The Burrow

Its hard to talk about death, even more so your own, especially with those you love. However, discussing what happens after you’ve passed away with those who will be left behind can help you plan ahead.

It’s a difficult subject, but its one that’s best had before its too late. It’s important enough that in 2013, the Groundswell Project started Dying to Know Day to encourage Australians to talk openly about death so that more people would be better prepared.

New data from the life insurance experts at Compare the Market, however, suggests more people may need to be having these tough conversations.

To get an understanding of whether people have funeral plans, an up-to-date will, and what could motivate them to take out life insurance, Compare the Market surveyed more than 3,000 Australian, Canadian and American adults to find out.

The findings show a disparity between Australia and these North American nations when it comes to being prepared for the end, highlighting the need for Dying to Know Day and the conversations it inspires.

In a stark divide between Australia and the two North American nations surveyed, most Australians do not have life insurance, whereas the majority of Americans and Canadians do. Just over a quarter of Australians (27.9%) have a life insurance policy, compared to 56.8% of Canadians and Americans.

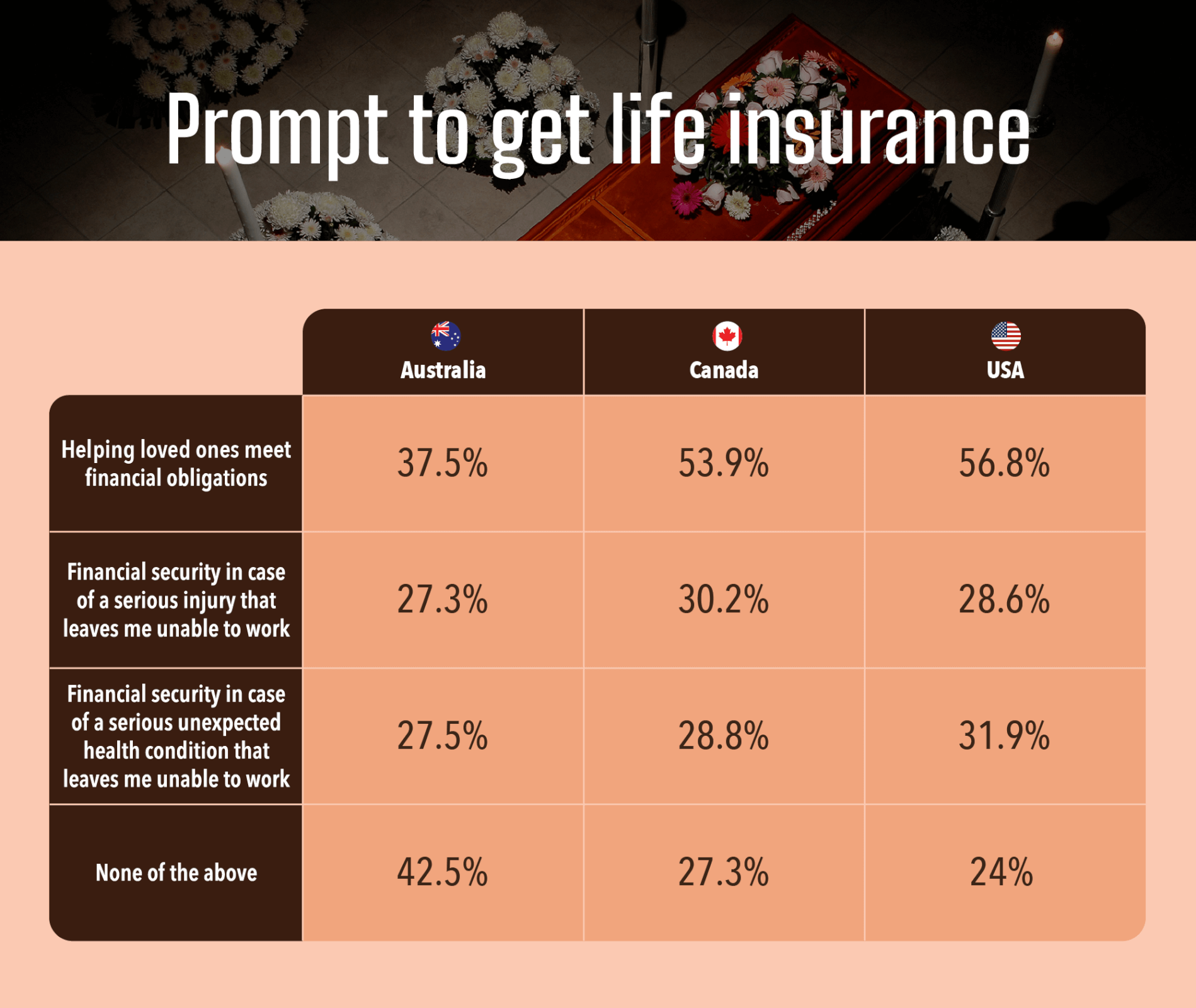

