The Burrow

There are quite a number of things that can influence the cost of a home, and subsequently, the size of your mortgage. As experts in Australian home loans, we have compiled a list to help prospective buyers understand how the size of their future mortgage can vary, based on some of the following factors:

Just for fun, we wanted to look at some outlier homes that may be worth a pretty penny due to such special features. We’ve looked at the properties featured in some of the most popular TV shows across the U.S. and Canada, worked out how much they’d be worth in real life and what they’re predicted to be worth in 10 years’ time.

Read on to find out just how dramatically a ‘special feature’ could impact the price of a home!

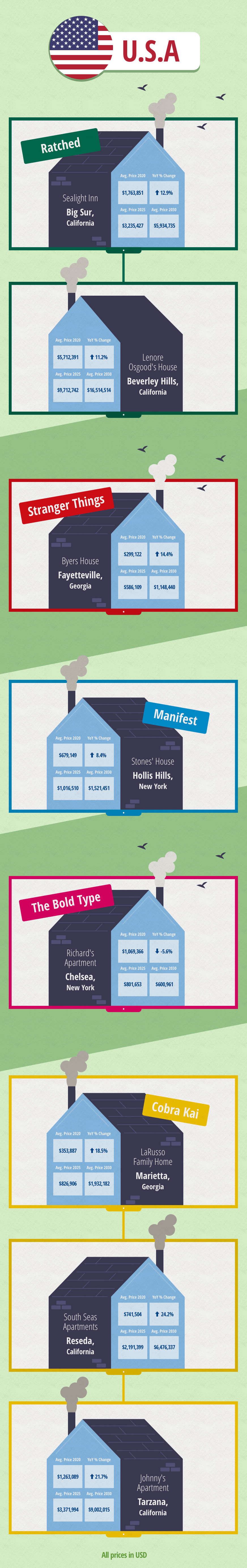

Looking at properties located within the U.S., the Ratched heiress’ sprawling mansion has come out on top, priced at $5,712,391 USD in real life in 2020. Based in Beverley Hills, the price of an equivalent abode is set to increase by 11% year-on-year (YoY), reaching over $16 million by 2030.

Best described as ‘wonderfully cluttered’, Lenore’s mansion is home to intriguing furnishings, including beautiful coral chairs and lacquered coffee tables. The exterior is even more impressive, boasting a garden that sprawls over three levels and features several pagodas, a koi pond and a waterfall. The cast of Selling Sunset would be fighting it out to get their hands on this property if it ever came on the market!

Cobra Kai’s South Seas Apartments is the property whose real-life equivalent is set to increase the most in value YoY. Based in Reseda, the price of a condo there is predicted to rise by 24.2% year-on-year. Of course, Daniel and his mum, Lucille, lived in these LA apartments before they were evicted, resulting in Daniel moving in with Mr Miyagi (and the rest, of course, is history!).

Even Johnny’s dingy apartment in Cobra Kai is set to increase in value in real life, climbing 21.7% YoY to reach $9,002,015.06 USD in value by 2030.

For those eagerly awaiting the return of Stranger Things for its fourth season, a home on the same street as the Byers’ family is currently priced at $299,122 and is set to rise by 14.4% YoY, meaning that in 10 years’ time it might be worth $1,148,441.

Also seeing an increase in value (albeit a smaller one compared to other U.S. properties) is the Stones’ house in popular NBC show, Manifest. Located in New York, the ZIP code is set to see an increase of 8.4%, with a home in the area predicted to be worth $1,521,451 by 2030.

At the other end of the spectrum, the only property on our list that’s expected to decrease in value over the years is Richard’s apartment in The Bold Type. On paper, it seems like the perfect place to move to: located in Chelsea, New York, and boasting huge windows with breath-taking views of the city, it’s the kind of place that everyone wants to move to. Unfortunately, that means the potential to increase in value has already been maxed out, so all it can do, realistically, is lose value.

