The Burrow

With house prices becoming increasingly out of reach for people wanting to buy their own home, teaming up with a friend or a family member might make getting a house that much easier.

But is buying with a friend, sibling or other family member – rather than by yourself or with a romantic partner – really something people want to do?

To find out, the home loan experts at Compare the Market surveyed over 3,000 adults across Australia, the USA and Canada, asking them if it is something they would consider, if they had ever done it before, and whether it had led to any problems that impacted the relationship.

Join us as we explore how willing people are to team up with friends to tackle the financial goal of home ownership.

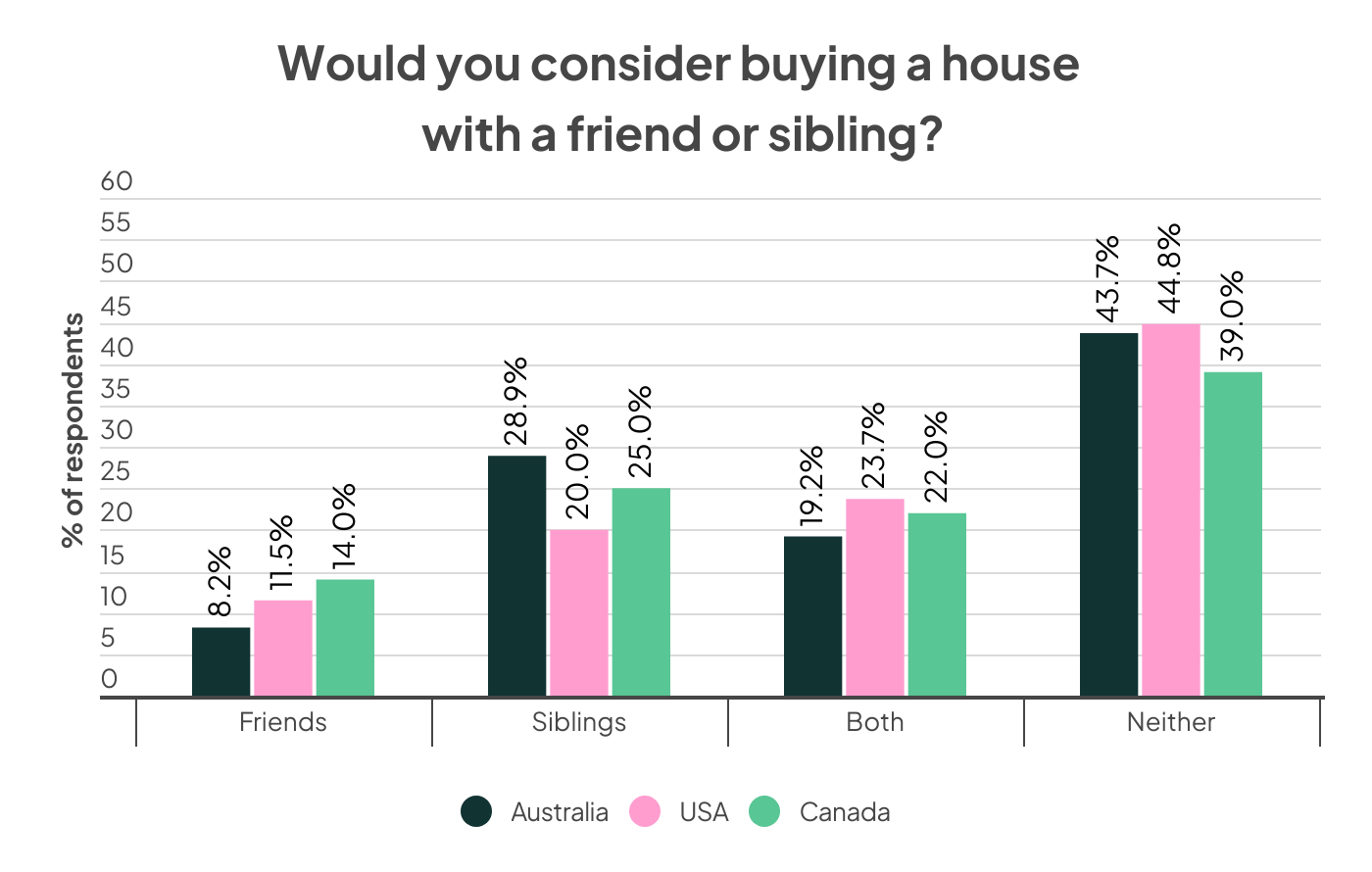

In total across Australia, America and Canada, over 50% of people surveyed said they would consider buying a home with either a sibling, a friend, or both.

