The Burrow

Parenting isn’t easy, and with dirty nappies and toddler tantrums to worry about, the last thing you’ll want adding to the stress is your finances. From buying a house with extra bedrooms to supporting your child’s education and wellbeing, it’s not cheap to have kids – yet there’s certainly much to be gained from having a healthy nest egg.

But that can sometimes be much easier said than done. When you have children or dependants and are applying for a home loan, your borrowing capacity from banks and lenders will likely be impacted, which can affect your opportunity to secure a home in a competitive market. This is because living expenses are one of the key considerations for lenders looking to offer you a loan, and your living expenses will typically increase depending on the number of dependents you have.

Luckily in Australia, there are various policies and schemes in place from both lenders and the Government to assist customers with children when it comes to home loan finance. As experts in the Australian home loan space, we are here to explain some of those benefits to you, which include:

Despite having a range of policies in place to support parents on their home loan journey, OECD data has revealed that economically speaking, Australia is not at the top of the world’s leaderboard for parental benefits.

In this article, we compare Australia’s benefits to those around the world to determine where in the world it’s financially better to be a parent when it comes to your savings and retirement. From baby bonuses to employment support, we’ve listed the top countries in which to raise a family, with the help of the latest available data from the Organisation for Economic Co-operation and Development (OECD).

As far as monetary benefits, Australia ranks 35th in the list of OECD countries,¹ which could be thanks to the government’s Newborn Upfront Payment and Newborn Supplement. Eligible parents will receive either $570 AUD ($440 USD^) per child upfront or a 13-week payment plan to a total of $1,709.89 ($1,321 USD^). For any further children, the maximum total amount is $570.57 ($441 USD^) for the period.15

National parental paid leave policies placed Australia 33rd out of 36 countries.⁶ The current rate of Parental Leave Pay in Australia is $150.78 ($117 USD^) a day before tax for up to 12 weeks, which is the same for everyone, regardless of salary.16

Finally, when it comes to retirement savings, a 2018 study by Rest found that women save, on average, $159,590 ($123,328 USD^) less than men for retirement due to career breaks, such as parental leave.17 This is because the paid parental leave scheme in Australia does not attract a superannuation guarantee, meaning it’s not compulsory for employers to pay super while parents are on paid parental leave.18

And so, how does Australia compare to other nations?

The table below reveals public spending on family benefits by percentage of GDP and orders it from highest to lowest (rounded to two decimal points). The OECD defines family benefits as public spending on the financial support of parents. This includes publicly funded child-related cash transfers or baby bonuses, public income support payments during parental leave and public spending on family-related services such as childcare.

Danish families rank the highest for monetary benefits, as many receive up to two forms of child financial assistance. The Child Cheque is a tax-free payment that households receive quarterly until their child turns 18. For the first two years, a parent will receive DKK 4,596 ($756 USD*) per quarter, with this steadily reducing to DKK 954 ($157 USD*) per month when the child is between 15-17 years of age.² Single parents are also eligible to apply for the Child allowance which is an additional DKK 1,499 or $246 USD* per quarter.³

Swedish parents receive a monthly child allowance until a child turns 16. It’s SEK 1,250 ($151 USD*) per month, divided evenly between guardians if there are two.⁴ Once a child turns 16, the child starts receiving their own payments and becomes more financially independent.

In Luxembourg, residents who have children receive a family allowance which is intended to cover education and some living costs until a child either finishes schooling or turns 25. The allowance is €265 or $324 USD* per child, monthly, which increases by €20 ($24 USD^) at age six and €50 ($61 USD^) at age 12.⁵ Non-permanent residents will receive an amount that varies according to the policy in their country of residence.

