The Burrow

As the cost of living rises, so too does the cost of healthcare. This is leading to an increase in medical debt, even in nations with public healthcare systems.

As experts in health insurance comparison, Compare the Market AU has surveyed more than three thousand adults across Australia, Canada and America about going into debt for medical expenses – either for themselves or a loved one.

It builds on previous surveys from 2025 and 2023, and the results reveal that all three countries have seen an increase in the number of people with medical debt.

The number of Australian adults with medical debt is now as high as 30%, on par with Canada, and is an increase of 150% from the previous year – the biggest increase amongst all three countries in the survey.

In the United States, 38% of people have incurred medical debt, a 36% increase from 2025. Out of the three countries, America has the highest population with medical debt overall.

Canada had a 76% increase in the number of people with medical debt, taking them from 17% in 2025 to 30% in 2026.

| Country | 2025 | 2026 | Increase |

| Australia | 12% | 30% | 150% |

| Canada | 17% | 30% | 76% |

| USA | 28% | 38% | 36% |

In all three countries, men were slightly more likely to go into debt for medical expenses, either for themselves or a loved one, than women.

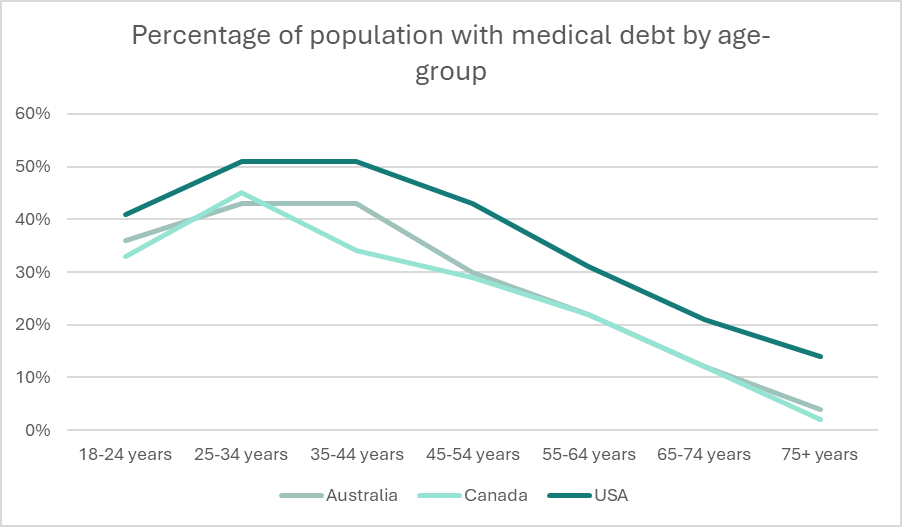

When breaking the data down by age category, it was millennials ( years old) who were the most likely to have incurred debt for medical expenses, which was true in each country.

Across all three nations, the leading cause of medical debt was dental work. In Australia and the USA, this applied to 14% of people with medical debt, while in Canada it was slightly higher at 16%.

The second-biggest cause of medical debt was different in each country. In Australia it was specialist treatment and consultations at 11%, while in Canada it was expensive prescription medication at 8%. In America, 11% of people with medical debt had gone into the red for medically necessary elective surgery.

Cosmetic surgery, physical therapy and rehabilitation were the least likely causes to drive people into debt for themselves or their loved ones.

| Top causes of medical debt | Australia | Canada | USA |

| Dental work | 14% | 16% | 14% |

| Specialist treatment or consultations | 11% | 5% | 9% |

| Expensive prescription medication | 9% | 8% | 10% |

| Medically necessary elective surgery | 9% | 5% | 11% |

| Mental health care | 6% | 5% | 10% |

| Life-threatening emergency surgery | 5% | 4% | 9% |

| Cosmetic surgery | 4% | 4% | 3% |

| Physical therapy/rehabilitation | 4% | 5% | 5% |

| Other | 0% | 0% | 1% |

Note: Respondents could select more than one option, so percentages do not total to 100%.

When asked how much medical debt people have gone into to pay for their healthcare bills, Americans had the highest average debt, which is not surprising given their infamously expensive medical fees.

On average, Americans went into debt to the tune of AU$36,043.80 (US$25,382.96), leagues above the other countries in the survey. Canada had the second-highest at AU$5,302.25 (CA$5,098.31), while Australians had an average of AU$3,844.98.

When asked whether they would be willing to go into debt for healthcare fees, 69% of Aussies, 64% of Americans and 62% of Canadians would be willing to go into debt for themselves or a loved one.

The leading medical issue people would be willing to go into debt for was life-threatening emergency surgery (61% in Australia, 55% in America 52% in Canada). The next leading issue was medically-necessary elective surgery (27% in Australia, 19% in Canada and 17% in the USA).

Compare the Market’s Executive General Manager of Health, Steven Spicer, explains how people in countries with public healthcare systems can still go into medical debt.

“In some circumstances the government may cover a large portion of the cost, but not the whole fee. This can potentially leave patients out of pocket for healthcare treatment,” Mr Spicer says.

“Furthermore, you may be on a lengthy public waiting list. For some, they would rather pay privately for treatment to skip the waiting list, especially if they are living with a painful or difficult medical issue that could worsen over time. This is where private health insurance comes in.

“Private health insurance is designed to help pay for treatment and offer greater choice for treatment to policyholders. There are different levels of cover that will cover different treatments, and there’ll usually be waiting periods before you can make a claim – especially if you have a pre-existing condition.

“That said, private health insurance is a fantastic product for those wanting to be proactive about their healthcare and get greater choice, while lowering the out-of-pocket cost for treatment compared to paying for it privately without health insurance.”

Compare the Market commissioned PureProfile to survey 1,104 Australian, 1,005 Canadian and 1,020 American adults in a demographically representative survey for each nation in February 2026.

Currencies were converted into AUD on 17/02/2026.