Inspected a property and want to know more about it? We can help with that – our new property report tool is fast, friendly and free to use.

Once you’ve told us which property you’re interested in, it’ll take mere minutes for us to serve up the relevant report.

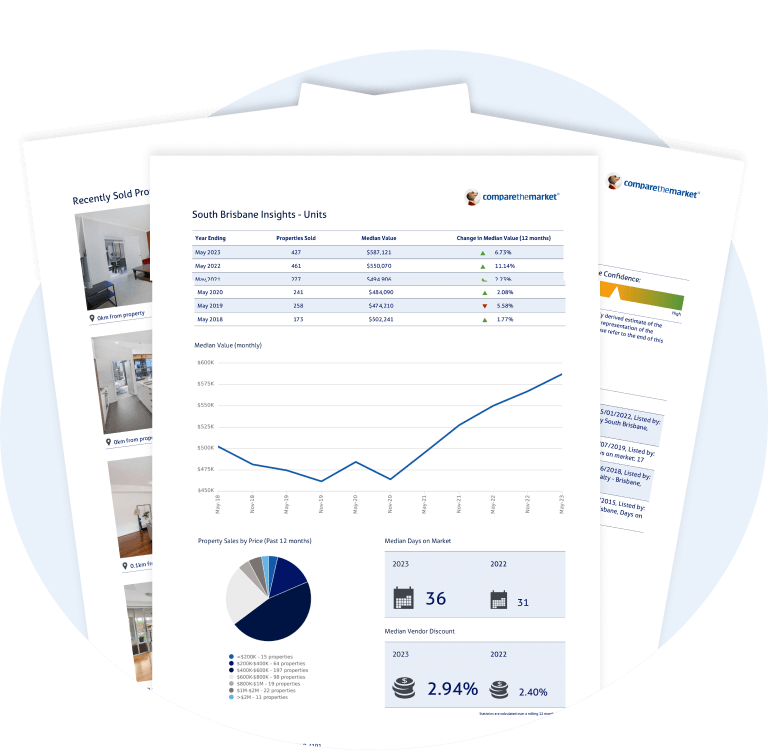

When you get a property report from us, you won’t just get the basics – you’ll also get an activity summary, a price estimate and recent sales in the area.

There’s no limit on how many property reports you can retrieve via our service, so search away!

You won’t pay a cent for any property reports we help you retrieve.

Our Meerkat Technology makes our comparison and application process a breeze, but sometimes you just need a helping hand! Our team of brokers and home loan experts are here to bring ease and expertise, and no question is too big or small; we're happy to help!

We'll arm you with the tools you need to make the right choice for you. From property reports to credit scores, let's work together to make your property dreams come true.

Dreaming of owning a property? Let's find out how much you can potentially borrow to put towards your new purchase.

Get the same credit information that lenders, telcos and utility providers use to assess your creditworthiness without impacting your actual score.

Buying, selling or being a nosey neighbour? Get valuable insights about the property, view recent sales and more.

Ready to buy or refinance? Apply online via a single application and we'll instantly check your eligibility for a home loan from a wide variety of lenders on our lender panel.

Should you get a property report? Andrew Winter, host of Selling Houses Australia, has a few reasons why it could be worth your while.

Andrew Winter walks you through the process of accessing unlimited free property and suburb reports with Compare the Market.

Getting a property report is one of the quickest ways to decide whether you’re interested in a property or not. Get unlimited free property reports in minutes today with Compare the Market!

Get your free property report

A property report is a document designed and compiled to provide relevant information on a specific property. They’re often used for two key purposes by two groups of people:

But before commissioning a property report, you should understand what information it’s likely to contain.

If you’re buying a property, a property report can be a useful tool at any stage of the purchase. However, it might be most useful following your initial inspection of the house, before you’ve committed to any extent but after establishing that you’re interested in buying it.

And if you’re selling a property, you’ll generally want to get a property report well before making any plans or commitments to sell. It will give you general price and sales data that you’ll want to be able to consider before making the decision to sell.

Our new home loan platform offers free property reports as well as:

You can also obtain a free property report from a number of online sources including real estate websites and home loan providers.

A property report will generally contain the following property information:

A property report may also include additional information, such as vacancy rates and recent sales in the area, and an estimated rental yield for the property. However, you should keep in mind that these reports are only guides; the property data they contain could potentially be out of date.

If you’re after a property report because you’re considering buying a specific property, there are a few other steps you should consider taking. These include:

A property report will tell you a lot about the place, but getting the right inspections done before you buy will show you even more and can help you decide whether you should proceed with the purchase or not.

If you’re gearing up to sell a property based on the information you’ve learned from a property report, you should probably also:

Stephen has more than 30 years of experience in the financial services industry and holds a Certificate IV in Finance and Mortgage Broking. He’s also a member of both the Australian and New Zealand Institute of Insurance and Finance (ANZIIF) and the Mortgage and Finance Association of Australia (MFAA).

Stephen leads our team of Home Loan Specialists, and reviews and contributes to Compare the Market’s banking-relating content to ensure it’s as helpful and empowering as possible for our readers.

As General Manager of Money at Compare the Market, Stephen Zeller wants to empower consumers to help them make smart property moves, and knows how crucial the ability to read and understand a property report is in that respect. With that in mind, he’s got some top tips for you:

Don’t waste your own time inspecting properties that aren’t right for you – take the guesswork out of your property search with a free property report today! Click the button below to get started.

Get your free property report