The Burrow

Imagine hearing about an investment with consistently high returns.

Your uncle says, “I just received a 50% return on an investment in postal coupons.”

So, FOMO (fear of missing out) kicks in and you invest your savings. Months later, the investment is exposed as a scam and you lose your initial deposit – along with the alleged profits.

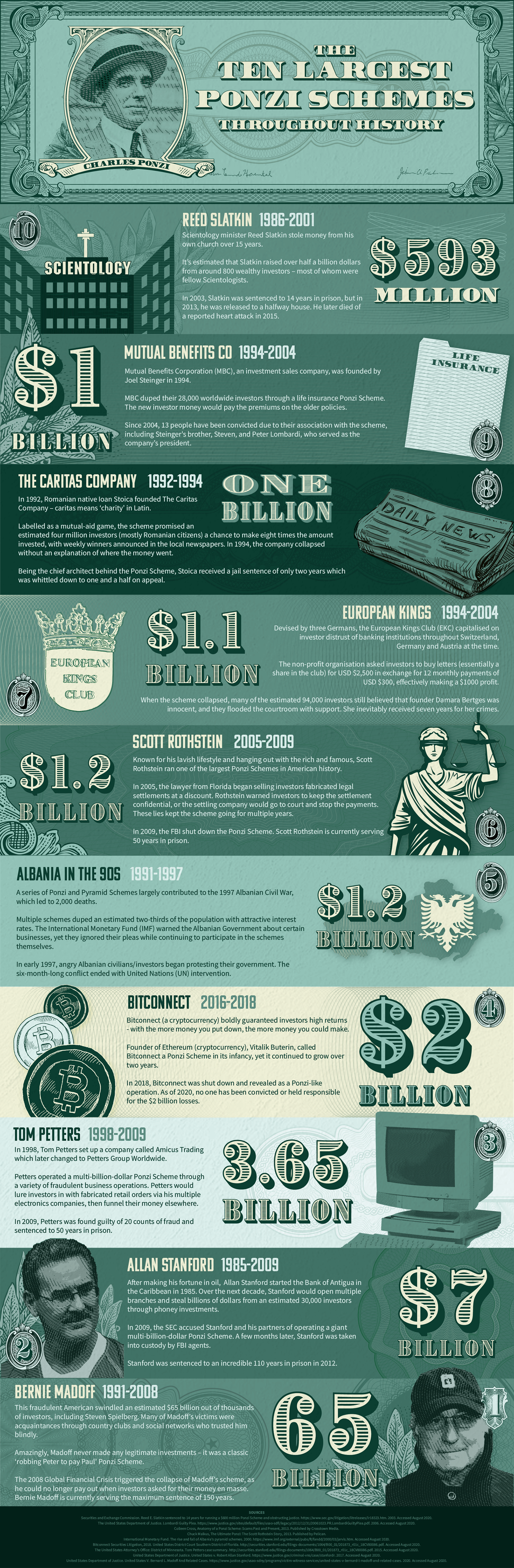

Does this sound farfetched? Well, it happened in Boston in 1920 when Charles Ponzi defrauded thousands of Americans. Unfortunately, it wasn’t the first or last time a scam of this nature would occur.

In this article, we outline how a Ponzi Scheme works, countdown 10 of the largest Ponzi Schemes ever (by estimated money taken) and list how to identify one of these scams!

Born in Italy in 1882, Carlo (Charles) Ponzi boarded a boat to America in 1903 seeking fortune and a better life. After years of working menial jobs and two stints in prison for fraud and people smuggling, Ponzi founded ‘The Securities Exchange Company’ in 1920.1

Ponzi built his scheme on trading postal coupons for a cash profit. However, that was a façade, and he simply took investor money and paid (some) older investors monthly dividends with new investor money. It’s estimated Ponzi defrauded USD $193 million (in today’s dollars) out of thousands of New England residents.2

While Ponzi didn’t invent this type of scam, it became synonymous with his name.

In 1921, Ponzi was sentenced to five years in prison and released after three and a half. In 1949, Charles Ponzi died penniless in Brazil, aged 66 due to natural causes after many years of ill-health.

A Ponzi scheme is a type of investment fraud. The schemer gathers money from investors, promising large fixed term returns (e.g. monthly dividends).

![]()

The schemer then uses that ‘buzz’ to lure in more investors. The money from the new investors pays older investors. The basic premise of a Ponzi Scheme is ‘to rob Peter to pay Paul’. It’s worth noting that most investors reinvest their ‘dividends’ and never make a cent.

![]()

Eventually, the scheme collapses when funds run out, or the schemer gets caught by government authorities – whichever comes first.

They’re often spoken about interchangeably. However, there’s one key difference that separates a Ponzi Scheme from a Pyramid Scheme. After the initial investment, a Ponzi Scheme victim plays no further active role while a Pyramid Scheme victim is required to recruit new members so they can get paid.

Both Ponzi Scheme and Pyramid Scheme victims are paid money from new investors/recruits (if they’re lucky) and are typically unaware that the whole construct is a scam.

High returns. Avoid claims of ‘high returns’, ‘guaranteed returns’ and ‘no-risk’. Remember: If it’s too good to be true, then it probably is.

Consistent positive returns. Most investments go up and down over time – that’s just the nature of the economy and the market. Be cautious about any investment that generates consistent positive returns.

Non-specific details. Schemers are usually big with the promises and vague on the details, so if the terms are hazy, then the investment is probably shady.

Complicated business model. Conversely, a Ponzi Scheme can be deliberately complicated – it’s so the investor can’t work it out. The bottom line is, if you don’t understand what you’re investing in, then don’t invest.

Unregistered investments. Ensure your investment is registered with government-backed state regulators.

Unlicensed sellers. Most Ponzi Schemes involve unlicensed sellers or unregistered companies. Once again, take the time to check credentials with your state’s authorities.

If you’re unsure about an investment opportunity, consult a financial advisor or investment expert before making any decisions.

Source: Ponzi Schemes. https://moneysmart.gov.au/investment-warnings/ponzi-schemes. 2020.

Sources

Brought to you by Compare the Market: Making it easier for Australians to search for great deals on Credit Cards.