The Burrow

Few of us are fortunate enough to be in a position to buy a second home, but for those who are looking to build their property portfolio, doing so can be a good investment.

Not only does a second home give you somewhere different to spend your long weekends or holidays in the sun, but it can also reap financial rewards too if you choose to rent your property out while not in use. However, you may want to consider looking at what home loans are available to you before committing to investing in a second property.

Comparing your options for different home loans can help you find a deal that is most appropriate for you and your circumstances, which could put you in a better financial position to kick-start your investment. If you’re looking to purchase a second property in Australia in particular, our very own home loan comparison journey is a great place to start.

Whatever your motivation for buying a second home, there are many perfect destinations to choose from, but which come out on top as the best?

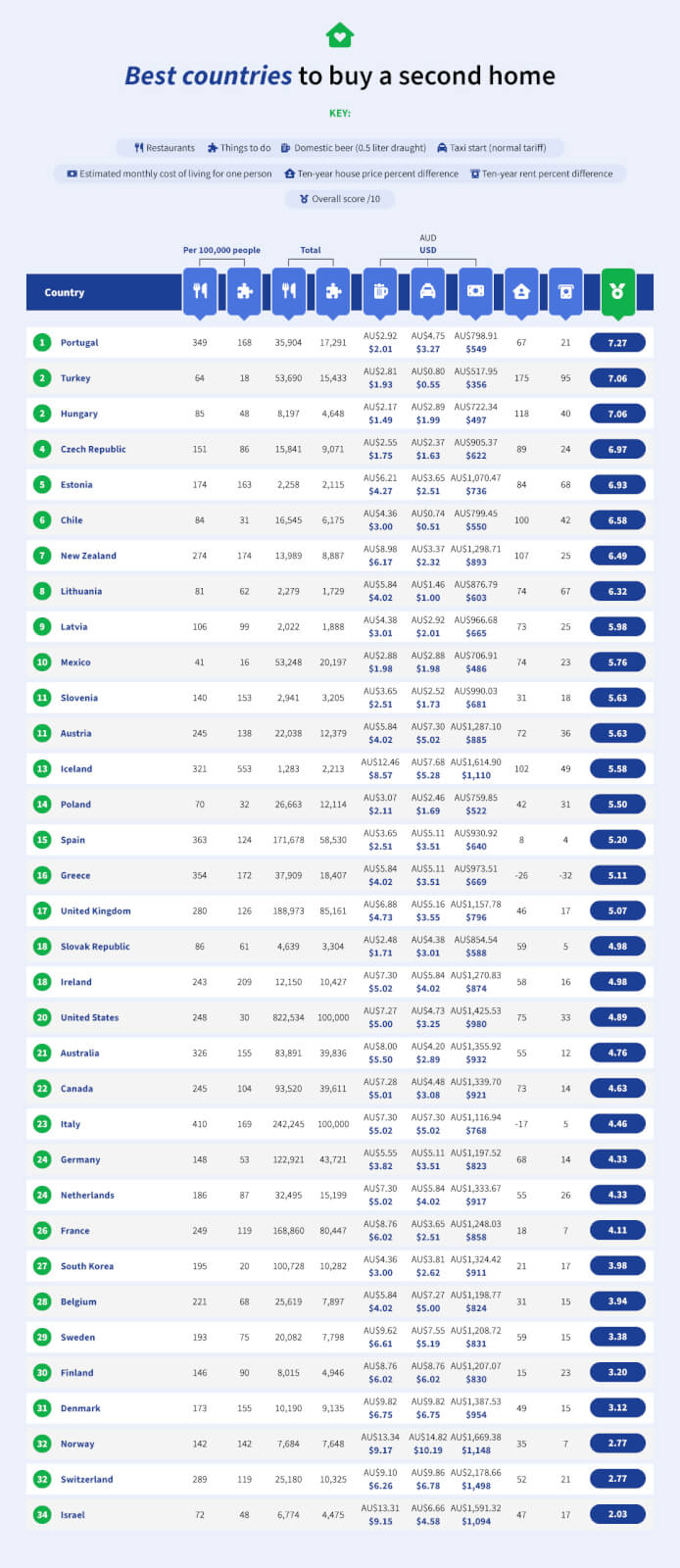

To find out, we at Compare the Market Australia analysed 34 OECD countries on key factors such as the cost of living, increasing property values, and more.

