The Burrow

It’s a classic question you might come across in a ‘getting to know you’ exercise at work or university.

“Assuming your loved ones and pets are safe, what three items would you take with you and save in an emergency?”

It’s not pleasant to think about, but in the event of a natural disaster or emergency like a wildfire or flood, you might only have minutes to grab your things and evacuate. The answers to this question reveal things about us, such as the items we value and what we think is important to have at hand in such a crisis.

To get a better understanding of what possessions people truly value and would save, the home and contents insurance experts at Compare the Market surveyed over 3,000 Australian, Canadian and American adults.

What would you choose to save in an emergency?

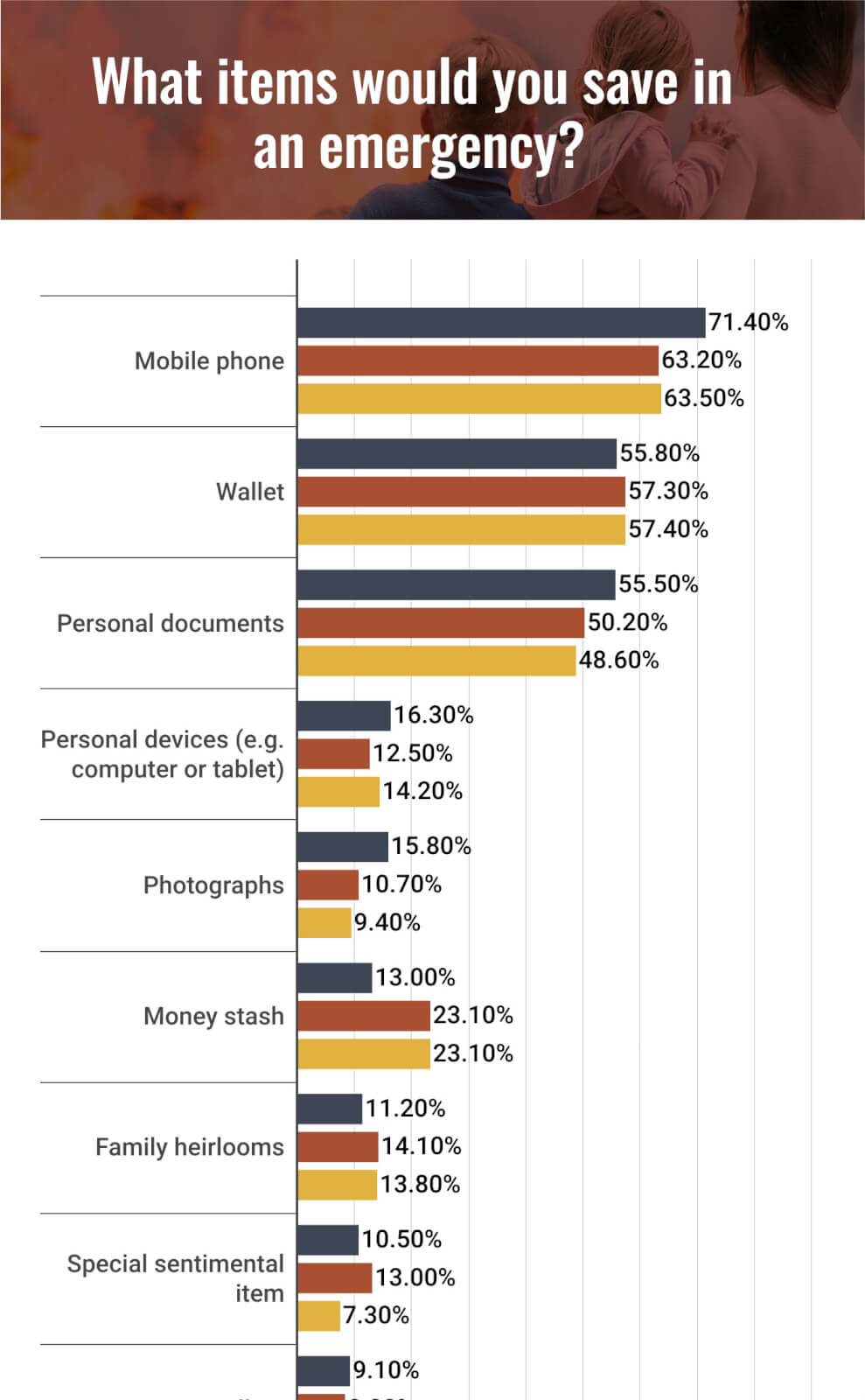

Across all three nations, the three most popular choices were the same: mobile phones, wallets and personal documents (such as birth certificates).