Canadians were the most likely to team up with friends or family to become homeowners, with 61.0% saying they would. Australia was second at 56.4% while the USA was close behind with 55.2% of respondents.

Canadians and Australians were most likely to specifically choose to buy with siblings (25.0% of Canadians and 28.9% of Australians), while Americans were most likely to say both (23.7%).

Less than half of those surveyed – 44.8% of Americans, 43.7% of Aussies and 39.0% of Canadians – said they wouldn’t consider buying with friends or family.

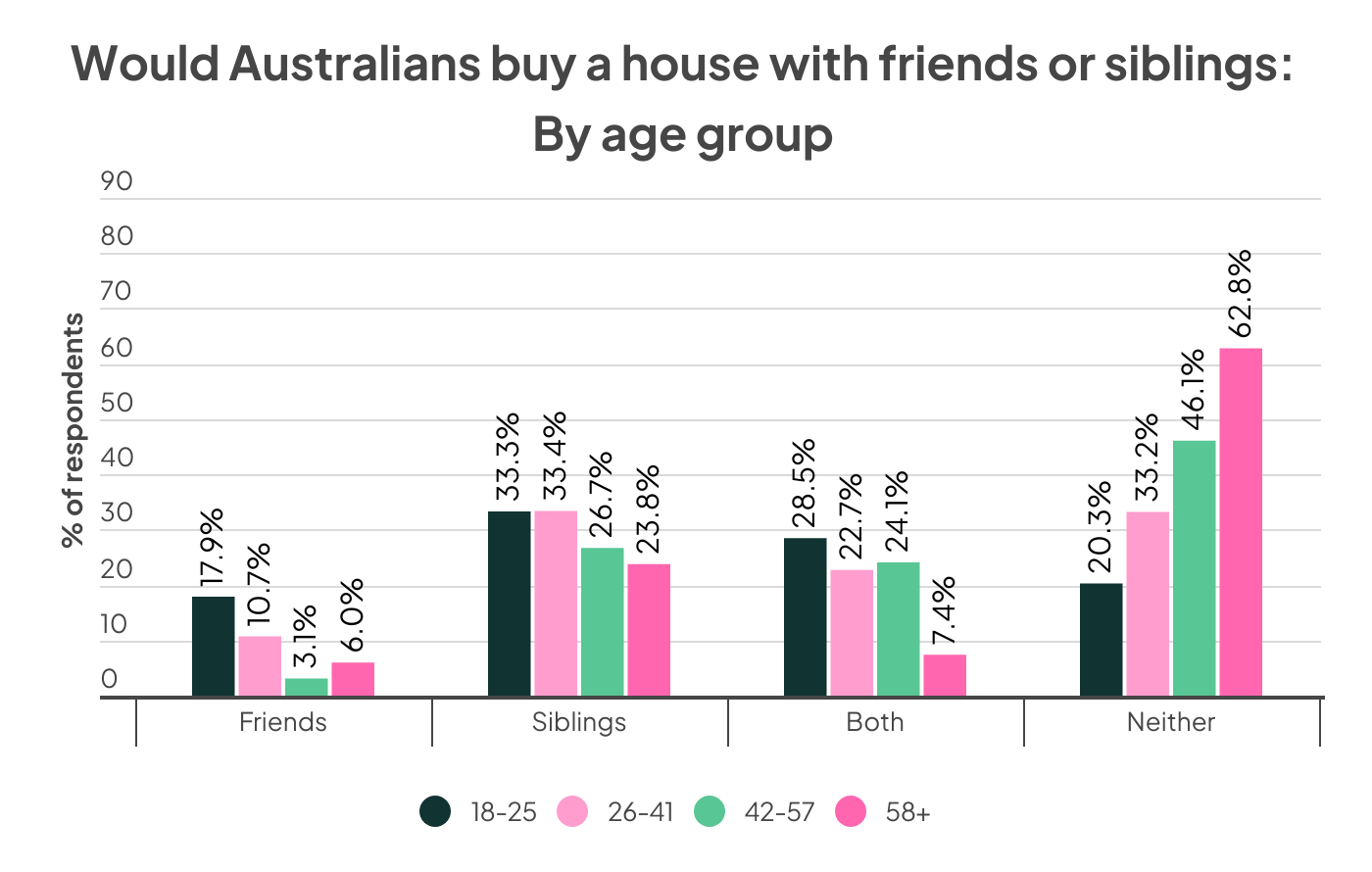

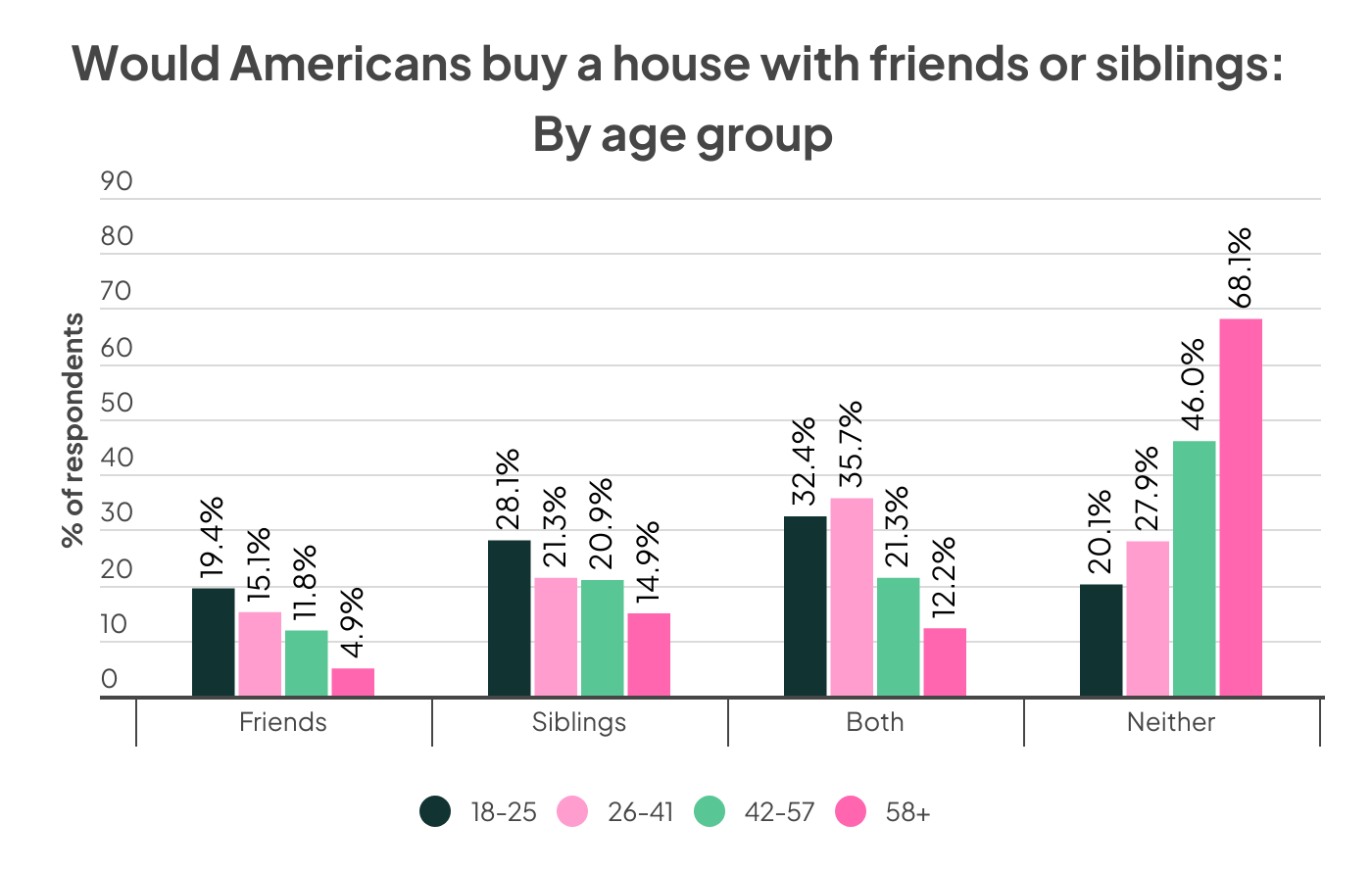

