The Burrow

Many of the world’s most developed countries saw a boom in housing throughout the pandemic, which at first glance might seem like a positive for those looking to get in on the deal.

But, when that boom was met with pandemic shutdowns, increased shipping costs, backlogs and significant delays, the pieces aligned to create a perfect storm for increased prices.

As building timelines continue to stretch and costs continue to rise, the way the construction industry operates may need a permanent reshuffle.

To understand how this might be affecting prospective buyers around the world, the home loan experts at Compare the Market surveyed 2,513 adults across Australia, America and Canada to see if there was a sentiment shift from before the pandemic compared to today.

The results revealed that in general, there are less people in the market for a new home now than there was prior to the pandemic.

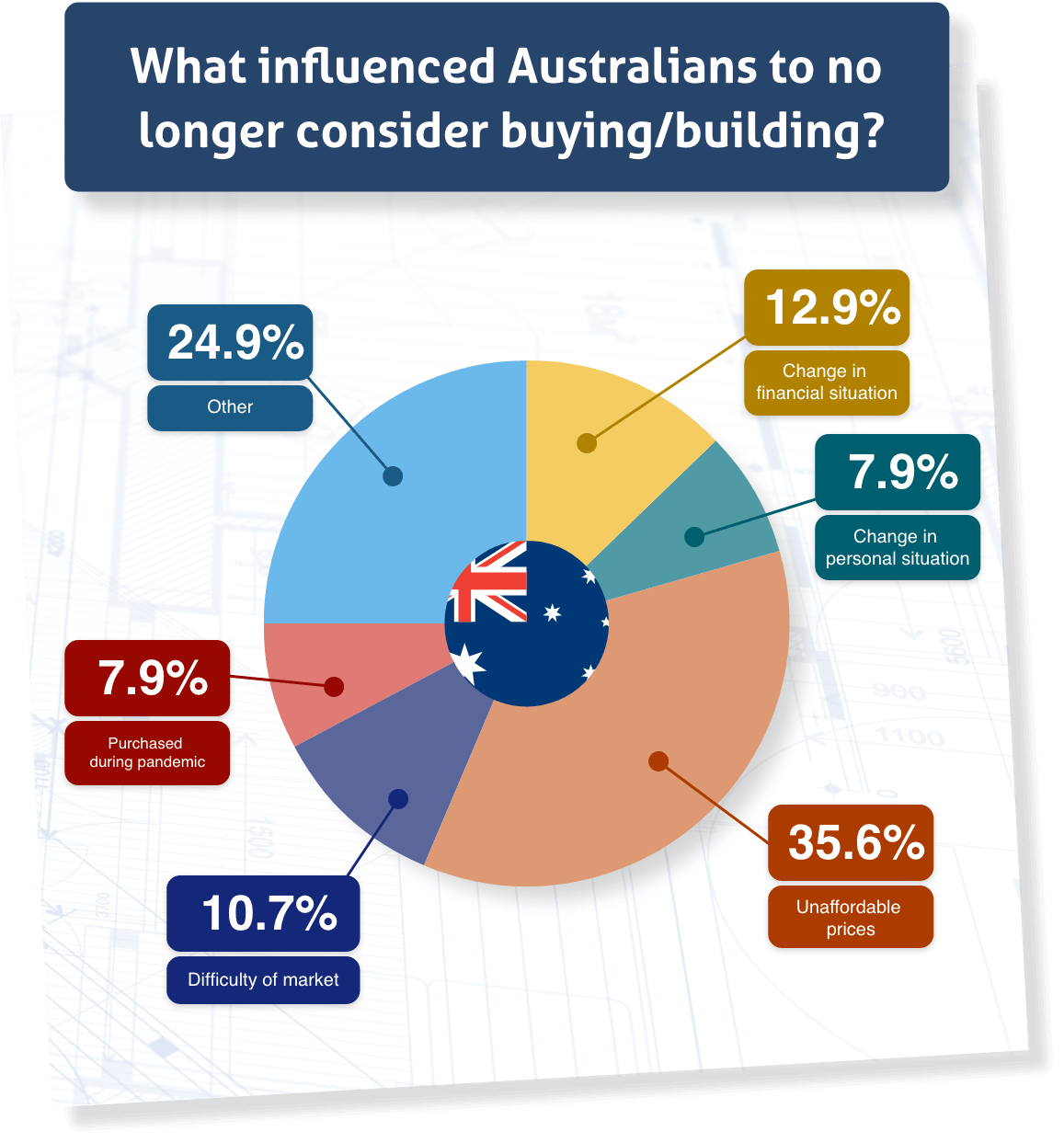

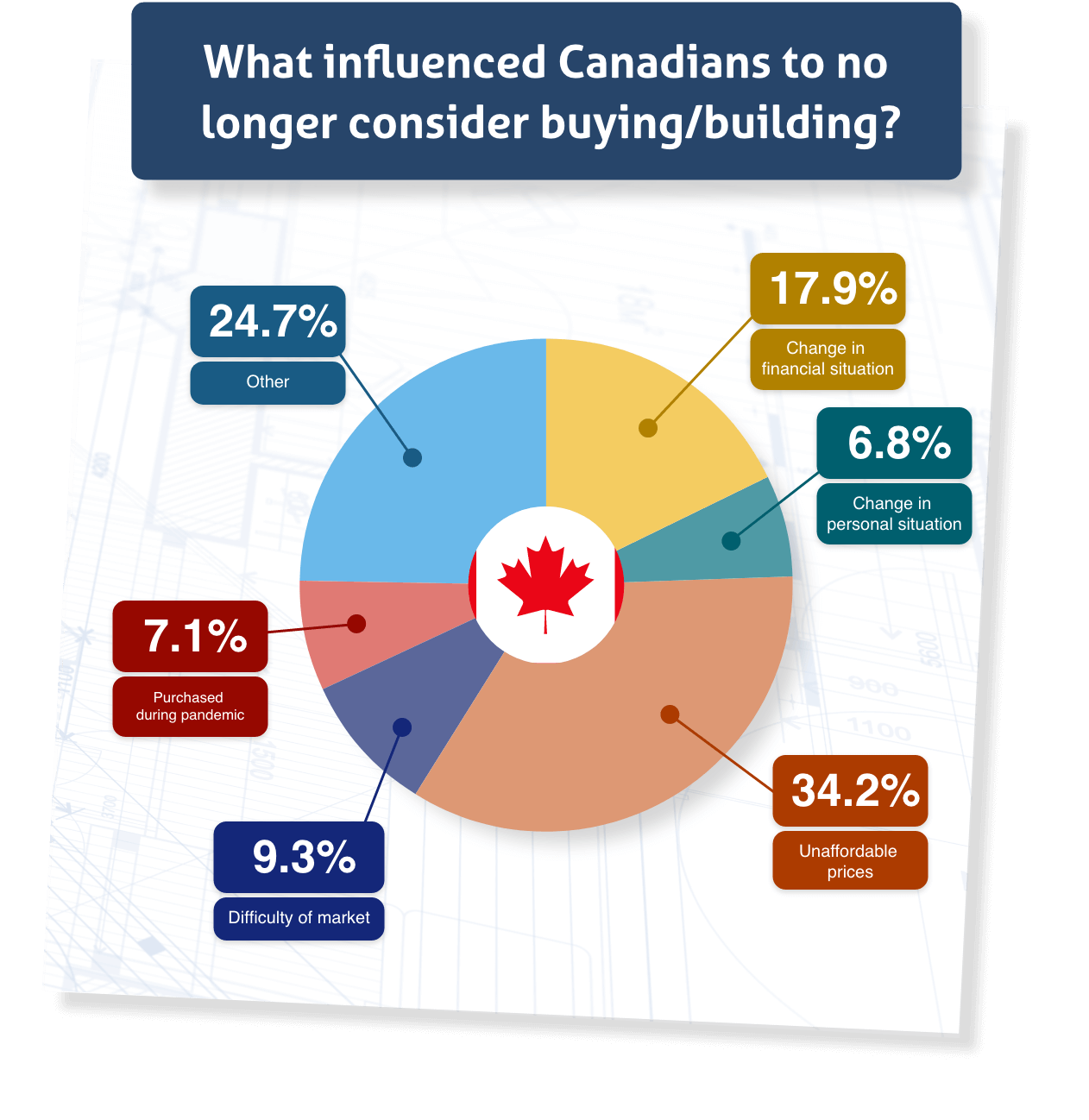

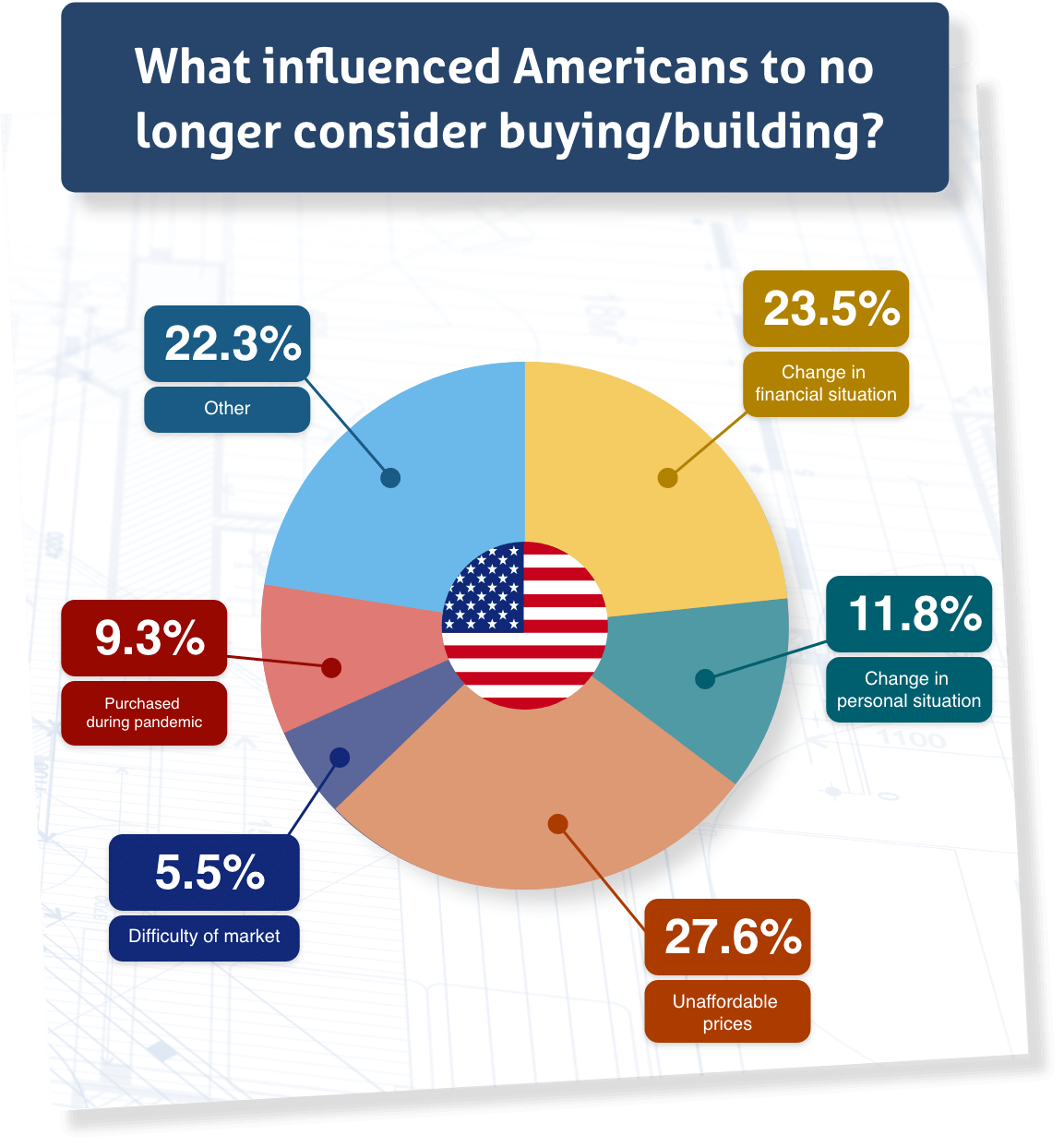

The most common reason for a decrease in homebuyers was the unaffordability of the market in the past two years, which was the case for at least a quarter of respondents across all three nations.