Sentimental items also proved a popular choice to save in an emergency. Photographs, family heirlooms and special sentimental items were in the top 10 choices, as were personal devices (like tablets, laptops and computers), and stashes of money.

Sporting equipment, tools (separate from equipment required for work) and musical instruments were the least prioritised items.

Download this chart as a single PNG image

Adrian Taylor, General Manager of General Insurance at Compare the Market, says it makes sense that most people would choose to bring their phones, wallets and personal documents in an emergency.

“Phones help us keep in contact with people, which can be crucial during a disaster. Our wallets typically have our credit cards, driver licence and other forms of ID that we will need to get around and buy things,” Mr Taylor explains.

“Personal documents like birth certificates, on the other hand, are very hard to replace and are a key part of proving your identity for a range of services. These are incredibly important to take with you in an emergency.”

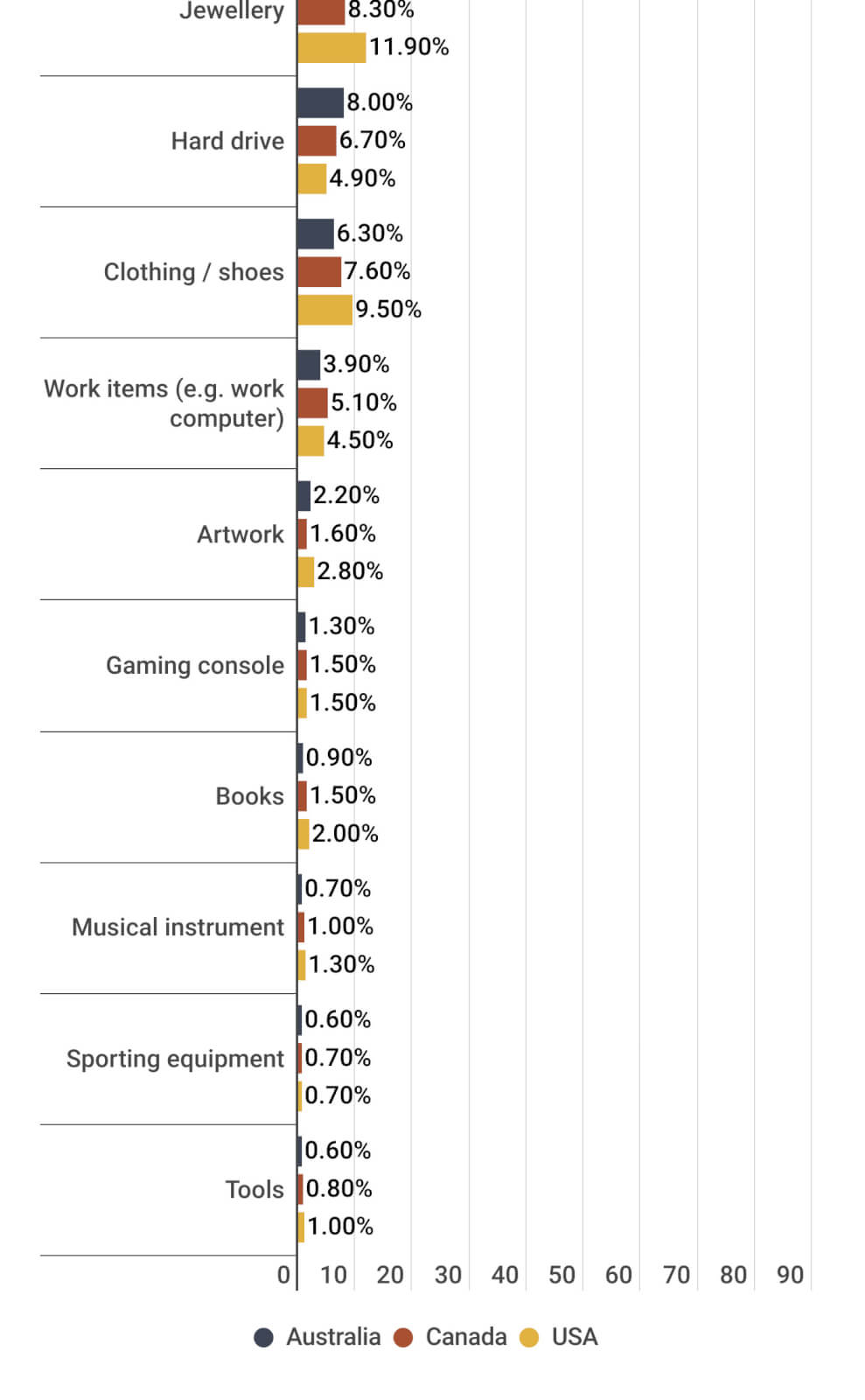

The survey asked respondents which of their items they believed were covered by their home and contents insurance. There were a few items that most respondents across all three countries believed were insured.