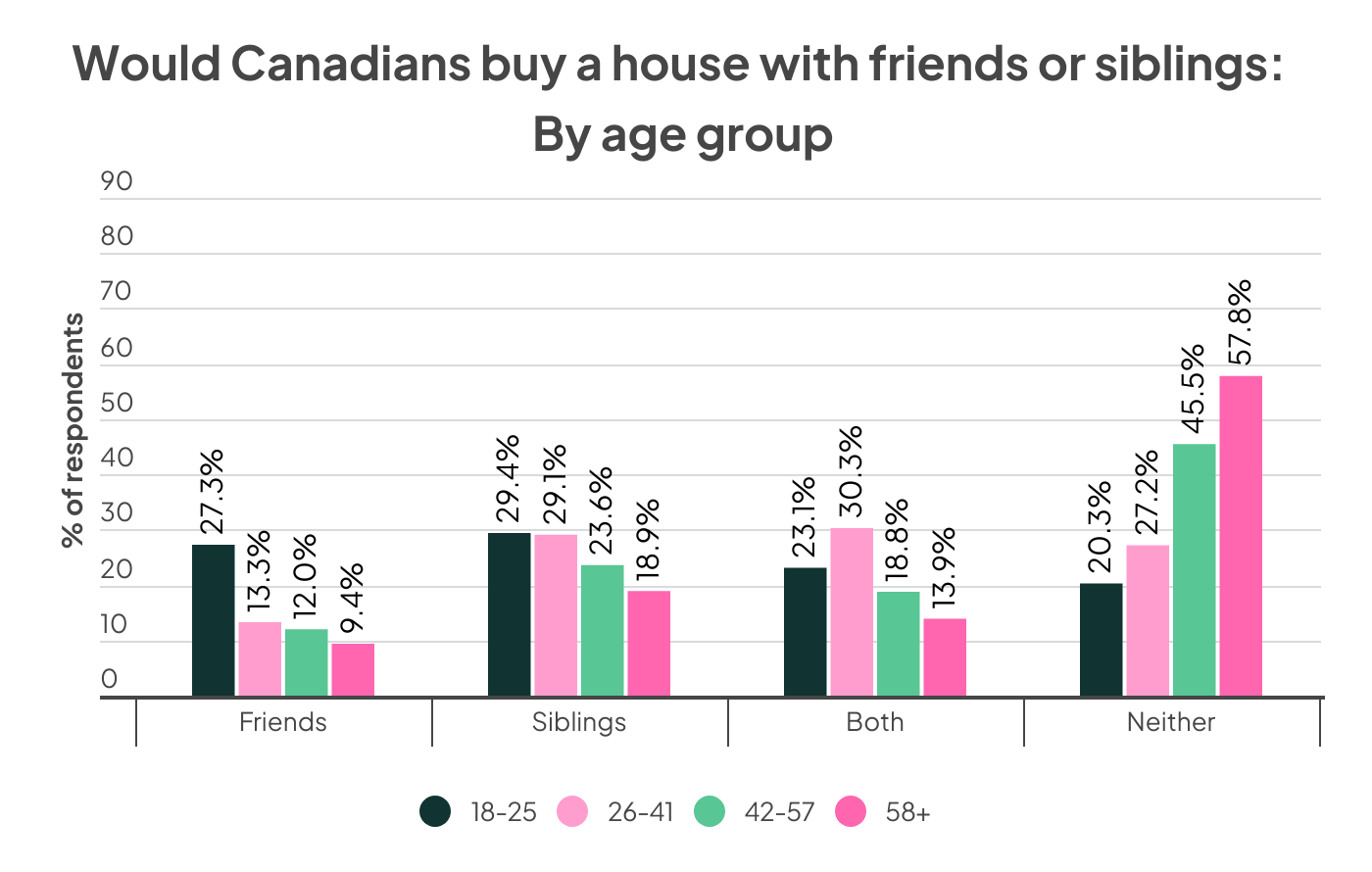

Unsurprisingly – given that home ownership is getting further and further out of reach – young people were more likely to consider buying with friends and family than older generations who have had more time to work and save for a house, and were around for more affordable house prices.

