The latest unemployment figures shocked economists because of the number of jobs lost in December: 65,200. 106,600 full time jobs were lost (41,400 part-timers were added), which was the biggest monthly decline since May 2020 during COVID lockdowns.

The December unemployment number stayed at 3.9 per cent because less people were looking for work, but unemployment in Queensland and Victoria is now back above 4 per cent.

To put this into perspective, the job losses in December followed strong jobs growth of 72,600 in November and 44,200 in October. Even the Australian Bureau of Statistics is asking whether there is a change in hiring patterns because of the success of Cyber Monday and Black Friday shopping events. Instead of retailers hiring more staff in December for Christmas they are now doing it in November instead for these other retail events.

Over 2023 the economy still added a solid 380,900 jobs over the year, but annual employment growth eased from the ultra-strong 528,300 positions created in 2022 at the peak of the post-pandemic labour market rebound.

Big fall in home construction means no end to housing shortage

While building approvals are at a 10-year low… so are building commencements. Dwelling commencements in the September quarter fell by 10.4 per cent and are at a new decade low. Over the year, commencements are 16.3 per cent lower and 44.7 per cent lower than the recent high in June 2021.

Higher borrowing costs, elevated inflation for new dwellings, poor consumer sentiment, uncertainty around the future of interest rates and uncertainty from the number of builders going broke are all weighing on activity.

Interestingly while building approvals and commencements are at decade lows, current dwelling completions rose 8.2 per cent and there is still a large backlog of work to be done. This all because of the impact of (and catch up from) the COVID lockdown years, which caused enormous delays and backlogs.

As supply chains have eased, material shortages have become less of a problem but shortages in labour have remained.

So a lot of housing supply is becoming available in the short term – although still well below demand – but that shortage will likely worsen over the next few years.

While there is a lack of supply fuelling the housing shortage, demand could start to ease. When consumers were asked whether it is the right time to buy a major household item or a new home, they agreed it wasn’t. Which means potential buyers are dwindling.

Like everyone else, retirees are hurting in these tough economic times

As the intergenerational war of words continues as different generations argue on who is doing it tougher in this economic environment, retirees are withdrawing more cash out of their superannuation funds to make ends meet.

To cope with the increasing cost of living from inflation and higher interest rates, retirees are withdrawing more in both lump sums and via their private pensions than in normal years. Excluding the COVID years, they are withdrawing more than ever before. So everyone is finding it tough at the moment. Including retirees.

It’s a great time to be a property investor

Property research group CoreLogic’s chart of the month shows that last year rental returns were higher than the capital growth of investment properties – only the third time that’s happened in the last decade.

Last year investment property recorded 8.1 per cent capital appreciation and 8.3 per cent rental return – that’s a total 16.4 per cent. That is a terrific return and the housing and rental crisis looks as though that return could be maintained for the foreseeable future.

Here are some things to think about before becoming a property investor.

Understand your rights as a landlord

This is the scary bit. However, if you do it before buying an investment property, it can be a good test of your resolve to see whether being a landlord is for you. If not, then property investments can be made through managed property funds such as listed property trusts or property syndicates.

Make yourself familiar with the appropriate Landlord and Tenant Act in your State to fully understand your rights and obligations, as well as your prospective tenants’.

Rent out at the right time for the best price

Like anything else there is a good time to rent out your property and an even better time. The difference can mean an extra 10 per cent on the rent which will mount up over the life of the investment.

Peak renting time is late spring and early summer

This is the time when uni leavers are most likely to cut their cord with mum and dad to venture out “flatting” and when most interstate business transfers occur.

In the depths of winter there is usually a shortage of renters and therefore rents can be lower to make the property more attractive.

It also depends on supply and demand.

Choose your tenant carefully

This is crunch time. Thoroughly checking the background of tenants and ensuring all parties act responsibly is crucial. Landlords also can’t discriminate between tenants on the basis of sex or if they have children.

Your screening process should be formalised with the right application form which outlines the renter’s history as a wage earner, tenant and bill payer. It must have an area where references can be nominated and you must follow up these references. The best references to look at are from employers, bank managers and previous landlords. The biggest pitfall for any landlord is the problem tenant whose rent gets into arrears.

