The Burrow

Which countries aren’t taking care

of their homes?

The saying ‘nothing is certain in life but death and taxes’ is perhaps a bit too limiting. A third option that could be added to that list would be ‘chores’.

An inescapable fact of adult life is that being responsible means doing arguably boring and mundane things like cleaning and maintaining a home, when we would rather be doing almost anything else.

However, as Compare the Market’s General Manager of General Insurance Adrian Taylor notes, some of these household chores are vital not only to keep your home clean and tidy, but to help protect your home from disaster.

“Some basic household chores could help prevent disaster, such as making sure your smoke alarm batteries still have charge, and your gutters are clear or broken locks and windows are repaired,” says Taylor.

“Failing to do so could make it more likely something could go wrong, like a fire or a break-in.”

So, with this in mind, the home insurance and contents insurance experts at Compare the Market have surveyed more than 3,000 adults from Australia, Canada and the USA to find out who is slipping behind on crucial chores.

Here are the results.

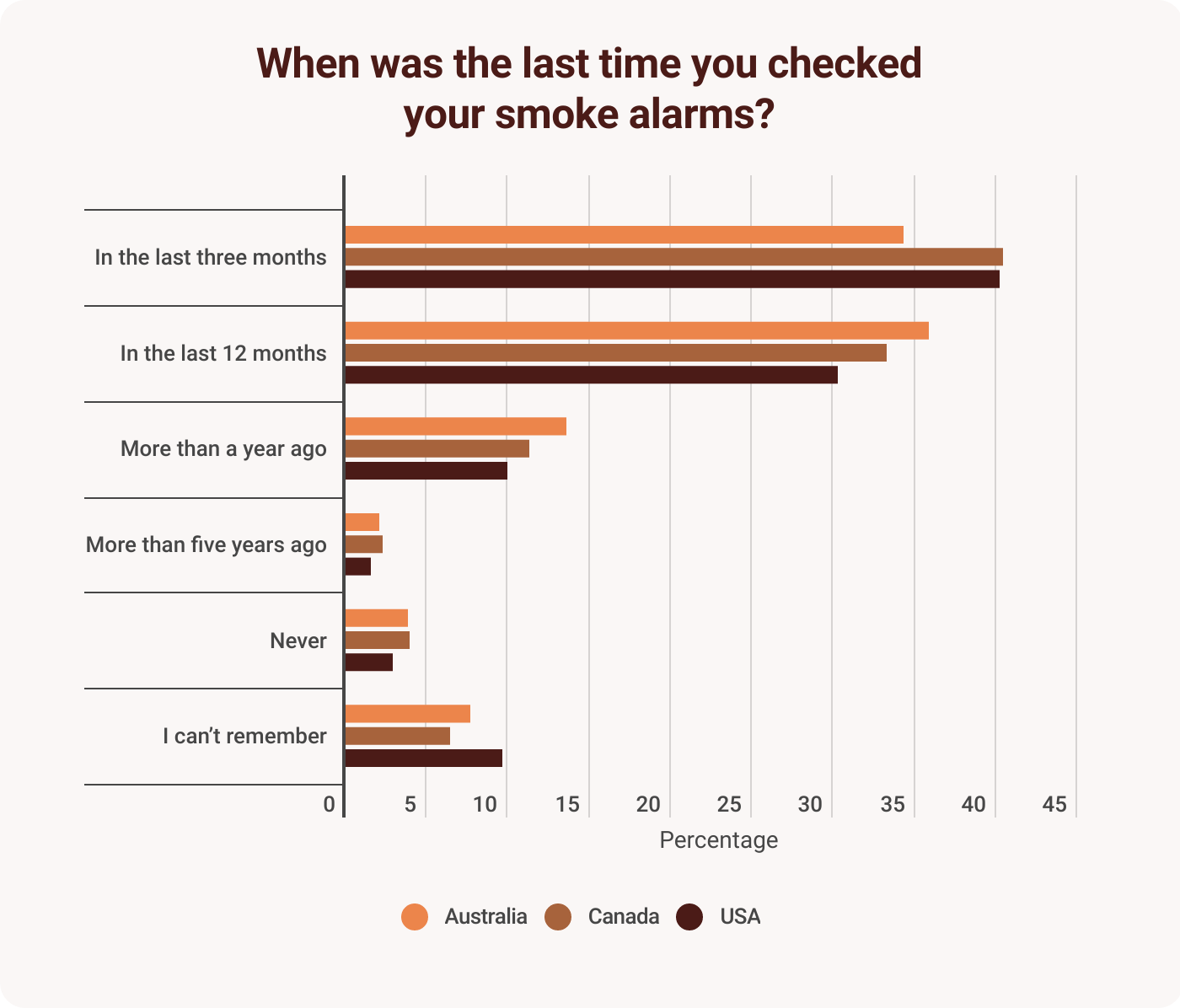

Helping dispel the stereotype of Americans being lazy, respondents from the USA were more likely to clear gutters and check appliances for exposed wires or lint build-up. Americans were also just as likely as Canadians and Australians to check smoke alarms frequently or to fix a broken lock, door or window immediately.

