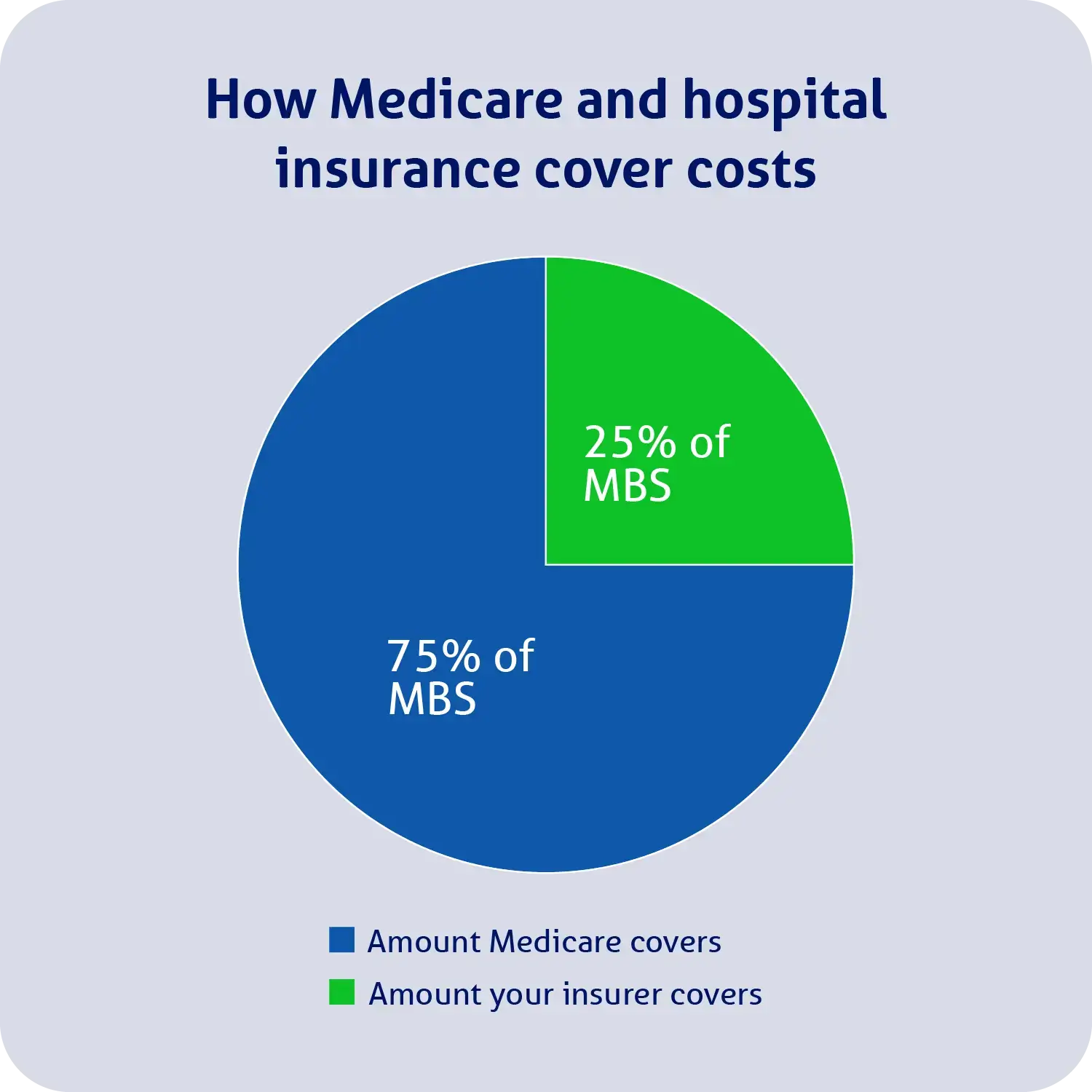

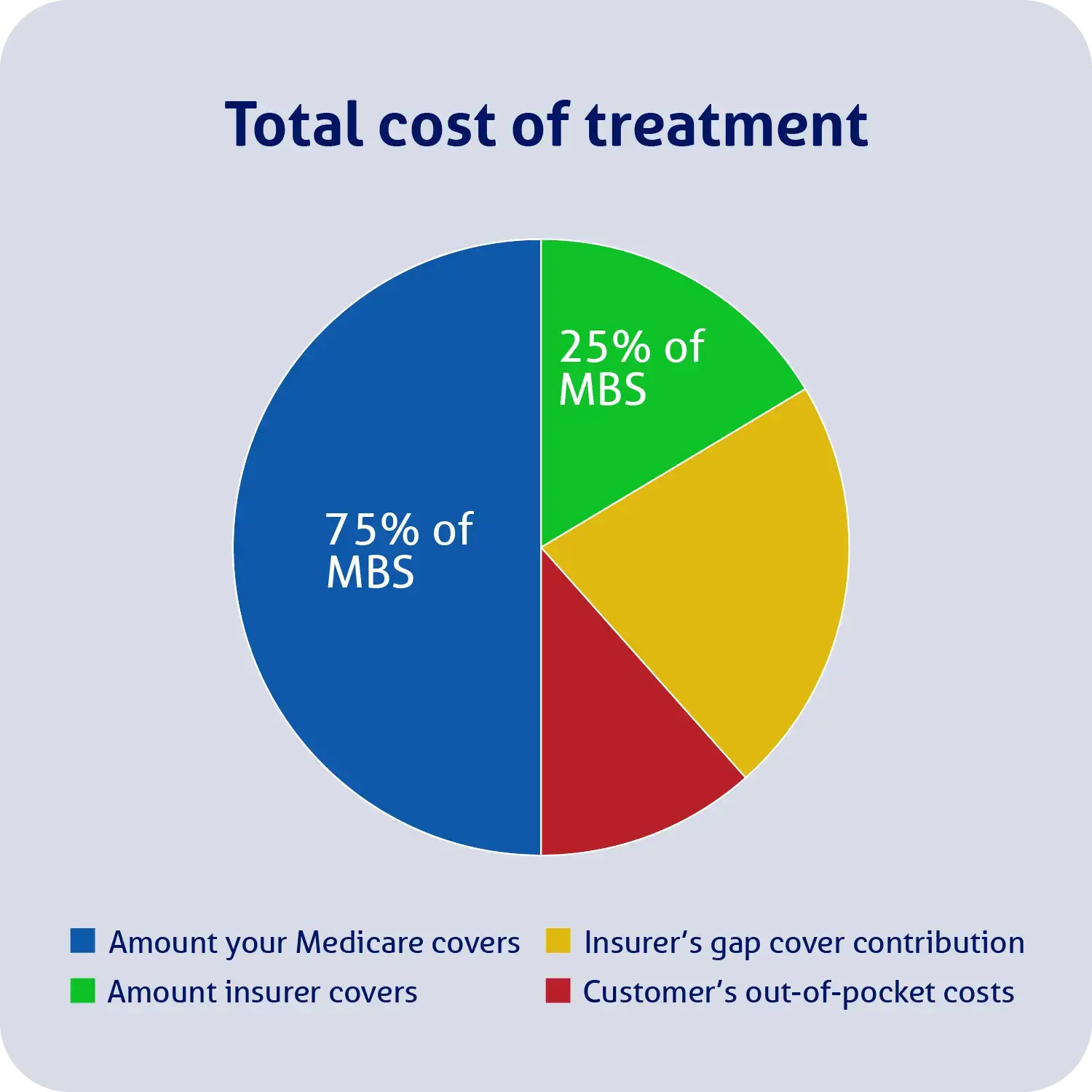

Private health insurance can pay a benefit towards costs when you’re admitted to hospital as a private inpatient, and your treatment is listed on the MBS. Medicare will rebate 75% of the treatment’s MBS fee, and your insurer can cover the remaining 25%.

See our example below:

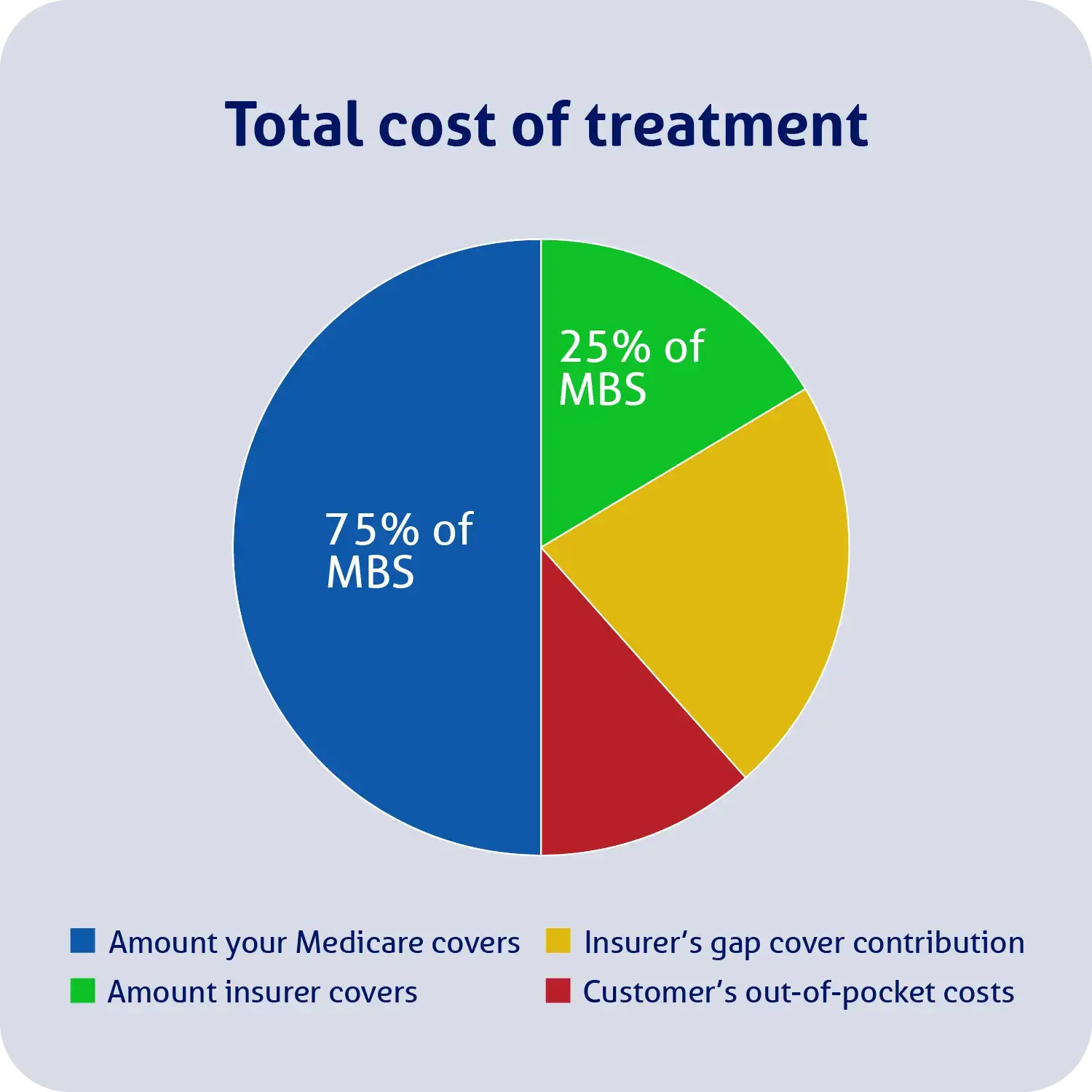

Keep in mind that specialists can charge you more for your treatment than what’s listed on the MBS (e.g. they could charge you $500 for your treatment, even though the MBS fee is $400).

As such, it’s possible that you may have some out-of-pocket costs, which are referred to as the gap.

You may be able to reduce or eliminate the gap if you participate in your insurer’s gap cover scheme. Most health funds have agreements with a selection of hospitals and doctors to reduce the out-of-pocket costs of their fund members. There are typically two types of gap cover schemes your doctor could participate in:

- No gap. Your health fund has a threshold above the MBS fee they are willing to pay if the doctor charges above the MBS but under the no-gap threshold. If your doctor agrees to this gap cover scheme, you should have no out-of-pocket costs for their services.

- Known gap. Limits your out-of-pocket costs so it won’t go over a set amount. Your health fund can inform you of this limit before you go in for treatment.

Keep in mind that it’s up to your doctor if they want to participate in your health fund’s gap cover scheme on a case-by-case basis. Therefore, it’s important to confirm this with your doctor before seeking treatment. It’s also a good idea to speak to your health fund prior to a hospital admission.

Below, we’ve included a visual example of how Medicare and your health fund may help cover the cost of treatment when the treatment cost is greater than its MBS fee, and your doctors and hospital participate in your fund’s known gap cover scheme.

However, for your hospital policy to contribute to the cost of specialist consultations (the green and yellow portion of the above example), your treatment must be as an inpatient, listed on the MBS, medically necessary and included in your hospital insurance policy with all relevant waiting periods having been served.