Another common explanation was a change in financial situation, which could be because of the hardship many people have experienced in recent times.

The survey also indicated that young people have struggled the most to break into the market, compared to any other age group.

Click through the below sections to find out more about the state of construction in Australia, Canada and the United States in particular.

Australia’s homebuilding industry was operating at capacity throughout 2021, which has continued into 2022 and has shown no signs of slowing.1 Improvements have been primarily inhibited by the availability of land, materials and labour as the nation saw a significant increase in demand.

A nationwide desire for lower density housing has played a large part in demand increases.

This increase in demand, combined with supply shortfalls, has impacted not only material costs, but the cost to employ tradespeople as well. From January to September 2021, the cost of tradesmen activity saw surges of around 5.2%, alongside material costs which saw an 8% increase.

The cost of residential land, in conjunction with the above, saw a nationwide average price hike of 8.5% across the 2020/21 financial year.1 This was much higher in Sydney, which experienced increases as high as 27.1%.2

The ABC reported that the overall cost to build a new home rose by 20% in 2021, thanks to a combination of the above.3 Unfortunately, that’s not the worst of it. Prices are now set to rise yet again, due to the federal government imposing a tariff increase of 35% on imports from Russia and Belarus. This will primarily affect lumber and laminated beam prices from those nations.

In Compare the Market’s survey, it was revealed that the number of people looking to build or buy a home reduced considerably once the pandemic hit and the market drastically changed. Of the 40.6% that were intending to build pre-COVID-19, one in ten has changed their mind and are no longer interested in pursuing a new home.

Females typically experienced the biggest change of heart, with an 11.36% increase in those not wanting to build given the current climate, in comparison to before the pandemic hit.