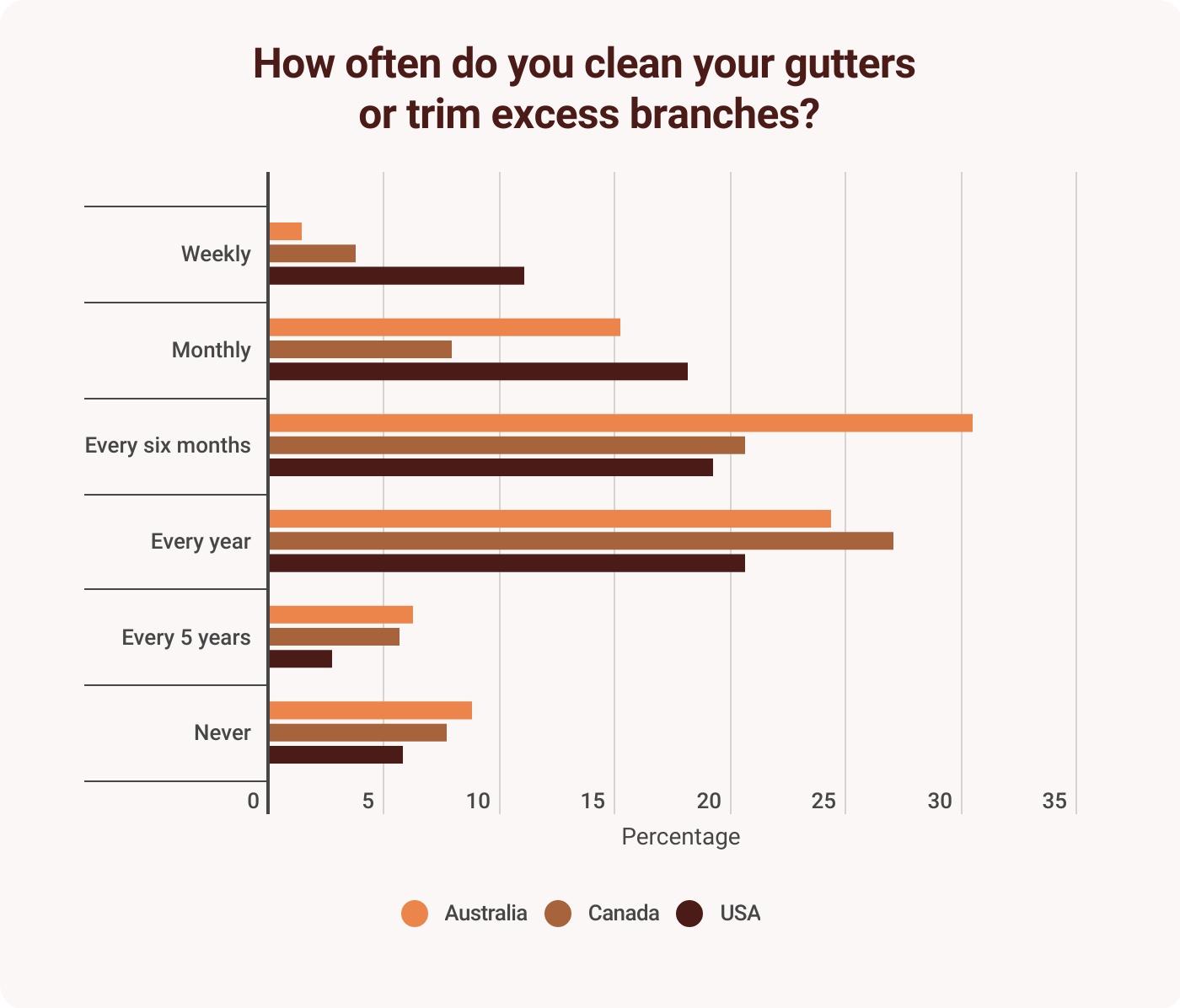

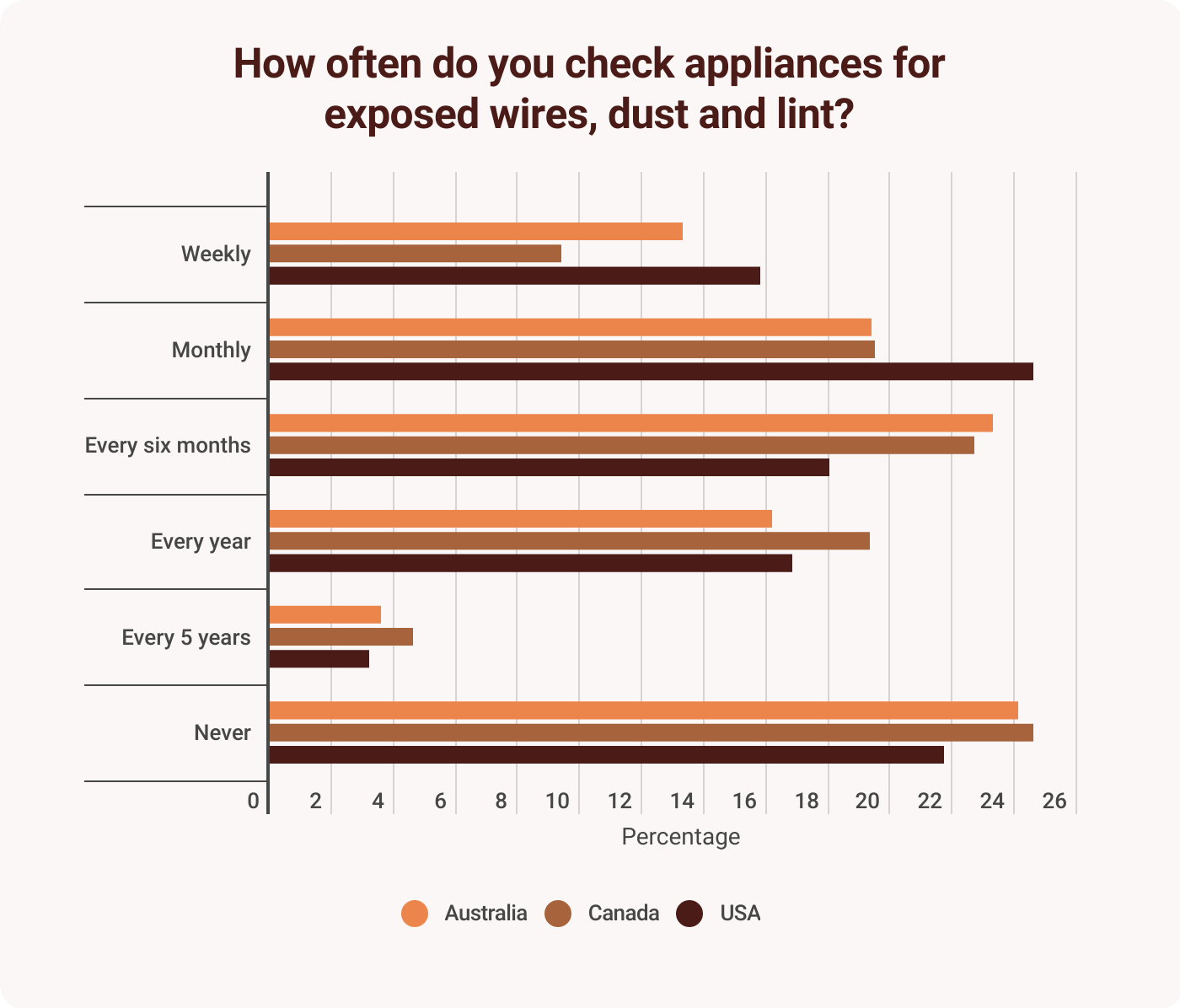

People from the US are almost 10% more likely to clean their house gutters weekly than Aussies and Canadians. In contrast, Australians were the most likely to never clean the gutters or trim excess branches out of all three countries. Americans were the most likely to check their appliances for exposed wires, dust and lint build-up every month, and 16% of Americans said they do so every week.

This compares to roughly a quarter of Australians and Canadians who never check their appliances for these things.

