We do not compare all brands in the market or all products offered by all brands. At times certain brands or products may not be available or offered to you. Learn more about how our comparison service works.

What’s the difference between types of car insurance?

We’ve compiled this table of benefits to help you see the differences between the levels of cover. This information should be used as a guide only, as different policies and insurers might offer varying coverage.

Comprehensive

Usually the highest level of cover available, it includes protection for your car and also covers damage to other people’s vehicles and property.

- Legal liability for third party vehicle and property damage

- Damage to your car in an accident

- Loss or damage to your car from fire and theft

- Storm damage to your car

- New car replacement

Third Party Fire and Theft

Generally covers damage you cause to other people’s vehicles and property. It also includes protection for your car for fire and theft.

- Legal liability for third party vehicle and property damage

- Damage to your car by an uninsured driver

- Loss or damage to your car from fire and theft

- Storm damage to your car

- New car replacement

Third Party Property Damage

It provides cover for damage you cause to other people’s vehicles and property. It only covers your car if it’s damaged by an uninsured vehicle.

- Legal liability for third party vehicle and property damage

- Damage to your car by an uninsured driver

- Loss or damage to your car from fire and theft

- Storm damage to your car

- New car replacement

Comprehensive

Usually the highest level of cover available, it includes protection for your car and also covers damage to other people’s vehicles and property.

- Roadside assistance

- Car hire after an accident

- Windscreen excess cover

- Choice of repairer

Third Party Fire and Theft

Generally covers damage you cause to other people’s vehicles and property. It also includes protection for your car for fire and theft.

- Roadside assistance

- Car hire after an accident (fire and theft only)

- Windscreen excess cover

- Choice of repairer

Third Party Property Damage

It provides cover for damage you cause to other people’s vehicles and property. It only covers your car if it’s damaged by an uninsured vehicle.

- Roadside assistance

- Car hire after an accident

- Windscreen excess cover

- Choice of repairer

Top 3 things to know about car insurance in Victoria

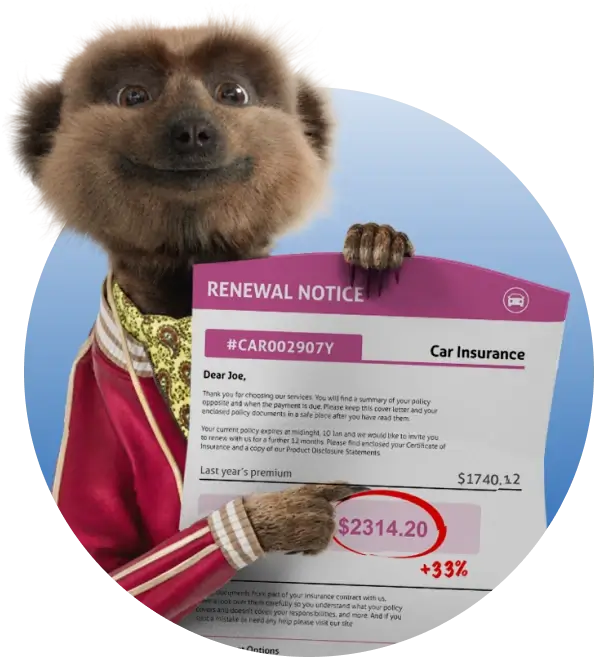

It pays to compare

Compare quotes in minutes and start saving today.

Simple to use

Get started by answering a few quick questions to help us understand your needs.

Compare & save

Save time and money by easily comparing options from a range of providers side-by-side.

Switching is easy

Follow a few easy steps online to switch to a new deal that suits you and your budget.

Why compare with us?

Our smart comparison technology is trusted, free, safe and secure.

We believe the best decisions start with a comparison.

We’re proud to have helped millions of Aussies look for a better deal.

A guide to comparing car insurance in Victoria

Updated 24 January 2025Kochie’s top tips for Victorians

Looking for great value car cover in Victoria? Our Economic Director David Koch shares our expert tips to help you save.

Picture this – you’re motoring down the beautiful Great Ocean Road, top-down, wind in your hair. I can only imagine that. Next thing you know, you’ve taken your eyes off the road and you’ve rear-ended the caravan in front. Accidents can happen in the most unlikely places.

Luckily there’s a car insurance policy out there for every car and every driver – you just need to know what’s right for you. Most drivers will want financial protection against damage to their car, in which case they’ve got three options. Third Party Property Damage will cover you for damage you cause to other people’s vehicles and property and, in limited circumstances, your own vehicle. Third Party Fire & Theft adds cover for fire and theft on top of that.

And comprehensive car insurance covers damage to your car and more, for the ultimate piece of mind. But finding suitable cover doesn’t mean being taken for a ride. Compare the Market has these tips to help you save. Shift your excess.