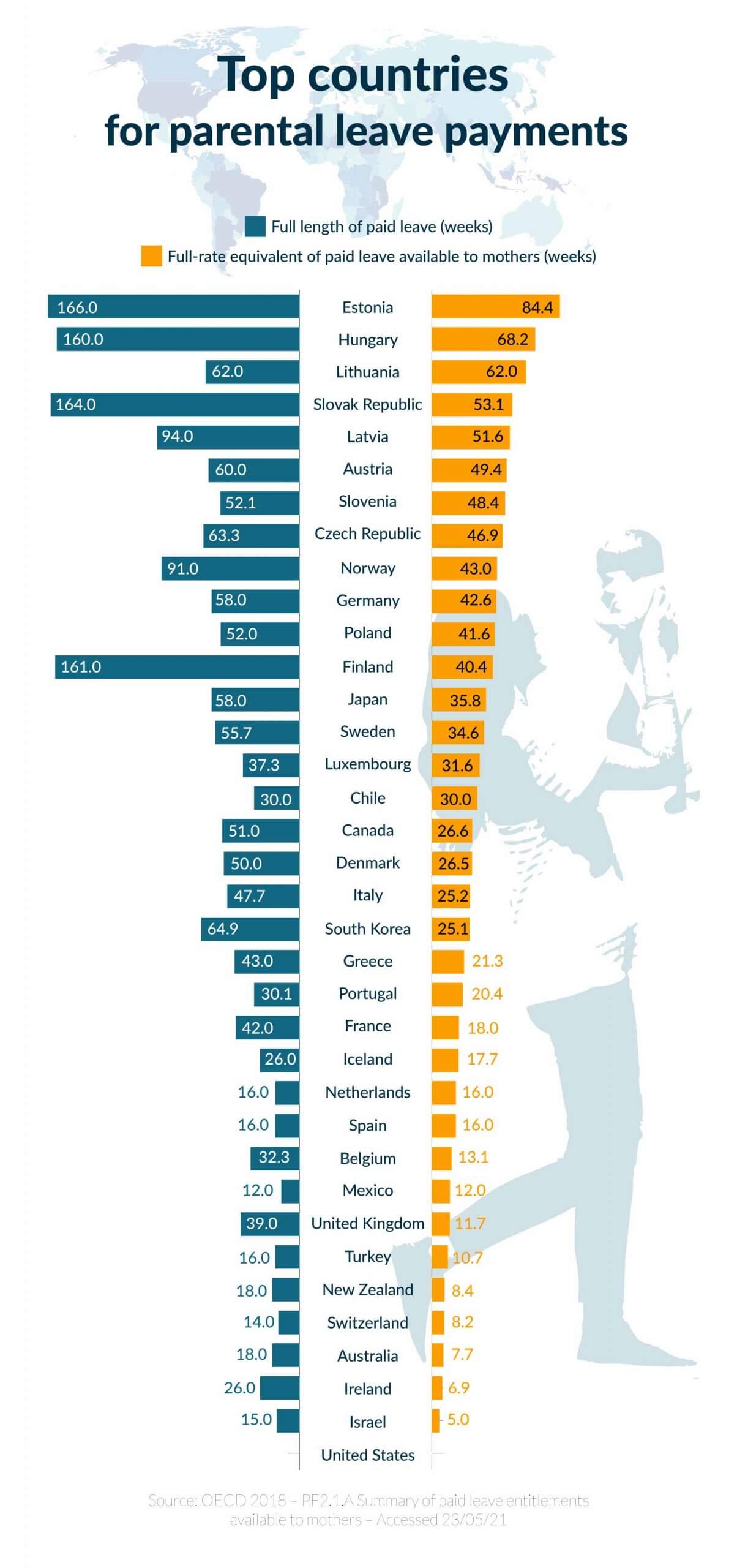

The table below represents the total length of time in weeks for which paid leave is made available to mothers, which could incorporate varied rates of pay (blue series) in comparison with the number of equivalent weeks at the full rate of pay (yellow series). The full-rate equivalent figures show the average payment rate available across the paid leave period for a mother on 100 per cent of national average earnings. As shown in the data, Estonia has the most generous entitlements, with 166 weeks of paid leave available.

This list is exclusive of any state or organisation-based parental leave programs a country might have. Where a parental leave period is longer than the full-rate pay period, other payments may or may not be received.

