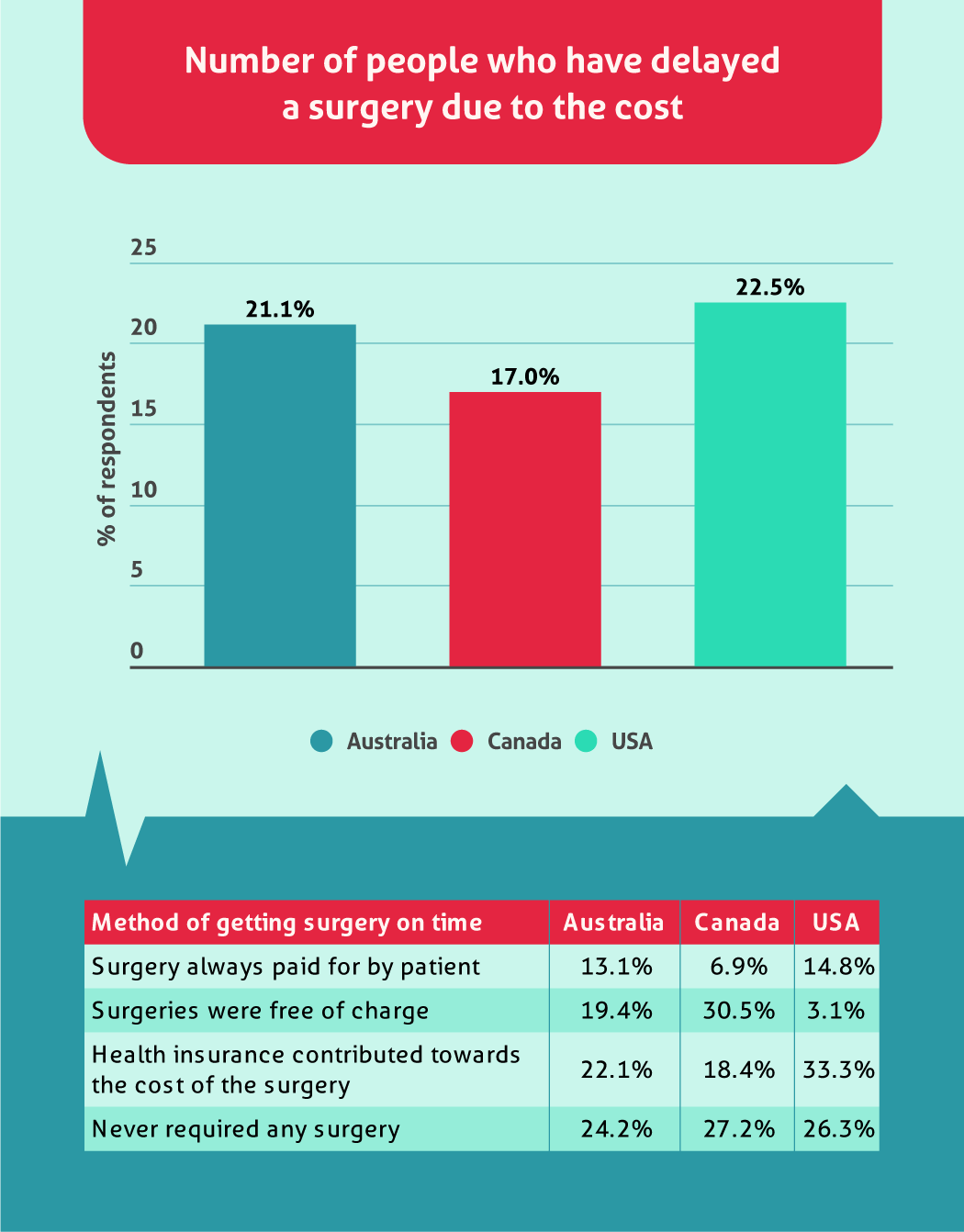

Fortunately, most people were able to have necessary surgery. However, about one-in-five people across the three countries surveyed reported having to avoid or delay surgery due to the cost.

It was highest in America with 22.5% of respondents delaying necessary surgery. Australians had a similar response at 21.1%, while Canadians were less likely with only 17.0% of respondents putting off a surgery.

Across all three countries, about half of all those surveyed had any required surgery without delaying it due to cost.

There were some interesting differences between nations for those that had never delayed a necessary surgery, and why. For example, almost a third of Canadians said their surgery was free (30.5%), compared to just 19.4% of Australians. Americans, however, rarely get surgeries at no charge – only 3.1% of Americans surveyed had free surgeries!

America is infamous for extraordinarily expensive healthcare and hospital bills. In March 2023 it was estimated that 100 million Americans have medical debt.1 Even those with health insurance often face expensive bills, known as deductibles.

Canadians were less likely to say they paid for surgery (6.9%) compared to Australians (13.1%) and Americans (14.8%). However, Americans were the most likely to get help from their health insurance, with 33.3% of Americans saying their health insurance helped pay for medical treatment. Australians were less likely, at 22.1%, but were still ahead of Canada where only 18.4% said health insurance helped with costs.