Expected to decrease by 5.6% each year, the apartment’s real-life equivalent was worth $1,069,366 USD in 2020. It’s expected to decline in price by nearly $400,000 over the next 10 years, meaning it’ll be worth around $600,961.04 in 2030 – so if you’re considering moving to Chelsea, it may be best to wait 10 years when you can get a bargain!

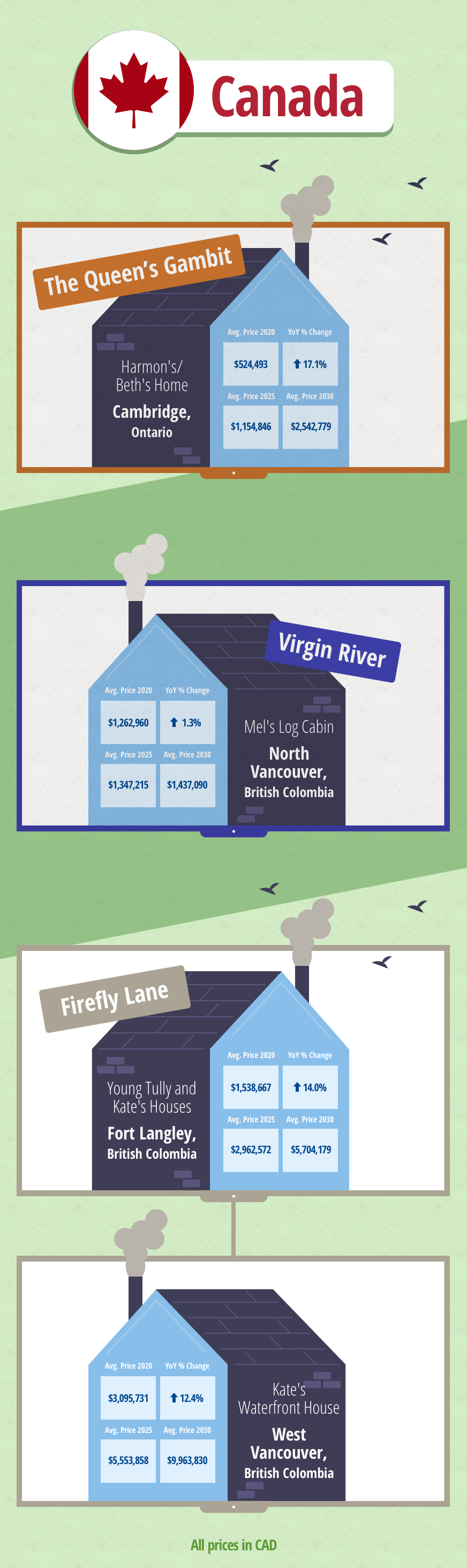

If, like many of us, you found yourself admiring the home that Beth Harmon inherited in The Queen’s Gambit, you might be interested to know that a home in the same neighbourhood would cost you around $524,493, currently. If you were to invest, with the +17.10% YoY increase, the property could be worth as much as $2,542,779 in 2030.

If you’re an owner of a log cabin in North Vancouver, you should expect minimal returns on your investment. A property similar to Mel’s cabin in Virgin River is expected to increase by 1.3% YoY and is predicted to be worth $1,437,090.27 CAD in 2030.

For those interested in moving to the same area as Kate and Tully from Firefly Lane, properties within the neighbourhood are set to increase by 14.0% YoY and could potentially cost just under $3 million CAD by 2025.

If you’ve recently moved into your new home and you’ve gotten your energy bills sorted, one of the most important things you need to do (if you haven’t already) is take out home and contents insurance. That way, if you decide to decorate your home just like Lenore Osgood (or in any other way you wish!), you can be rest assured that should the worst happen, it’ll all be taken care of.

Each property displays the current and forecasted prices of different homes in the filming locations for these TV shows. The YoY percentage changes between 2019 and 2020 were found for each location and used to forecast projected property values for 2025 and 2030. Any stated increase or decrease in value is an estimate only.

Brought to you by the home loan and refinancing experts at comparethemarket.com.au.