When asked what prompted (or what would prompt) people to get a life insurance policy, the most common response from Australians was “none of the above” (available options included helping loved ones meet financial obligations, financial security in case a serious injury leaving me unable to work, and financial security in case of an unexpected health condition that left me unable to work).

In contrast, the most common option chosen by Americans and Canadians was “helping loved ones meet financial obligations,” which was the second-most-common response from Australians surveyed.

GM of Health, Life and Energy, Anthony Fleming, explains what’s behind the disparity.

“In America and Canada, it’s a lot more common for employers to provide some form of life insurance to employees – separate from social security, with costs typically deducted from pay. This isn’t the case in Australia, and while people may have some type of life insurance through their superannuation (money put away for retirement in a similar fashion to social security), it isn’t front of mind for people in the same way that employer-provided group cover or privately-purchased policies are,” says Fleming.

There may be a greater perceived need for Canadians and Americans to have life insurance when mortality rates are considered. Australia’s mortality rate is 507.2 per 100,000 people,1 compared to 810.0 per 100,000 in Canada2 and 1,027.0 per 100,000 in the USA.3

When asked whether they had a funeral plan in place for their passing, less than half of those surveyed in each country had made preparations, though Australians had the smallest proportion of people who had planned their funeral. Just 16.2% of Australians had a funeral plan, compared to 32.5% of Americans and 24.8% of Canadians.