From the survey stats it would seem Canada is doing well overall to make surgeries more affordable. Canada is well known for its universal healthcare, but the free healthcare often comes at a cost of long wait times. In February 2023 the Canadian Prime Minister Justin Trudeau pledged an additional CAD$46 billion in funding to help address staffing issues and surgery delays.2

Our survey results suggest that major dental surgery in hospital is the operation most delayed as a result of the cost. Of the Australian and Canadian respondents who had delayed surgery for financial reasons, almost half had delayed major dental operations (46.2% of Australians and 49.4% of Canadians). Major dental surgery was also the most delayed type of surgery in the USA, but at a lesser rate (37.3%).

For Australians, joint replacement and joint reconstruction were the next most-commonly delayed surgeries (excluding the category ‘other surgeries’), while in Canada it was cataract and other optical surgeries. In the USA colonoscopies were the second-most commonly delayed operation, followed by medically necessary plastic surgery.

| Surgery | Australia | Canada | USA |

| Cataract surgery | 8.5% | 12.9% | 9.8% |

| Other optical surgery | 9.4% | 14.1% | 9.3% |

| Major dental surgery | 46.2% | 49.4% | 37.3% |

| Surgical skin lesion treatment | 9.4% | 9.4% | 11.1% |

| Joint reconstruction | 11.3% | 7.1% | 7.6% |

| Joint replacement | 11.8% | 3.5% | 7.1% |

| Endoscopy | 5.2% | 4.7% | 12.0% |

| Colonoscopy | 7.5% | 3.5% | 15.6% |

| Medically necessary plastic or cosmetic surgery | 7.1% | 8.2% | 15.1% |

| Other | 15.6% | 12.4% | 13.8% |

For all three nations, money forced the majority of people surveyed to delay at least one kind of appointment or medical treatment. More than two thirds of Australians and Canadians said they had pushed back appointments due to cost (64.6% for Australia and 64.0% for Canada).

Interestingly, while the USA had the biggest cohort who cancelled surgery due to cost, America had the smallest percentage of people who had cancelled other medical appointments, with only 50.4% having delayed at least one type of treatment.

Across all three nations, dental appointments were once again the most likely to be delayed with 45% of Canadians, 43.3% of Australians and 29.8% of Americans saying they had put off dentist trips because of the cost.

| Appointment | Australia | Canada | USA |

| Regular doctor’s visit | 24.2% | 11.0% | 22.1% |

| Optical | 18.1% | 22.3% | 14.4% |

| Dental | 43.3% | 45.0% | 29.8% |

| Physiotherapy | 14.5% | 13.8% | 2.8% |

| Chiropractic | 7.5% | 11.8% | 6.4% |

| Podiatry | 6.5% | 3.1% | 1.8% |

| Psychology | 11.1% | 14.3% | 11.8% |

| Skin health appointment | 9.4% | 5.7% | 9.1% |

| Gynaecology | 4.5% | 1.5% | 6.2% |

| Scan/X-Ray/Ultrasound | 7.9% | 3.6% | 5.7% |

| Other | 1.8% | 1.5% | 0.7% |

For Australians, a regular doctor’s visit was the next most-likely treatment to be delayed with almost one-in-four Aussies delaying a trip to the GP (24.2%), compared to 22.1% in the USA and 11.0% in Canada. Optical appointments were the third-most delayed for Australians with 18.1%.

The number of Australians who delay health services despite needing them has been increasing in recent years. According to the latest Australian Bureau of Statistics, in 2021-22:

One contributing factor behind the increase in Australians putting off important health appointments because of cost is a drop in bulk-billing (where the Government gets billed for a health appointment so it is free for patients) rates for GPs. In 2020-21, 88.8% of GP services were bulk billed, but in 2021-22 this dropped to 80.2%, as noted by the Royal Australasian College of General Practitioners.4