If you’re a safe driver, you could pay less on your premium if you chose to pay a higher excess in the event of a claim. Update your details. Small changes like parking your car in a garage overnight or restricting your policy to drivers aged 25 and over could lower your premiums. If you’re now driving less because you’re working from home, see if a low kilometre policy could be right for you.

Pay your way. Pay fortnightly, monthly or annually to suit your budget and cash flow but remember paying in instalments can be more expensive than paying annually. And – most importantly – compare your options! It’s the best way to make sure you’re getting good value for your money.

Start your journey today with Compare the Market.

What types of car cover are available in Victoria?

Comprehensive car insurance

A comprehensive car insurance policy is the highest level of car insurance, covering you for financial loss or damage to your car from insured events like theft, fires, storms, floods, malicious acts and accidental damage. A comprehensive policy can also cover the damage you cause to someone else’s vehicle or property following an accident.

Third Party Fire and Theft (TPFT)

Third Party Fire and Theft covers you for damage you cause to other people’s cars or other people’s property, as well as for loss or damage to your car from fire or theft. Some insurers may also offer conditional cover for your vehicle where you’re not at fault in an accident and the other driver isn’t insured.

Third Party Property Damage (TPPD)

Third Party Property Damage (TPPD) covers the expenses of another person’s damaged property or vehicle when you’re at fault for an accident. It can sometimes provide a limited amount of cover for your own car’s loss or damage if the at-fault driver is uninsured.

Transport Accident Commission (TAC) charge

Like Compulsory Third Party (CTP) insurance in other Australian states, the TAC charge is mandatory insurance for all registered vehicles in Victoria. It covers your legal liability for death or injuries in an accident caused by your vehicle.

The basics

Do I need car insurance in Victoria?

In Victoria, the TAC charge (or CTP insurance) is a requirement for all registered vehicles. However, it’s worth considering a level of car insurance beyond that. Mishaps can strike at any time while you’re on the roads and having some level of cover for vehicle and property damage could provide peace of mind.

What is the best car insurance for Victorians?

It depends on the level of cover you’re looking for. If you’re looking to cover damage you cause to other vehicles and property as your main priority, a TPPD or TPFT policy could be suitable. However, if you’re looking for more cover for your own vehicle, comprehensive car insurance is worth considering.

The table below provides an overview of what each type of car insurance policy generally covers.

| What is and what isn’t covered? | Third Party Property Damage | Third Party Fire and Theft | Comprehensive | TAC |

|---|---|---|---|---|

| Damage to your own vehicle following a collision | ✗ | ✗ | ✓ | ✗ |

| Loss or damage to a third party’s vehicle/property caused by your car (legal liability) | ✓ | ✓ | ✓ | ✗ |

| Loss or damage to your own vehicle caused by weather (e.g. storm, flood, hail) | ✗ | ✗ | ✓ | ✗ |

| Loss or damage to your vehicle caused by theft | ✗ | ✓ | ✓ | ✗ |

| Hire car after theft | ✗ | ✓ | ✓ | ✗ |

| New car replacement (if your car is less than two years old) | ✗ | ✗ | ✓ | ✗ |

| Loss or damage to your vehicle caused by fire | ✗ | ✓ | ✓ | ✗ |

| Loss or damage of personal possessions/effects | ✗ | ✗ | ✓ | ✗ |

| Damage to your vehicle caused by an uninsured driver | ✓ | ✓ | ✓ | ✗ |

| Emergency transport and/or accommodation | ✗ | ✗ | ✓ | ✗ |

| Towing | ✗ | ✓ | ✓ | ✗ |

| Key replacement | ✗ | ✗ | ✓ | ✗ |

| Death benefit | ✓ | ✓ | ✓ | ✗ |

| Legal liability for injuries or death to other people | ✗ | ✗ | ✗ | ✓ |

| Variable excess | ✗ | ✗ | ✓ | ✗ |

| Restricted driver discount | ✓ | ✓ | ✓ | ✗ |

Always read the relevant Product Disclosure Statement (PDS) for full details on specific exclusions and conditions to the cover. The Target Market Determination (TMD) could also help you decide whether this product is suitable for you.

Which features should Victorian drivers look for in a car insurance policy?

Car insurance can provide a range of benefits, with higher levels of insurance typically offering more features. Depending on your insurance provider, some of the benefits listed below may be available as optional extras if they’re not already standard inclusions:

Car insurance can provide a range of benefits, with higher levels of insurance typically offering more features. Depending on your insurance provider, some of the benefits listed below may be available as optional extras if they’re not already standard inclusions:

- Flexible payments. You may have the choice of paying your insurance premiums fortnightly, monthly or annually. However, some insurers may increase their fortnightly or monthly premiums for the convenience of paying in instalments, so you may want to consider an annual payment.