The survey also asked if people had bought a home before with family members and relations. For most people, they had bought with a romantic partner – 46.2% in Australia, 42.5% in Canada and 37.5% in the USA.

This makes a great deal of sense – after all, you not only want a home for your family, but potentially having two incomes can help make a mortgage more affordable.

The next most common response was from people who had never purchased a home at all, and this was followed by people who had bought on their own.

The number of people who had bought a house with family or friends was actually quite low, as shown in the table below.

Note: responses to this question were not exclusive, meaning people could select more than one option.

| Have you purchased a property with any of the following relations before? | Australia | USA | Canada |

| Romantic partner | 46.2% | 37.5% | 42.5% |

| Friend/s | 4.0% | 6.1% | 5.4% |

| Parent/s | 8.0% | 8.0% | 8.4% |

| Sibling/s | 5.7% | 6.2% | 5.4% |

| Child/ren | 2.4% | 5.7% | 3.5% |

| Extended family | 2.1% | 1.9% | 1.8% |

| I have purchased a property by myself | 24.1% | 22.4% | 21.0% |

| I have never purchased a property | 25.1% | 32.2% | 28.8% |

It’s a telling sign that most people who have already bought houses did so with a partner or on their own, but over half the population would consider teaming up with family and friends to purchase one now.

It just goes to show how hard the housing market has become to buy into, forcing prospective home buyers to think outside the box for help purchasing a property.

Buying a home and getting a mortgage are massive financial investments, and all those who applied for the loan will have responsibilities to make sure repayments are made on time. This can be a source of stress and add an element of pressure to anyone who gets a home loan.

