The Reserve Bank of Australia (RBA) has confirmed it is lifting the cash rate for the 13th time, with a 0.25% increase following November’s Board meeting.

The cash rate has now surged by a whopping 4.25% since May last year – that’s roughly a 0.24% increase per month.

Compare the Market’s Economic Director, David Koch said the recent inflation data forced the Board into delivering a rate rise.

“A rate rise was definitely short odds today, but it still doesn’t help the pain at the hip pocket. Another $100 hit to minimum monthly repayments for some, and when we can least afford it,” Mr Koch said.

“The RBA needs to keep inflation on a tight rein, otherwise it really could bolt away in 2024. A tough day, but let’s hope it is the last for a while now.

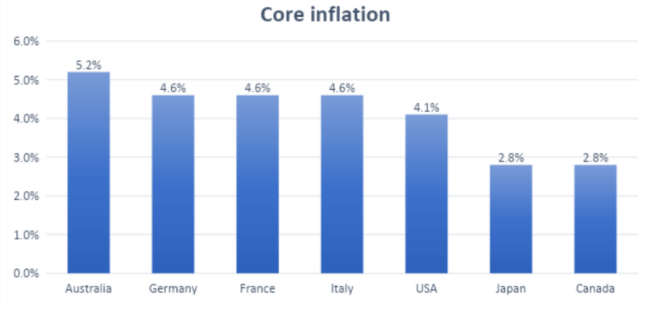

“This is what is worrying the RBA.

Source: Trading Economics, September 2023

“Our core inflation is worryingly higher than all of our major trading partners, which is coming down much quicker than ours. That’s what the RBA Governor, Michelle Bullock means when she talks about our so-called sticky inflation.

“The economy is finely balanced at the moment and the RBA wouldn’t want to tip it over the edge of a deep recession.

“Despite that, they went for the hard line rate rise.

“A major consequence of the rate rises is the number of Australians defaulting on their home loans, which recent research found had now surpassed the mortgage stress peaks in the Global Financial Crisis.

“Borrowers can’t take this hit lying down though, they need to be proactive, and spring clean their finances to make sure they’re on the best deal for them and a low rate”.

If a 0.25% rate rise was passed on in full, a borrower with a $600,000 loan size could see a $98 increase in their monthly repayments.

| Mortgage size | 0.25% interest rate increase to 6.5% p.a. |

| Increase in monthly minimum repayments | |

| $500,000 | +$82 |

| $600,000 | +$98 |

| $750,000 | +$123 |

| $900,000 | +$147 |

| $1,000,000 | +$164 |

| Monthly repayments do not include any reduction in the mortgage balance over time. These calculations assume: An owner-occupied variable interest rate of 6.25% p.a; principal and interest (P&I) repayments; cash rate increases are passed on in full; the loan term is 30 years; and there are no monthly fees. | |

“From lucrative cashback offers and discounted rates, the home loan market is back and bubbling away with competition.

“But it’s up to borrowers to take advantage of the market and to do their research – rather than aimlessly betting on their lender who might not have a good deal.

“There are plenty of cashback deals lingering around for owner occupiers, but you’ve got to make sure you don’t get sucked in by the sugar hit.

“Make sure the cashback deal is attached to a low rate – otherwise it may not be worth it”.

Australians with a $600,000 variable mortgage may soon be paying $1,552 more each month than they were at the start of May 2022, following a 4.25% jump in just 12 months.

| Mortgage size | Increase in average monthly repayments since the start of May 2022 |

| $500,000 | + $1,293 |

| $600,000 | + $1,552 |

| $750,000 | + $1,940 |

| $900,000 | + $2,328 |

| $1,000,000 | + $2,586 |

| Reserve Bank Lenders’ Interest Rates. Monthly repayments do not include any reduction in the mortgage balance over time. These calculations assume: An owner-occupied variable interest rate of 2.86% p.a in May 2022; principal and interest (P&I) repayments; cash rate increases are passed on in full; the loan term is 30 years; and there are no monthly fees. | |

For more information, please contact:

Natasha Innes | 0416 705 514 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, travel and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.