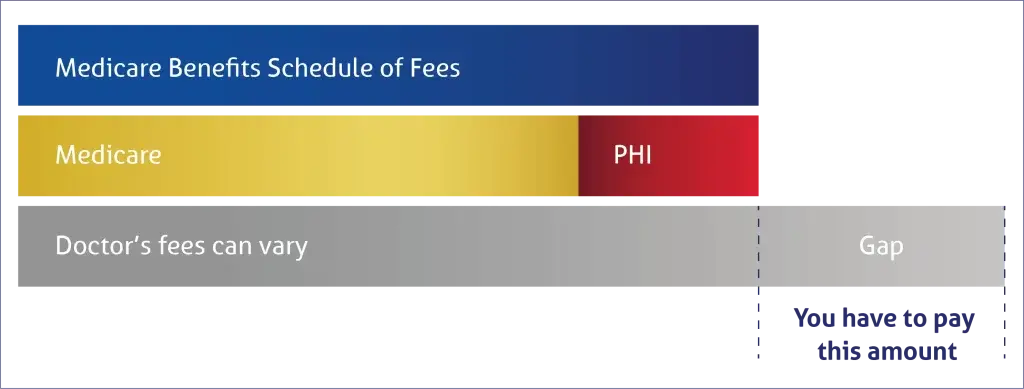

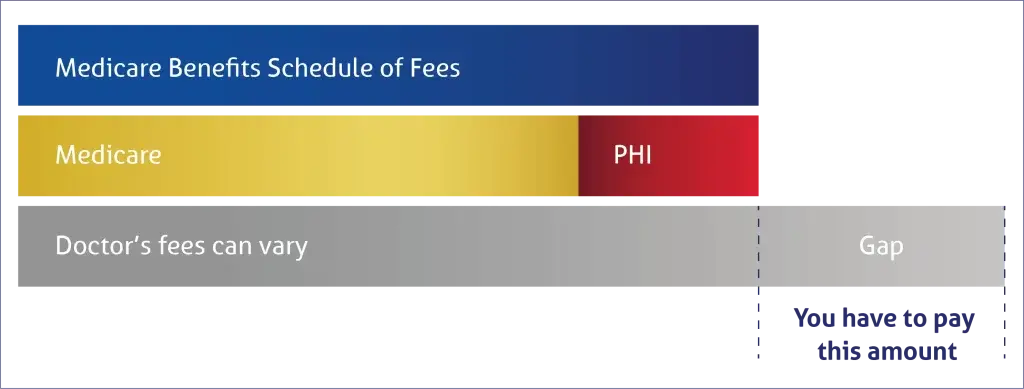

When you’re treated in a hospital, there’s a ‘scheduled fee’ for each different Medicare item number, as outlined in the Medicare Benefits Schedule (MBS). Together, Medicare and private health insurance cover 100% of this scheduled fee, as well as the cost of your accommodation and theatre fees (if you’re treated in a hospital that has an agreement with your health fund).

The medical gap is the amount above the scheduled fee that your specialist charges.

The above example is for a hospital admission as a private patient. You’ll notice that Medicare and private health insurance both cover a portion of your doctor’s fee. If your doctor only charges the Medicare Benefits Schedule fee, you may not have to pay anything as a gap.

However, if your doctor charges more than the standard MBS fee, you may need to pay the gap to make up the difference.

When you receive treatment, you have a right to informed financial consent. This means that your healthcare provider must inform you of all medical costs before you’re treated so you know exactly how much you may or may not have to pay. The only exception is for treatment in the emergency department as a public patient, where Medicare covers 100% of the costs. Private hospital insurance cannot be used in the emergency department, as they’re outpatient facilities.