In Australia, the items that most people believed were covered included personal devices (37.5%), jewellery (36.5%) and clothing and shoes (34.1%). In Canada, the order was slightly different, with jewellery being the item most people had confidence was covered (35.5%), followed by personal devices (33.2%) and mobile phones (30.1%). The USA cohort had a slight difference again, with mobile phones being the item most people believed was insured (33.5%), followed by jewellery (30.9%) and personal devices (23.4%).

Mr Taylor says that in Australia, contents insurance typically covers most of these items, but not all – and even then, there are things to be aware of.

“Some insurance companies might cover cash up to a certain limit, while others don’t. Additionally, personal devices like laptops, tablets, mobile phones and jewellery that you take out of the house might not be covered unless you have portable contents cover. Portable contents is usually a policy add-on that costs extra,” Mr Taylor says.

The items least believed to be insured across all three countries were money stashes, personal documents, photographs, special sentimental items and family heirlooms. Mr Taylor explains that some of these sentimental items might be covered, while others aren’t.

“Insurance won’t cover personal documents or photographs, but it can cover the cost of replacing hard drives that might house photos on them, though there’s no guarantee you’ll see those specific photos again unless you have digital backups saved to cloud storage,” Mr Taylor says.

“Family heirlooms and sentimental items could be covered, depending on what exactly they are and what your policy wording states. Given that they may be old, rare and difficult to replace, you may receive a similar contemporary item or a cash payment to replace that item with a contemporary.”

| Item | Australia | Canada | USA |

| Personal devices (e.g. computer or tablet) | 37.5% | 33.2% | 23.4% |

| Jewellery | 36.5% | 35.5% | 30.9% |

| Clothing / shoes | 34.1% | 29.5% | 19.1% |

| Mobile phone | 33.6% | 30.1% | 33.5% |

| Tools | 29.5% | 23.1% | 15.1% |

| Artwork | 22.1% | 19.9% | 15.8% |

| Books | 21.4% | 18.3% | 10.6% |

| Gaming console | 21.3% | 22.0% | 12.4% |

| Sporting equipment | 19.9% | 18.9% | 10.9% |

| Musical instrument | 19.0% | 19.5% | 10.3% |

| Hard drive | 18.6% | 14.2% | 11.4% |

| Work items (e.g. work computer) | 18.5% | 21.2% | 15.2% |

| Wallet | 16.6% | 15.4% | 13.4% |

| Special sentimental items | 16.3% | 12.5% | 10.6% |

| Family heirlooms | 15.7% | 16.6% | 14.9% |

| Photographs | 15.4% | 11.8% | 7.8% |

| Personal documents | 14.8% | 15.0% | 16.3% |

| Money stash | 10.4% | 12.4% | 9.5% |

Interestingly, 21.8% of Australians surveyed didn’t have insurance, and 18.2% said they didn’t know what their insurance covered. In Canada, 16% of respondents said they had no insurance, while 24.7% didn’t know what was covered. Lastly, 17.8% of respondents in the USA said they didn’t have any insurance, while 19.5% didn’t know what was covered.

Mr Taylor states that it’s crucial for people to think about what is and isn’t covered, especially when it comes time to planning an emergency escape.

“It’s important people understand what their insurance covers so they can evaluate if they have any gaps in their cover for important items,” Mr Taylor says. “It’s also important when thinking about what you can afford to leave behind, and what you might want to take with you.”

“From the list of items people would bring, personal documents, wallets and mobile phones were the top three. Personal documents are typically not covered by insurance, so this makes sense. While wallets and mobile phones may be covered, they are still vital to have with you in an emergency.

“Insurance can provide peace of mind if the worst should happen, which is why it’s vital to cover the things that are important to you.”

Mr Taylor recommends that people include the following items in their emergency kit, alongside other essentials like non-perishable food, water and a flashlight:

Lastly, Mr Taylor says it’s important to regularly update your insurance so that the insured amount adequately covers your belongings.“If you’ve purchased new items after buying your insurance policy, it’s worth ensuring that you’ve updated your insurance to make sure that if the worst happened, your coverage limits would cover the value of your things,” Mr Taylor says.

Compare the Market commissioned PureProfile to survey 1,006 Australian, 1,004 Canadian and 1,004 American adults in February 2023.