Get the tenant to sign a property condition report that shows you both agreed on the condition of the unit when the tenant moves in. It should include notes on things like cracked ceilings, torn flyscreens and stained carpets, and list what is in the property, e.g. chairs, fridge, cups, towels, light fittings and curtains.

If the tenant leaves before the end of the agreed tenancy, the tenant may be liable for rent until new tenants are found.

Always have your tenancy agreement in writing. Most people are pretty honest, but anyone can forget details about what was agreed.

Hire a good handyman

If you don’t hire a good handyman, you will more than likely kiss your free time goodbye. If something goes wrong at a property, many tenants will simply fix it themselves, but other tenants will be less cooperative and you’ll need someone to take care of maintenance.

If you are a real handyman and enjoy pottering around, then you may be able to do all this yourself. If not, then organise an outside handyman to do the odd jobs but make sure their prices are competitive.

There are all sorts of horror stories of landlords being slugged $100 to change a light globe by a maintenance person, so make sure you find someone reasonable.

Don’t scrimp on repairs

The look and condition of a rental property is a big factor in determining what rent can be charged, so it is imperative your property is kept in good nick.

Remember that maintenance expenses can be offset against rental income for tax purposes. If the bathroom needs fixing, do it right away as it will pay off in the long run.

Don’t forget insurance cover to protect you from the unexpected. There is specific Landlord Insurance available for investment properties.

Many investors buy home units or townhouses because the maintenance of the common areas is the responsibility of the corporate body.

Find a good property manager

As you can see, being a landlord isn’t a simple matter. If you have the time, the application and follow the rules above, you should be okay. If it all sounds too daunting and complicated, let a good local real estate agent manage your property for a monthly percentage of the rent.