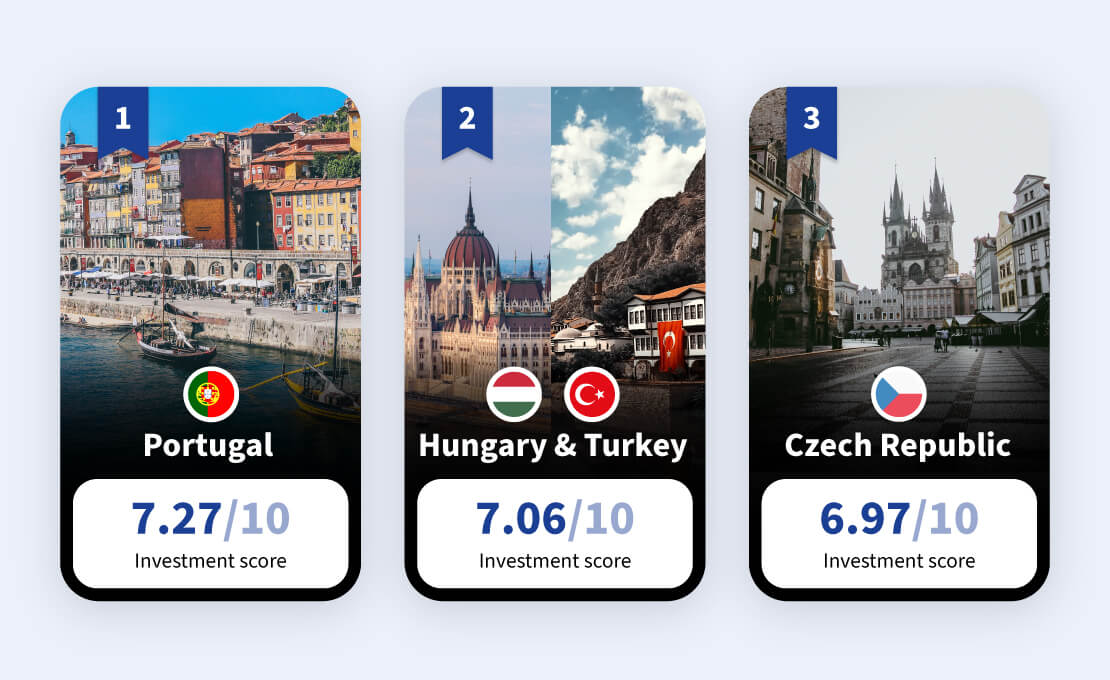

Known for its beautiful coastal towns, friendly locals, and relaxed pace of living, Portugal takes first place with a score of 7.27/10. The country is an extremely popular tourist hotspot, with many choosing to make Portugal their second home-from-home.

Portugal scores particularly highly for its proportion of restaurants, with 349 per 100,000, which is surprising for such a small country. Portugal also scores well for its average cost of living too, coming in at around US$549.28 per month (AU$798.91).

Hungary

Hungary and Turkey share second place, scoring 7.06/10. House prices in Hungary have risen dramatically, more than doubling over the last ten years, taking second place for the factor. This rise in house prices makes second homes in Hungary attractive if you’re looking to rent out your property while you’re away.

In contrast, Hungary’s average monthly cost of living expenses total around $496.64 (AU$722.34) a month. Hungary also ranked the best for their beer prices too.

Turkey

With its vast seaside resorts and excellent climate, Turkey is a very attractive location for those looking to buy a second home. The country has the lowest average cost of living expenses at $356.11 (AU$517.95) per month and can’t be beaten when it comes to both property resale and rent price increases, with a 175% increase in resale profits and an almost 95% increase in rent profits.

The Czech Republic is up next, with an overall score of 6.97/10. The country is renowned for its breweries with Pilsner Urquell and Staropramen exported all over the world. So it’s no surprise that it’s one of the most affordable beers, costing a mere $1.75 (AU$2.55) on average.

Getting around is also very affordable in The Czech Republic, as taxis have an average starting cost of $1.63 (AU$2.37) on a normal tariff, placing them in the top five for the factor.

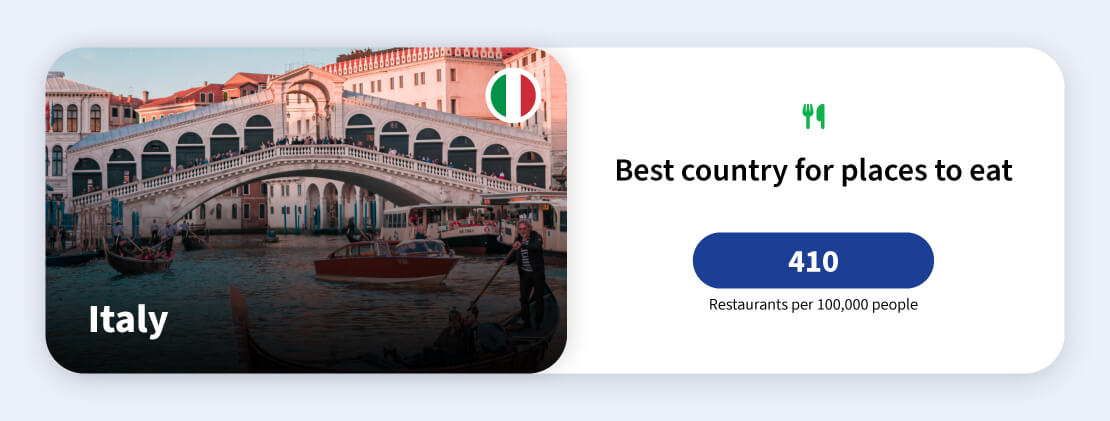

Being able to find somewhere to easily enjoy a bite to eat is always important. And it comes as no surprise that Italy, a country famous for its cuisine, has the highest proportion of restaurants at 410 per 100,000 people.