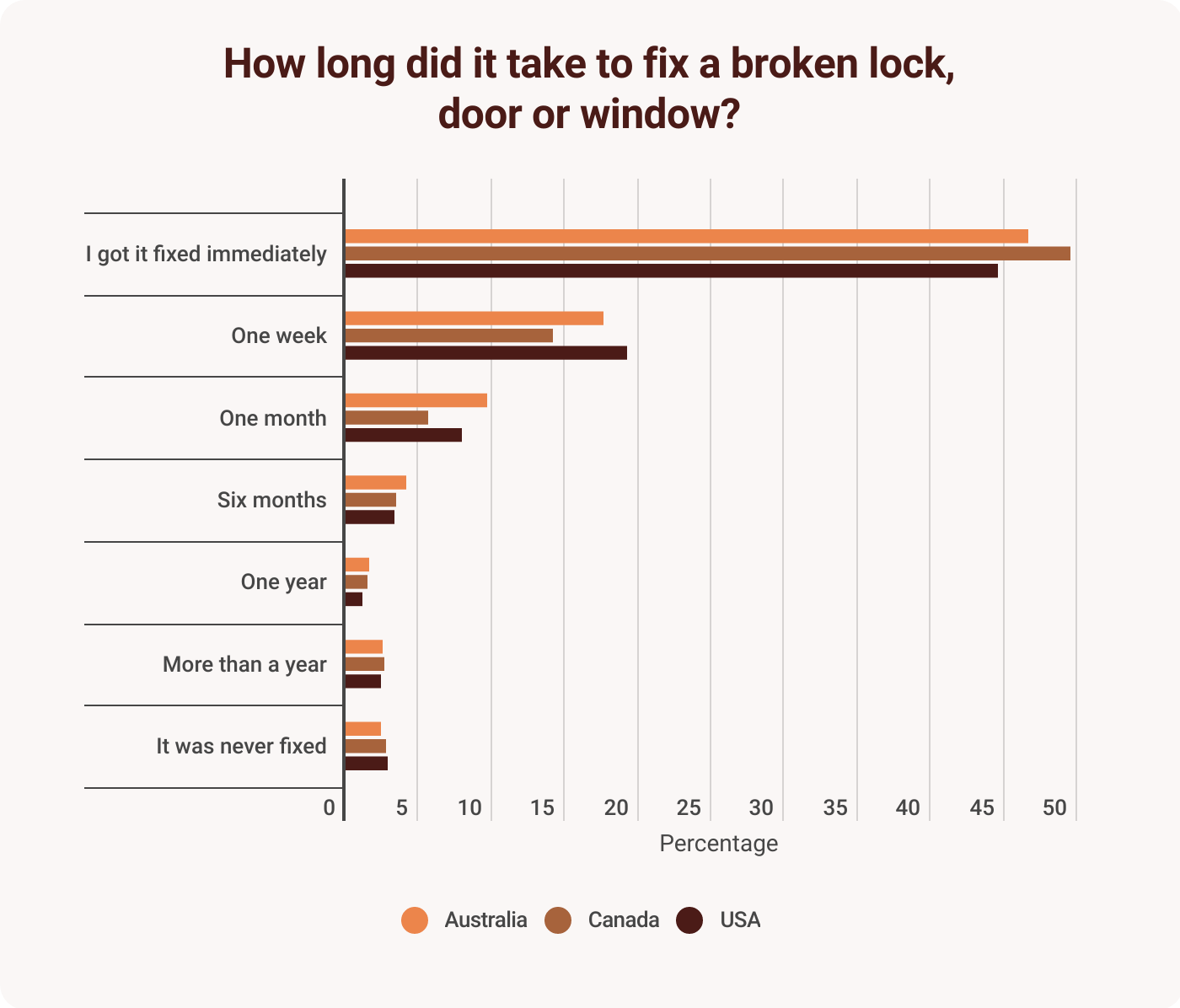

Almost half of Canadians (49.5%) fix a broken lock, door or window immediately, followed by 46.7% of Australians and 44.6% of Americans. Conversely, Americans and Canadians were five per cent more likely to check or test their smoke alarms within the last three months than Australians.

However, of those who never fix broken locks, doors or windows, most were Americans, just barely beating out Canada and Australia (2.9% of Americans selected they never fixed these things, compared to 2.8% of Canadians and 2.4% of Australians).

“In general, it appears Americans are on the ball when it comes to important home chores, leaving Australia and Canada with some catching up to do,” says Taylor.

The tables below display the results for each chore across all three countries.

N.B. does not include ‘not applicable’ responses.

N.B. does not include ‘not applicable’ responses.

Taylor explains that these household chores are not just important for taking care of your home, but they can also have an impact on your home and contents insurance policy.

“The particular chores we focused on in this survey help prevent potential damage to the home. For example, full gutters and overhanging branches can lead to storm damage. Exposed wires and lint build-up could increase the chance of an electrical fire. Broken locks, doors and windows could lead to a break-in. And of course, a flat battery in a smoke alarm could lead to serious danger to a home and its occupants during a fire,” says Taylor.

“The key here is that if you don’t take care of these things and an incident does occur, you may not be covered by your home insurance policy,” Taylor continues. “Many Australian insurance companies have specific wording in their policies, which in some cases won’t cover damage caused by neglect. Customers should always check the Product Disclosure Statement (PDS) for details.”

Taylor encourages homeowners to check these chores regularly throughout the year and to jump on any issues immediately, especially broken locks, doors, windows, smoke alarms and exposed wiring. When it comes to gutters and clearing branches, these should be done regularly, but Taylor suggests homeowners pay special attention ahead of storm and fire season.

“In dry weather, gutters full of dead leaves and overhanging branches could increase the risk of fire damage during a bushfire as they can provide fuel for embers and sparks,” notes Taylor. “In storm season, these could block up the pipes and damage the roofs and walls of a building. It’s important to know what times of the year your home could be at greater risk so you can be prepared as you head into fire or storm season.”

Compare the Market commissioned PureProfile to survey 1,004 Australian, 1,005 Canadian and 1,006 American adults in April 2023.