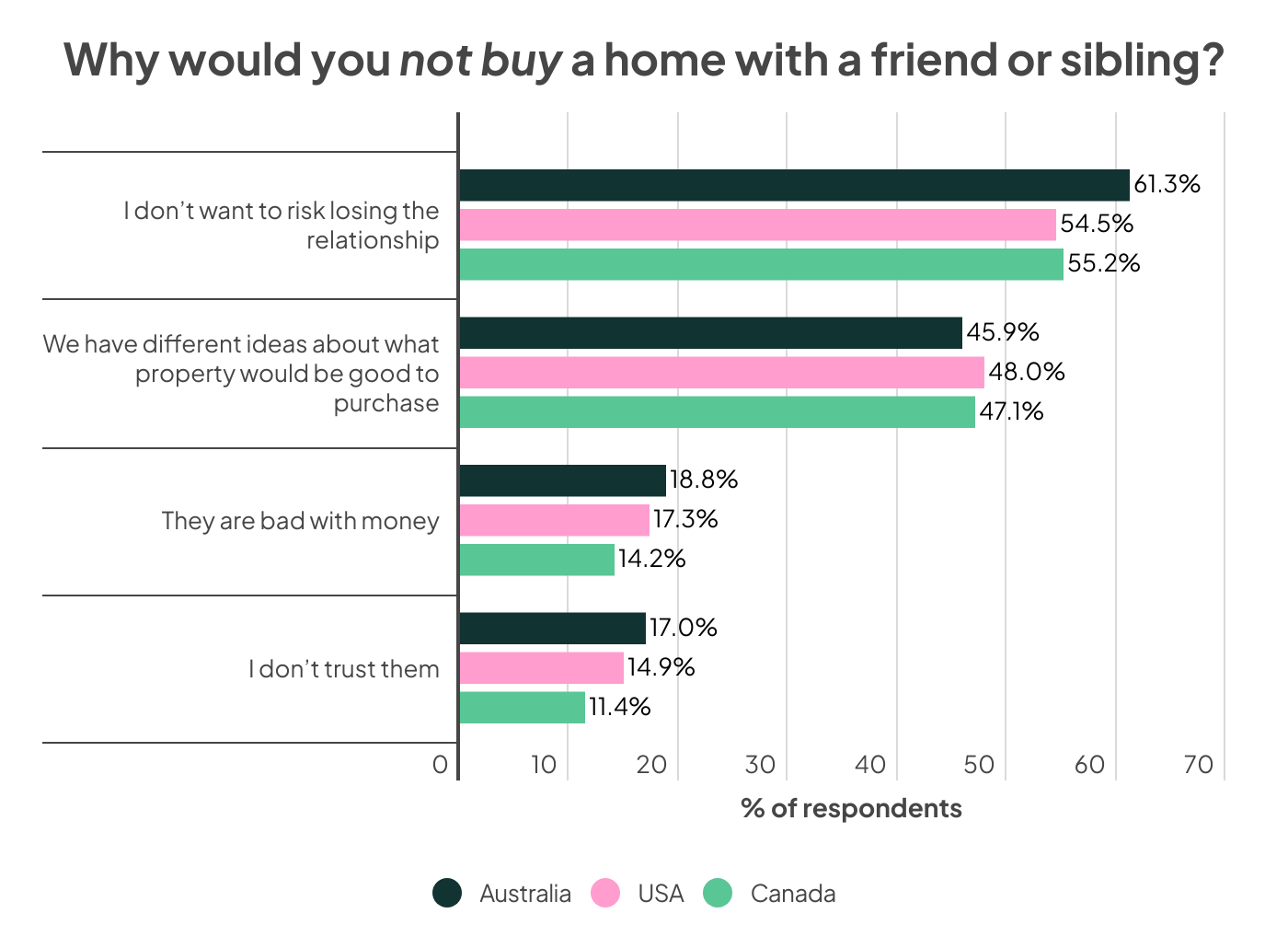

When respondents were asked if there was any reason why they wouldn’t buy with a sibling or friend, the number one response was “I don’t want to risk losing the friendship”.

This was highest in Australia (61.3% of respondents), followed by Canada at 55.2% and America at 54.5%. Almost half of people surveyed also said they had different ideas about what properties would be good to buy.

Interestingly, over one-in-ten people don’t trust their friends or siblings enough to buy a house with them. This was highest in Australia (17.0%), followed by America at 14.9% and Canada at 11.4%.

The chart below shows which options respondents chose to answer that question.

Fortunately, for those people who had bought a house with a relative or friend (including parents, children, romantic partners and extended family), most people said they had never had an issue with that person because of the joint house purchase. This was true in all three countries (68.4% in the USA, 67.8% in Australia and 66.5% in Canada).

When conflict did occur, most people reported a relationship breakdown unrelated to the property (13.2% in the USA, 12.8% in Australia and 12.5% in Canada), followed by conflict over home maintenance issues, which affected over one-in-ten people from each country who had bought a home with someone else.

| Have you had a conflict or issue with someone since purchasing a property with them? | Australia | USA | Canada |

| No | 67.8% | 68.4% | 66.5% |

| Relationship breakdown unrelated to the property | 12.8% | 13.2% | 12.5% |

| Conflict with maintenance issues | 10.1% | 10.2% | 11.8% |

| Conflict when selling | 8.7% | 7.2% | 5.8% |

| Conflict when purchasing | 6.3% | 6.8% | 5.3% |

| Disagreement surrounding a renovation | 5.3% | 6.0% | 7.6% |

N.B. This excludes responses from people who hadn’t bought a property before or had bought a property by themselves.

Becoming a homeowner is a big step, and with house prices becoming increasingly unaffordable for the average prospective buyer, borrowers could be facing bigger and more expensive home loans. Buying with friends or siblings might sound like the answer.

However, as Compare the Market’s General Manager of Money Stephen Zeller states, getting a mortgage with a friend or sibling is a little more involved than buying by yourself or with a spouse/partner.

“Your home is a massive investment, and a joint mortgage means there needs to be a clear understanding of how much each party owns,” says Mr Zeller.

“With a single buyer or a couple, the borrowers own the whole thing, and if a divorce occurs the spouses then work out ownership themselves. But with friends or siblings buying together, they need to work that out at the start.

“Some lenders will require each party to have a minimum share of 25% of the home, and each party must have an equal share. However, it’s possible to sign a legal agreement which states how much of a share each interested party will own.

“This is important because there is a range of possibilities, such as a friendship or familial breakdown, someone getting a partner and wanting to sell or buy their own place, or one of the borrowers passing away while the mortgage remains outstanding.

“Even if you trust your friends and family deeply, you’ll still likely need a lawyer to hash out and sign the agreement when going to a lender for a home loan.”

Compare the Market commissioned PureProfile to survey 1,005 Australian, 1,003 American and 1002 Canadian adults in February 2024.