- Roadside assistance. Roadside assistance offers services like towing and fuel delivery, as well as assistance if you have a flat tyre or dead battery.

- Excess-free windscreen repair. This covers the cost of repairing or replacing damaged window glass without incurring an excess payment.

- Agreed value vs market value. You may have the choice of insuring your vehicle for an agreed value instead of a market value; this is the amount you’ll be covered for in the event of a total loss.

Please note that adding any optional extras to your policy will likely increase your premiums.

How does living in Victoria affect my car insurance?

Your car insurance premium is partially affected by the state or territory you live in. For example, if your home is in a floodplain or bushfire zone, or your neighbourhood has a high rate of car thefts, you might end up paying higher premiums. Car insurance costs can also be affected by where you park, like whether your vehicle is secured safely in a garage or parked on the street.

Car thefts in Victoria

Victoria has one of the highest rates of car thefts in Australia. In the 12 months to September 2024, there were 22,554 vehicle thefts recorded.1 That’s over 3,000 more reported cases than 2023. In addition to the vehicle thefts, there were 3,219 attempted thefts during the same period, which was an increase of over 1,000 from 2023.

Victorians with comprehensive cover or a Third Party Fire and Theft policy can be covered against car theft, plus any malicious damage caused by an attempted theft. Some insurance providers may even provide a hire car when your vehicle is being repaired.

Does my car insurance cost more in regional Victoria or inner-city Melbourne?

The postcode you live in may influence how much your insurance costs. For example, perhaps your regional Victorian town has safe roads but a high rate of motor vehicle thefts. Taking out a new policy in places with high rates of theft and car accidents might cost a bit more than somewhere with lower rates, regardless of where it is in the state.

Melbourne is also well-known for its natural weather events, such as hailstorms. These can drive up claims, which can play a very real part in why insurance costs can vary across Victoria.

Premiums

How much is car insurance in Victoria?

The cost of car insurance will change for each driver since your premiums are calculated using a variety of factors that are usually unique to you. Some of these factors include:

The cost of car insurance will change for each driver since your premiums are calculated using a variety of factors that are usually unique to you. Some of these factors include:

- Your type of car. Generally, common makes and models would cost less to insure, whereas high-end, classic or sports cars cost more.

- How old you are. Your age can affect how much you pay for premiums, as younger drivers generally have a higher risk of being in car accidents. Most insurance providers offer cheaper premiums for drivers over 30, while some may still have more affordable premiums for drivers over 25 years of age.

- Your location. Where you live in Victoria can contribute to your risk of making a car insurance claim. Living in the city may come with higher car theft rates or a higher likelihood of having an accident.

- Your type of policy. Your premiums and excess will depend on the kind of policy you choose. Third party car insurance (i.e. TPFT or TPPD) may cost you less, but they also cover you for less. On the other hand, comprehensive insurance will cost you more, but you’ll have the peace of mind of knowing you’re covered for most situations.

How do I find cheap car insurance in Victoria?

If you’re looking to lower the cost of your vehicle’s insurance, here are some things to consider:

If you’re looking to lower the cost of your vehicle’s insurance, here are some things to consider:

- Park securely. Parking in the garage or a secure parking spot overnight can keep the price of insurance down and protect your car.

- Increase your excess. Choosing a higher excess may lower your premium. However, it’s important to make sure you can afford the additional excess should you need to claim.

- Restrict the age of drivers. Younger drivers are riskier to insure. However, you can place an age restriction on your policy to state that drivers under a certain age will not be operating the insured vehicle. This alone could bring down policy costs.

- Stay safe. Many insurers offer a no claims discount if you haven’t claimed within a specific time frame.

How to compare car insurance quotes online

You can compare policies from several insurers in minutes with our comparison service. To start comparing car insurance quotes for your vehicle in Victoria, you’ll need to enter the following:

- Basic car details such as vehicle colour, make and model can be prefilled if you enter your registration details. Otherwise, you can enter them manually.

- Type of car insurance from comprehensive car insurance, Third Party Fire and Theft or Third Party Property Damage.

- Advanced car details like the number of kilometres you drive every year and whether your car has any modifications.

- Personal details including your name and date of birth.

Meet our car insurance expert, Adrian Taylor

As a General Insurance expert with over 13 years’ experience in financial services, Adrian Taylor is passionate about demystifying car insurance for consumers, so they have a better understanding of what they’re covered for. Adrian’s goal is to make more information available from more insurers, to make it easier to compare and save.

Want to know more about car insurance?

1 Crime Statistics Agency – Recorded Offences. Accessed January 2025.