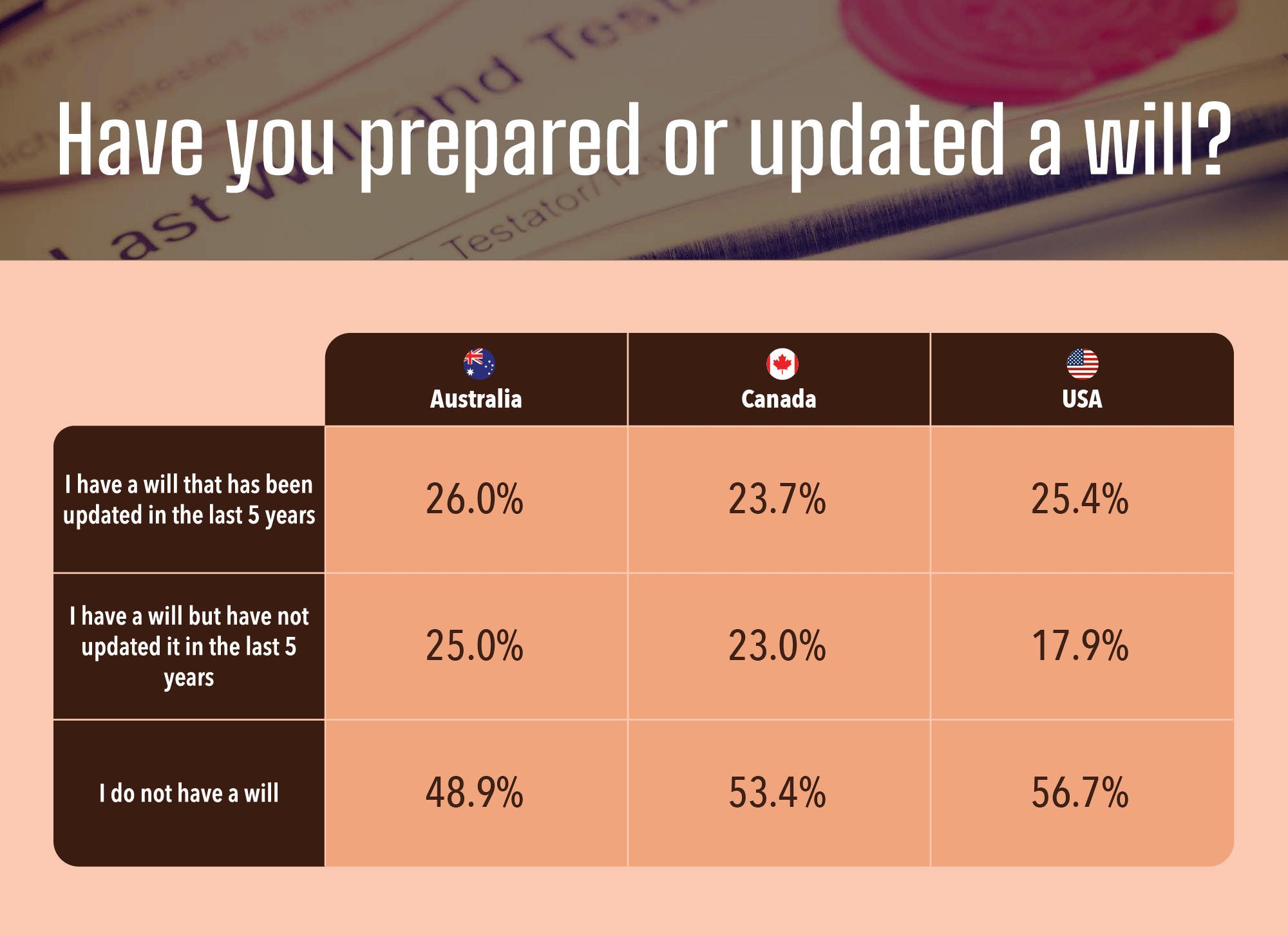

In contrast to this, Australians were more likely to have a will than US and Canadian respondents, but only by a small percentage as shown in the table below.

One trend that is common across all countries surveyed is that men were more likely to have funeral plans and life insurance than women. Men were also more likely to have a will, though in Australia, women were more likely to have a will that hadn’t been updated in the last five years (25.3% vs 24.5%). In Canada and the USA, men were more likely to have wills than women, whether they were updated recently or not.

Fleming said there is a benefit in holding life insurance for both men and women, and it’s important for households to discuss what’s important to them.

“We want to encourage everyone to think about what they want to have happen when they pass away, talk to their family and loved ones about it, and consider whether life insurance could benefit them.”

Life insurance can be very beneficial for people with spouses or families that depend on their income. Should something happen that cuts a life short or impacts a person’s ability to work, life insurance can provide peace of mind and financial support.

Having this cover can assist the insured person’s family to continue their lifestyle, helping them get the most out of life and avoid having to make big sacrifices like giving up the family home.