To gain an understanding of why this is the case, Compare the Market asked the reasons why people had given up their dream of owning a new home. The most common reason, as identified by more than a third of the population (35.6%), was the unaffordable prices that have continued to rise in an unprecedented way. This was followed by a change in financial situation (12.9%) and the market being too difficult to break into (10.7%).

45-54-year-olds appear to be struggling the most with price hikes – almost half of this age group (47.6%) stated unaffordability as the deciding factor for no longer wishing to build.

Perhaps unsurprisingly, young adults under the age of 24 were the most likely of all age groups to cite difficulty breaking into the market.

The Canadian Home Builder’s Association (CHBA) released data in late 2021 that indicated ongoing increases in the cost of construction had added close to CAD$70,000 to the average price of a 2,482 square foot home.4 Not only this, but disruptions in labour and supply have meant that construction timelines were experiencing 10-week delays on average, according to the CHBA quarterly Housing Market Index.

The cost of employing workers in the industry has also risen an average of 19% in comparison to pre-pandemic levels.5

From 2015 to 2021, new housing prices in Canada increased by 21%. However, a vast majority of this growth happened between 2020 and 2021 alone, where the year-on-year average rose by 15%.6

Results from Compare the Market’s survey show that throughout the pandemic, the number of people actively hoping to get into the homeowners’ market reduced in comparison to those hoping to do the same before 2020. Nearly 40% of the population had an intention of building pre-pandemic, but similarly to Australia, around one in ten have since changed their mind.

In most cases (34.2% of respondents), this is due to prices becoming too unaffordable in a short span of time. Some less common explanations for the drop in those looking to build are a change in financial situation (17.9%) and a further 9.3% who found that the market was simply too difficult to break into.

Of those who find the prices too high, 25-34-year-olds are suffering the most, with as many as 45.1% of the age group indicating this as their top deterrent.

Once again similarly to those in Australia, adults aged 24 and under were the most likely of all age groups to find the housing market too difficult to break into.

In the United States, the affordability of housing has been a long-running issue. In a recent survey on behalf of the National Association of Home Builders (NAHB), an alarming 79% of the population indicated that housing affordability was a problem in their state.7 In contrast, only 5% say there is not a problem anywhere in the country.8

As a measure of the issue, 20 million renting households in the States are cost burdened, which means that a considerable amount of their income is spent on housing. For example, around a quarter (24%) have a gross rent higher than 50% of their household income.

But the cost to live in existing homes is not the only problem. Home construction data released by the NAHB in October 2021 indicated that lumber prices had increased more than 25% in the previous month. This, combined with other significant delays and bottlenecks for materials, meant that new home prices sat around 20% higher than the previous year.9

In terms of addressing the issue, more than half of the population (55%) believes an effective support scheme from the government would contribute towards lowering the development and construction fees for builders, and incentivising builders to produce more affordable housing.8

As for what this means for American homebuyers, more than two in every five (41%) people actively looking to purchase a home have said they are unable to find one at a price that’s affordable to them.

Compare the Market’s recent survey revealed that of the three countries studied, Americans had the lowest number of adults actively looking to buy or build a home prior to the pandemic (36.4%). Of these, 25-34-year-olds were the most likely to be in the market.

While there was not much of a change in home buying sentiment throughout COVID-19, those most likely to be searching changed from females to males in more recent times.

There was also a considerable increase (23.1%) in 18-24-year-olds who want to build now compared to pre-pandemic. Given the general desire to build across all age groups decreased, it’s a notable peak in the data.

For the 63.1% of Americans that are no longer looking to get into the market, 27.6% of them cited unaffordability as the key reason why. This was followed by a change in both respondents’ financial situation (23.5%) and personal situation (11.8%).

Of those who find the prices too high, 55-64-year-olds are suffering the most (33.3% of this age group). Similar to the other countries studied, adults aged 18-24 was the age group most likely to struggle breaking into the market.

Compare the Market’s General Manager of Banking, David Ruddiman, explains what the price increases and construction delays mean for those still hoping to get their foot in the door.

“The home buyers’ market is a volatile environment at the best of times,” Mr Ruddiman says.

“The COVID-19 pandemic has made trying to get a foot on the property ladder harder than ever before for buyers in many countries.

“However, there still may be pockets of affordability or accessible housing if buyers are willing to sacrifice on proximity to major metropolitan areas, as an example.

“Expanding your options and choosing to budge on some factors will, in some cases, provide more options for those who are struggling.”

If you are looking to get into the homeowners’ market, the first step is ensuring you are eligible for a home loan. Compare the Market’s free home loan interest rate comparison service is a great way to compare your options and search for an offer that is suited to your needs.

Compare the Market commissioned Pure Profile to survey 502 Australian, 1,007 American and 1,004 Canadian adults in March 2022.