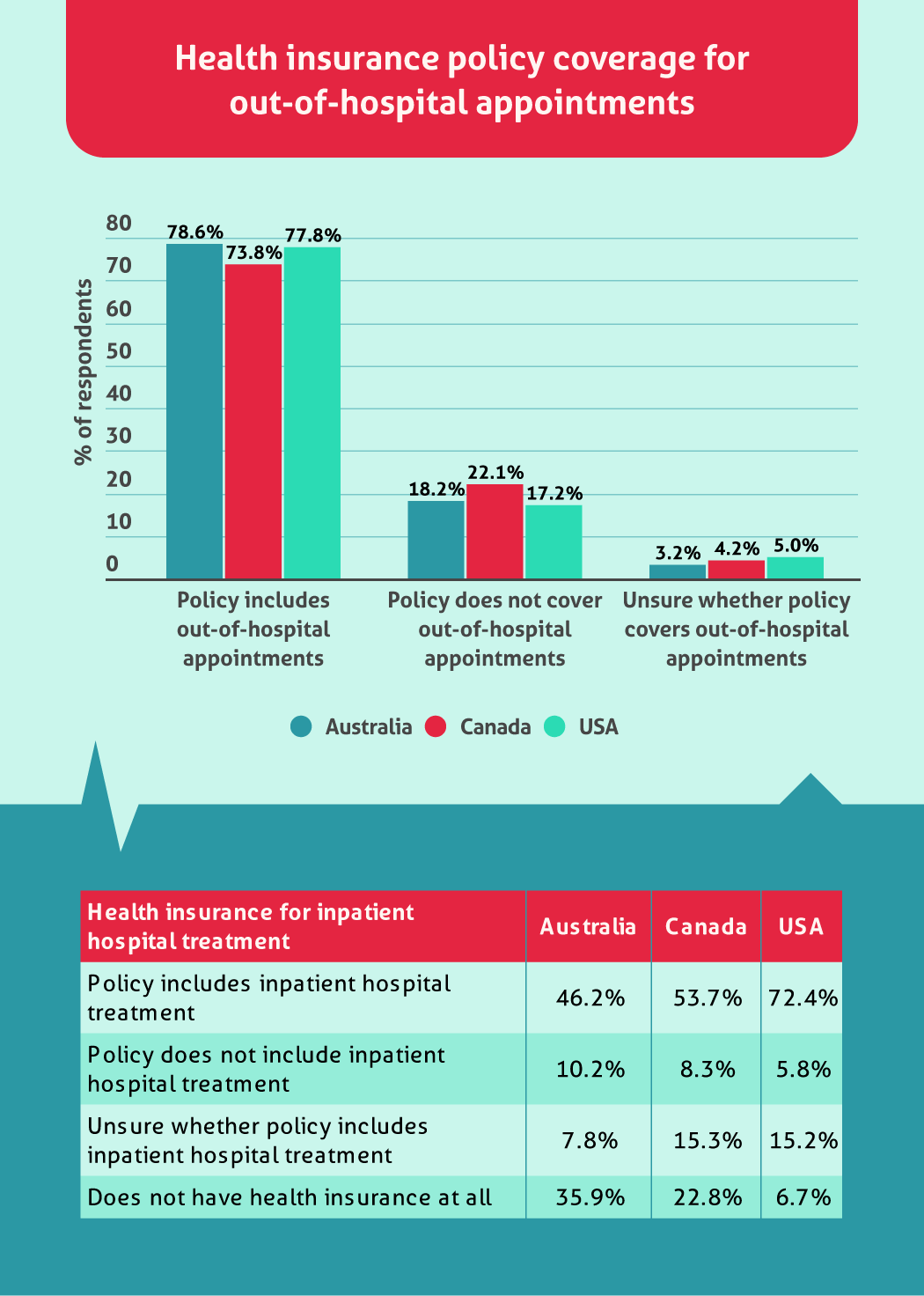

The survey also explored whether respondents had a health insurance policy that could pay a benefit towards inpatient hospital treatment, as well as whether they had health insurance to contribute towards out-of-hospital services like dental and physio appointments.

Only 46.2% of Australians have health insurance that includes inpatient hospital treatment. However, it is worth nothing that an additional 7.8% have a health insurance policy but don’t know what it includes.

This is in contrast to Canada and the USA, where 53.7% of Canadians and 72.4% of Americans have health insurance that includes inpatient hospital treatment.

A key reason behind this is that Australia has Medicare which covers a lot of healthcare needs for Australians, and health insurance is almost exclusively bought privately. In America, however, many employers offer health insurance as a benefit of employment, with differing levels of cover depending on what the health insurance provider offers to employers that they partner with.

Of those Australians who do have health insurance, 78.6% include an extras policy which pays a benefit towards out-of-hospital appointments, such as dental and physio. Americans and Canadians were close behind at 77.8% and 73.8% respectively.

Compare the Market Australia’s Head of Health Insurance, Lana Hambilton, explains how health insurance helps Australians take control of their healthcare.

“A private hospital insurance policy can give you greater choice in terms of how and when you will be treated. You can decide which hospital you go to and be treated by an available doctor of your choice. Perhaps more importantly, you can avoid the public waiting list by going to a private hospital, which can significantly cut down the length of time you wait before you get treated.”

However, there are a few things to be aware of, as Ms Hambilton adds that it’s crucial to check what’s included on your policy and regularly review these inclusions as your health needs change.

“Your policy will only pay a benefit towards the treatments included, which will vary depending on the level of cover. For treatments that aren’t included on your policy – you’ll either have to pay that cost yourself if you go privately, or go through Australia’s public system. Alternatively, you can upgrade your health insurance policy at any time however, you may need to serve a waiting period of up to 12 months before claiming on those additional hospital services” Hambilton explains.

Compare the Market commissioned PureProfile to survey 1,003 Australians, 1,002 Canadians and 1,002 Americans in September 2023.