Estonia tops the charts for paid leave available to mothers as per table PF2.1.A. The benefits households receive depend on the salary of the caregivers. Mothers initially receive 20 weeks of paid maternity leave, which can begin up to two months before the estimated delivery date.⁷ Fathers are given two paid weeks off after the birth of the child. At the end of this initial period, a parent is given 62 weeks from the end of maternity leave at full compensation, which is calculated at the average of both of their pay rates.⁷

In Hungary, maternity leave is 24 weeks in total, which is compensated at a rate of 70% of the mother’s normal salary.⁸ Fathers receive only 1 paid week off (5 working days), which must be used within the first two months of birth. At the end of these periods, one parent is entitled to additional leave until the child is 2 years old, which again is paid at 70% of the normal salary, or 70% of twice the minimum daily wage.⁸

Lithuanian parents receive a total of 158 days of paid leave. Mothers receive 70 calendar days prior to the birth and 56 days after the birth paid at a rate of 77.58% of their normal wage, or at least €234 ($286 USD*) a month before taxes.⁹ Fathers also receive their pay for 30 days at this rate. One parent may also stay home until the child is one year old at this same rate, or until the child is two years old at the rate of 54.31% of normal earnings for the first year, and 31.03% for the second year.⁹

Most of us start planning for retirement the moment we enter the workforce. Employment gaps and extended leave periods, such as for childcare, can have a major impact on your retirement savings – but this can also vary based on where you live.

Children affect retirement savings in two ways: by reducing retirement fund contributions while on maternity and parental leave, and through reduced work hours in favour of spending more time at home with them.

In some countries, pension contributions towards retirement are still made while on paid maternity and parental leave. In the UK, employers must continue to make pension contributions throughout maternity leave, even if an employee isn’t getting paid.10 In the US, certain states or individual employers do offer paid maternity leave, and 401(k) contributions (an employer-sponsored retirement plan in which employers and employees may invest in their retirement) will continue for this period (unpaid maternity leave won’t be covered).11 Swedish parents have it best as pension credits are offered for all parental leave benefits (income-related and flat-rate).12

Sometimes referred to as the ‘motherhood tax’, the financial loss experienced by a mother that has taken a career break to take care of a child can most certainly have impacts on retirement savings. Research has shown that a five-year childcare break from work can reduce a parent’s pension by 12% in Australia.13 In other countries, such as Canada, the same five-year gap in employment will reduce pension entitlement by just 2% compared to a full career.14

1OECD 2021 – Family benefits public spending (indicator). doi: 10.1787/8e8b3273-en – Accessed 21/05/21

2Life in Denmark 2021 – ‘Child and Youth Benefits’ – Accessed 23/05/2021

3Life in Denmark 2021 – ‘Child Allowance’ – Accessed 23/05/2021

4European Commission 2021 – ‘Sweden – Child allowance’ – Accessed 25/05/2021

5Editus Luxembourg 2021 – ‘All about family benefits in Luxembourg’ – Accessed 01/06/2021

6OECD 2018 – PF2.1. Parental leave systems – Accessed 23/05/21

7Republic of Estonia Social Insurance Board 2021 – ‘Kinds of family allowances’ -– Accessed 01/06/2021

82021 Globilization Partners – ‘Hungary – Employer of Record’ – Accessed 01/06/2021

9Renkuosi Lietuva 2021 – ‘Child Benefits’ – Accessed 01/06/2021

10GOV.UK 2021 – ‘Workplace Pensions’ – Accessed 27/05/2021

11U.S. Department of the Interior 2021 – ‘Benefits’ – Accessed 28/05/2021

12Leave Network 2020 – ‘Sweden’ – Accessed 28/05/2021

13OECD 2019 – ‘Pensions at a Glance 2019 How does AUSTRALIA compare?’ – Accessed 28/05/21

14OECD 2019 – ‘Pensions at a Glance 2019 How does CANADA compare?’ – Accessed 28/05/21

15Services Australia 2021 – ‘Newborn Upfront Payment and Newborn Supplement’ – Accessed 28/05/2021

16Services Australia 2021 – ‘Providing Parental Leave Pay’ – Accessed 28/05/2021

17Rest 2021 – ‘Super and having a baby’ – Accessed 28/05/2021

18Women in Super 2021 – ‘WHY IS IT SO IMPORTANT TO RECEIVE SUPER WHILE ON PARENTAL LEAVE’ – Accessed 28/05/2021

Brought to you by Compare the Market: Making it easier for Australians to search for great deals on their Home Loans or to refinance your home loan.