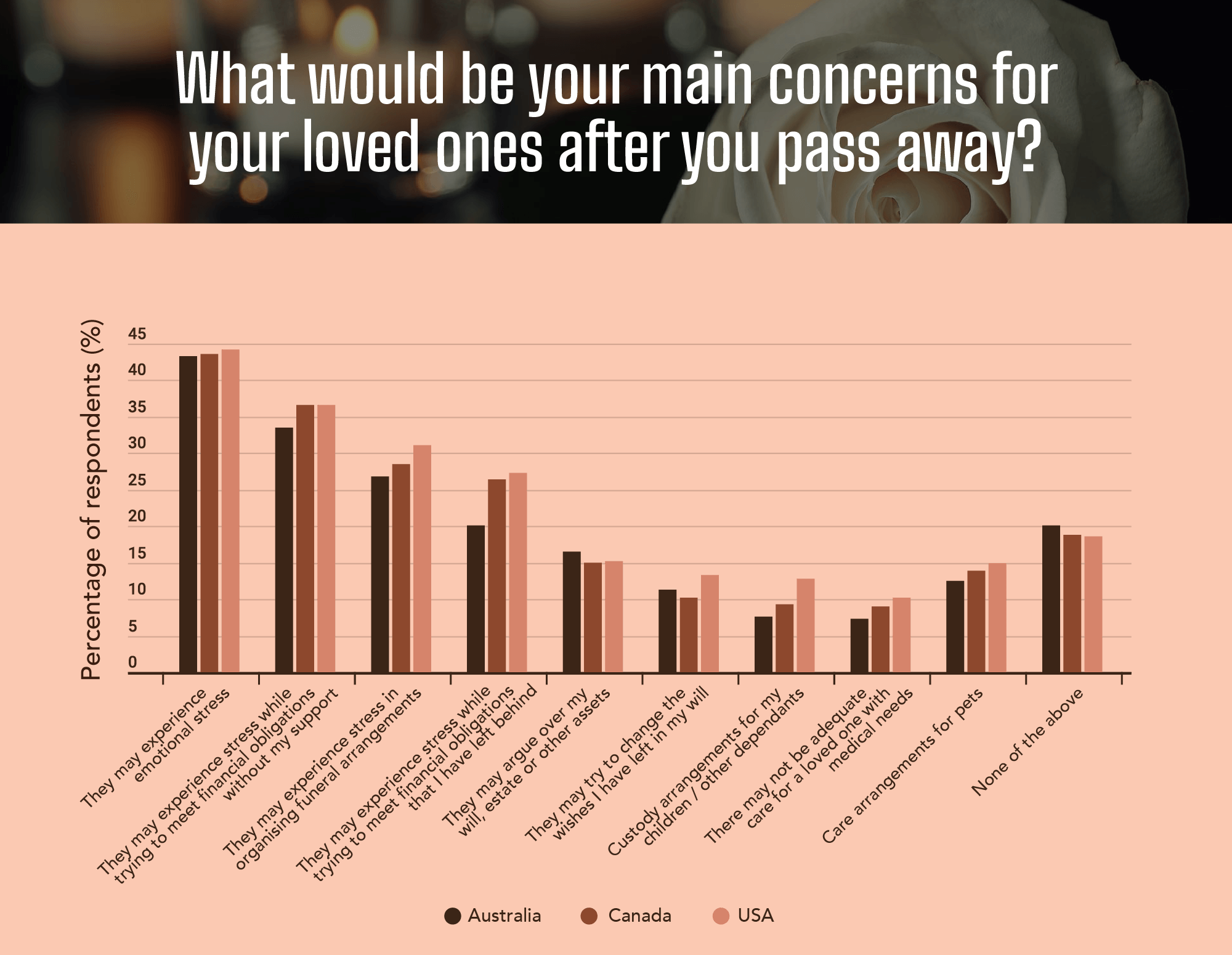

Lastly, survey respondents were asked what their biggest concern would be for their loved ones in the event of their own passing. Unanimously, all three nations listed emotional stress as their biggest concern.

The next two most common concerns were also consistent, and these were respondents’ loved ones experiencing stress from trying to meet financial obligations without their support, and stress in organising funeral arrangements.

Fleming encourages anyone, young or old, healthy or ill, to be open about their concerns and talk with their loved ones about what will happen after death.

“Even discussing your wishes for your funeral ahead and how your loved ones will access funds to pay for expenses as necessary can bring a sense of relief, and help avoid some stress when the time comes,” says Fleming.

“It may help you knowing your wishes will be respected and offer peace of mind knowing those you love are going to be okay.”

Compare the Market commissioned Pure Profile to survey 1,006 Australian, 1,010 Canadian and 1,012 American adults in September 2022. Some respondents identified as non-binary but represented fewer than 1% of all survey responses and that data has not been presented in this article.

1. Causes of death. Australian Bureau of Statistics, Australian Government. 2022.

2. Deaths and Mortality. Center for Disease Control, U.S. Department of Health and Human Services, United States of America Government. 2022.

3. Mortality rates, by age group. Statistics Canada, Canadian Government. 2022.