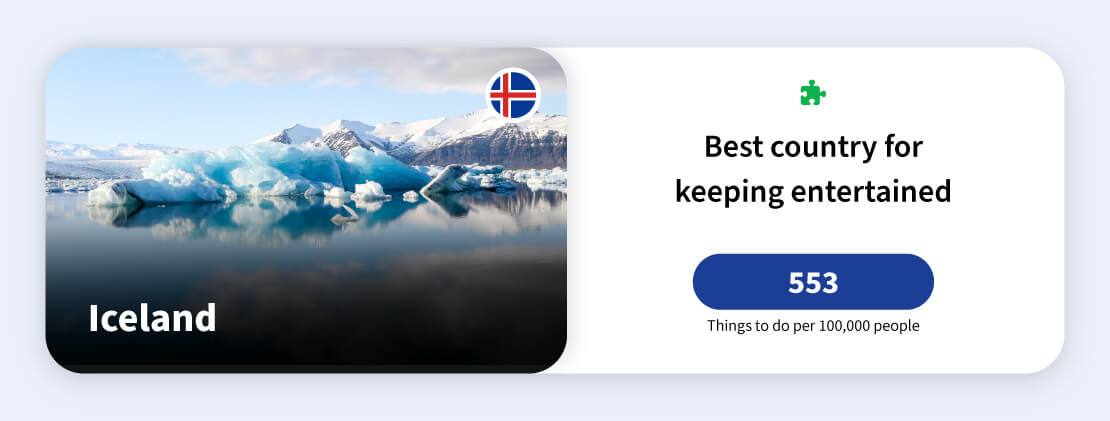

If there’s one country where you’ll never be short of things to do, it’s Iceland. The country is brimming with natural wonders, from volcanoes to lagoons and hot springs, so it’s no surprise it has the highest proportion of things to do with 553 per 100,000 people.

Affordability is also an important factor to consider when it comes to investing in a second home, with destinations in central Europe often proving to be the most affordable. In Hungary for example, a 0.5-litre beer will set you back just $1.49 (AU$2.17).

Getting around is also important if you’re going to be spending a lot of time in your second home. If you’re going to be taking taxis, the cheapest country on this list is Chile. The country’s taxi companies have an average starting cost of just $0.51 (AU$0.74).

Looking more generally at the average monthly cost of living for a single person in each country, it’s Turkey that comes out as the most affordable. The country has an estimated monthly cost of living of just $356.11 (AU$517.95) per person.

If you’re buying a second home, then you want to be sure that it’s going to be a sound investment. Looking at the average house price, Turkey has seen the biggest increase in purchase value, up by a huge 175% in the last ten years.

Renting out your second home is a popular option when you’re not living there, so it’s important to consider what sort of rental yield you would expect to receive. Turkey tops the list for this factor too, as rent prices in the country have nearly doubled in the last ten years.

When buying your second home, it can at times be difficult to have the cash to fund the purchase. Exploring your options for various home loans can be a dealbreaker between being able to secure the home and losing it to another, more prepared buyer.

Aside from the cost of the property itself, you will also need to factor in a range of additional, unexpected costs that come along with it, depending on where you are purchasing. In Australia, for example, these fees could include lender costs, conveyancing fees and Lenders Mortgage Insurance that you may need to budget for. When looking to secure a home loan, you can also compare aspects such as associated mortgage fees or fee-free extra repayments, which can help to reduce the amount of additional costs you could face across the life of the loan.

That’s why it’s important to explore a wide range of options when making such a significant financial decision. If you are looking to purchase a home in Australia, using a tool such as Compare the Market’s free refinancing and home loan comparison service, you can easily explore a range of options to look for the one that is best for your circumstances.

Looking at each OECD country, the following factors were analysed, giving each one a normalised score out of 10 for each factor before taking an average of these scores to reach an overall score out of ten.

Ten-year house price increase (higher = better). How much the average house price in each country has increased between 2011 and 2021 according to the OECD’s housing prices data.

Ten-year house rent increase (higher = better). How much the average rent in each country has increased between 2011 and 2021 according to the OECD’s housing prices data.

Number of restaurants (higher = better). Sourced from Tripadvisor on 22/08/2022.

Things to do (higher = better). Sourced from Tripadvisor on 22/08/2022.

Cost of a beer (lower = better). Sourced from Numbeo on 22/08/2022.

Cost of a taxi (lower = better). Sourced from Numbeo on 22/08/2022.

Monthly cost of living (lower = better). Sourced from Numbeo on 22/08/2022.

Population. Figures for 2021, sourced from the OECD.

All prices were converted using Google Finance on 22/08/22.