The Burrow

Saving for a home can be costly.

Amid challenging economic times, there may be other priorities such as paying the rent, bills and food that can get in the way for saving up for a home deposit.

As experts in helping Australians to compare home loan interest rates and refinancing, we explored what people want to save up for most – a home, car or retirement – and other general savings across four continents using average yearly online search volume data.

Here’s what we found.

Search volume between March 2023 to February 2024. Percentages were rounded to the nearest two decimal places.

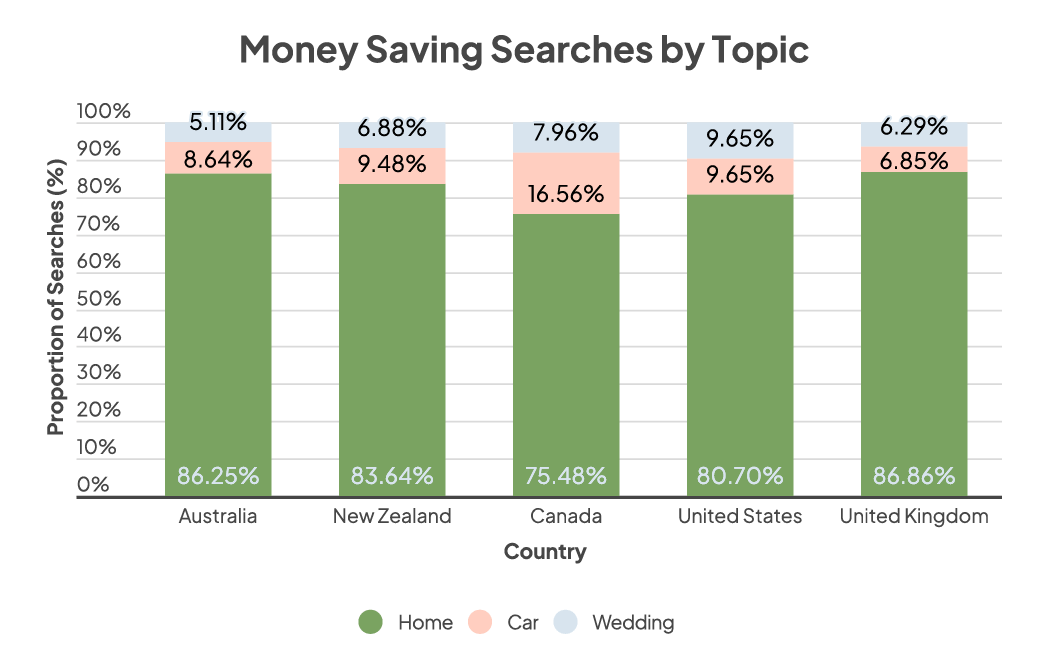

Overall, across five sampled countries, interest in saving for a home dominated across all sampled countries in the past year (3,285,130 total searches).

This was followed by saving for a vehicle (381,380) and saving for a wedding (333,550).

Delving into the data of each nation, these were the key takeaways:

| Grocery | Energy | Fuel | |

| Australia | 78,750 | 527,160 | 39,220 |

| New Zealand | 12,060 | 70,550 | 14,350 |

| United States | 113,390 | 373,890 | 51,700 |

| Canada | 1,023,230 | 2,921,370 | 466,410 |

| United Kingdom | 138,150 | 1,035,090 | 98,350 |

Search volume between March 2023 to February 2024.

Whether it’s aiming for a new home, car or better retirement, these ‘big’ savings goals can take time and cost-cutting in everyday essentials.

According to the total search volume data across five sampled countries from the past year, most wanted to save money on electricity bills (4,928,060 total searches), followed by groceries (1,365,580) and fuel (670,030).

This is an interesting revelation amid cost-of-living pressures – indicating more people are actively searching to save on energy bills, rather than food essentials and vehicle running costs.

With most people’s interest lying in saving for a home, Compare the Market’s General Manager of Money, Stephen Zeller, said a home loan is the typical pathway for Australians to own a property – but not all lenders are equal.

“If you’re looking to buy a property, you likely won’t have enough money to cover the full purchase price. Therefore, you may decide to apply for a home loan,” Mr Zeller said.

“However, each lender will offer different comparison and interest rates – which means you can ultimately be paying more for your home at the end of the loan, depending on who you go with.

“Those who currently have mortgages – especially those coming off fixed rates – should also compare the offerings out there to decide whether switching may provide features and rates that better suit your situation.”

Data collected on 25 March 2024 using Google Keywords Planner.

The search volume data is based on the average of five major countries in a 12-month period (March 2023 to February 2024).

We combined three common search phrases (in English) to result in each savings topic. For example, search volume for saving for a home included:

Percentages were rounded to the nearest two decimal places.

Full Data: Total Money-Saving Topic Search Volume

| Home | Car | Wedding | |

| Australia | 312,380 | 31,300 | 18,490 |

| New Zealand | 55,590 | 6,300 | 4,570 |

| Canada | 250,640 | 55,000 | 26,440 |

| United States | 1,929,090 | 230,640 | 230,640 |

| United Kingdom | 737,430 | 58,140 | 53,410 |

| Totals | 3,285,130 | 381,380 | 333,550 |