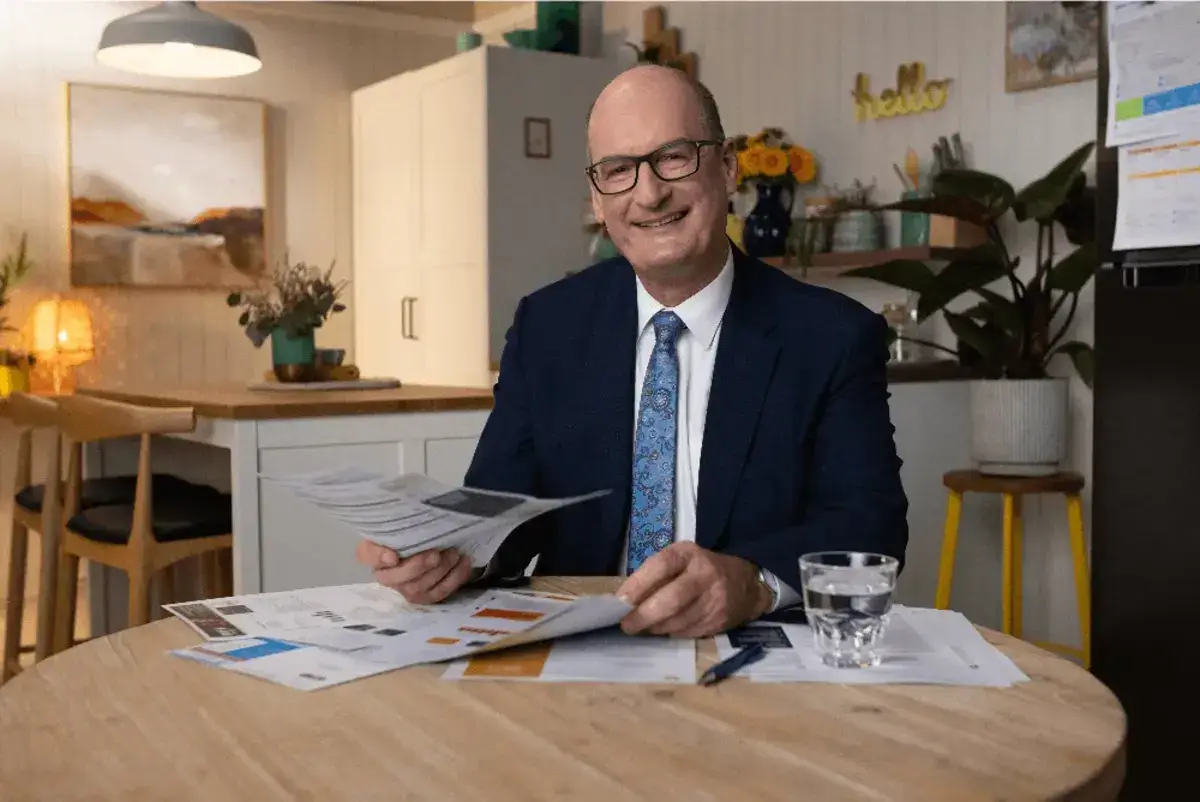

Financial infidelity: make sure your partner isn’t ripping you off

I know this isn’t very romantic, but have you ever lied to your partner about how much something cost or kept a financial secret from them? You’re not the only one, with new research revealing we’re a nation of financial cheaters.

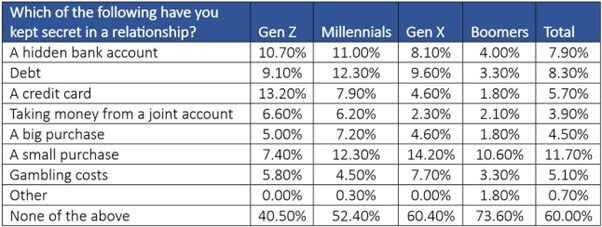

According to a recent Compare the Market survey, almost a third of Australians have confessed to keeping financial secrets from their significant other (31.2 per cent).

More than one in 10 admit to making small purchases without their partner knowing (11.7 per cent), 5.7 per cent have a secret credit card and 5.1 per cent gamble without their partner knowing. Meanwhile, 8.3 per cent have a secret debt, and 7.9 per cent have a secret bank account.

Lying to your partner about finances is a red flag. Whether it’s hiding small clothing purchases or keeping quiet when you lose big on a bet, financial infidelity comes in many shapes and forms.

While it’s most often in the form of minor purchases, there’s also a more serious, damaging level of financial infidelity. That’s when people have secret credit cards, take out loans to make risky investments or hide sources of income.

While couples need to have some financial freedom and independence, people in a healthy relationship won’t keep big financial secrets from each other.

Lying about finances can even be considered a sign of financial abuse in a relationship.

The age group that admitted to keeping the most financial secrets were Millennials, followed closely by Gen Z. Millennials were most likely to have a hidden bank account, debt and make a big purchase without telling their significant other.

Meanwhile, Gen Z were more likely to take money from their joint account and have a secret credit card.

The age group most likely to have a secret gambling debt was Gen X.

One of the keys to a successful and healthy relationship is to be transparent about money. It’s important to be open and honest about your finances.

It’s okay to disagree on some things. But you should clearly outline your money goals and divide up the financial responsibilities. Whether it’s opening joint accounts, paying the rent or mortgage, insurance or energy bills, it’s the responsibility of both parties.

Look out for the following red flags in a relationship:

• Your partner’s spending is inconsistent with their income

• You know nothing about their finances … and they insist on handling everything alone

• You notice your bank balance has fallen suddenly

• Hidden purchases: secretly buying items or services and not disclosing them

• Hidden debt: concealed debt, loans, betting apps, credit cards and loans

• Stashed cash: keeping physical cash hidden

• Hidden assets: not disclosing assets such as property or shares

• Lying about income: inflating or deflating what they earn

• Making big financial decisions alone: selling assets, incurring debt or making a large investment without your knowledge

• Hiding financial documents or faking financial documents

• Using money to manipulate or control you

• Money goes missing from your wallet

• They aren’t willing to talk about money with you

• They aren’t willing to do a credit check with you

If you notice any of the above red flags, calmly talk to your partner about it. It’s never okay for someone to take away your access to money, manipulate your financial decisions, or use your money without consent.

You don’t have to have the same spending styles, but there should be some clear ground rules. Each person needs a level of discretionary spending for which they’ve got the freedom to spend on their hobbies and gifts.

But if your partner is lying about money, there’s a good chance this will seriously undermine the relationship.

Financial abuse can happen to anyone, and it can leave you feeling vulnerable and on edge. If you or someone you know is experiencing financial abuse, free and confidential help is available.

Financial infidelity isn’t just about money… it’s about honesty, trust and communication.

Family Relationship Advice Line is free to call on 1800 050 321.