The following is David Koch’s personal views, as published in his ‘Your Money Digest’ newsletter.

Hi everyone,

Greetings from Bali. Libby and I are having a short break. Never been to Bali and really enjoying it.

But I’ve been closely following what’s happened at home this week when it comes to your finances.

The Reserve Bank confirmed it’s lifting the cash rate for the 13th time, with a 0.25 per cent increase following the November Board meeting.

As the RBA continues its inflation fight, the cash rate has now surged by a whopping 4.25 per cent since May last year (that’s roughly a 0.24 per cent increase per month).

A rate rise was definitely short odds on Melbourne Cup Day, but it still doesn’t help the pain at the hip pocket. Another $100 hit to minimum monthly repayments for some, when we can least afford it.

The RBA needs to keep inflation on a tight rein, otherwise its fear is that inflation could bolt away in 2024.

This is what is worrying the RBA: inflation isn’t dropping fast enough.

And our core inflation is worryingly higher than all our major trading partners; theirs is coming down much quicker than ours. That’s what the RBA Governor, Michelle Bullock means when she talks about our so-called “sticky” inflation.

But I must admit, I thought we’d have a pause in rates after October’s monthly CPI, which went down 0.1 per cent (deflation) – the first month prices have fallen in 14 months. On top of that, job ads in October fell 3 per cent – the lowest level since January 2022.

These two results would have given the RBA reason to rethink a decision to lift rates. The economy is finely balanced at the moment and the RBA wouldn’t want to tip it over the edge into deep recession. Despite that, they went for the hard-line rate rise.

But the statement attached to the RBA decision did show an important softening in its language… more on that coming up.

Lucrative cashback offers and discounted rates: the home loan market is back

A major consequence of the ongoing rate rises is that the number of Australians defaulting on their home loans has surpassed the mortgage stress peaks during the Global Financial Crisis.

Borrowers can’t take this hit lying down though, they need to be proactive, and spring clean their finances to make sure they’re on the best deal for them and the lowest possible rate.

Lenders are already starting to pass on the 0.25 per cent rate rise in full, so a borrower with a $600,000 loan size could see a $98 increase in their monthly repayments.

From lucrative cashback offers and discounted rates, the home loan market is back and bubbling away with competition.

But it’s up to borrowers to take advantage of the market and to do their research… rather than aimlessly sticking with their existing lender who might not have a good deal.

There are plenty of cashback deals lingering around for owner occupiers, but you’ve got to make sure you don’t get sucked in by the sugar hit.

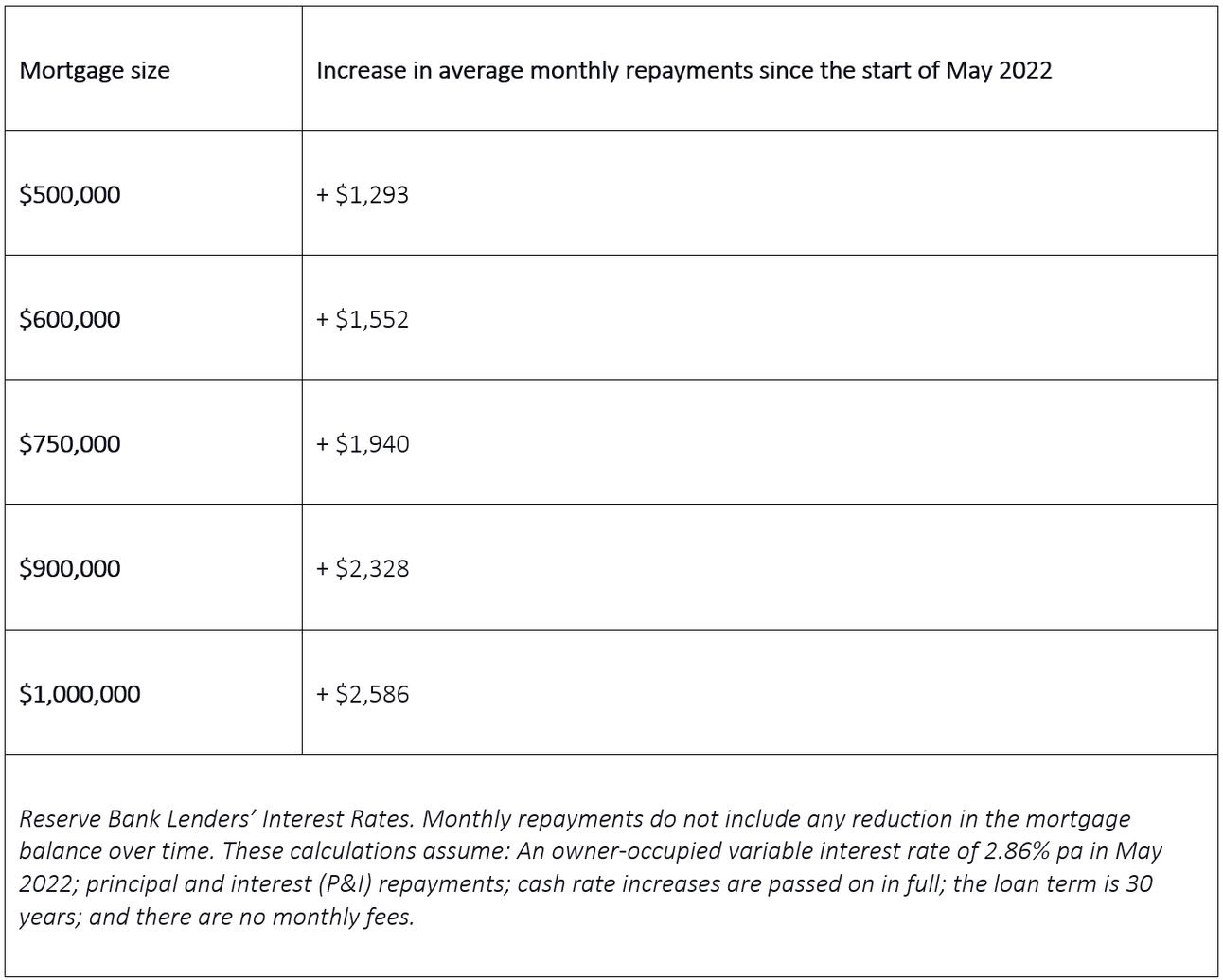

Make sure the cashback deal is attached to a low rate, otherwise it may not be worth it. Australians with a $600,000 variable mortgage may soon be paying $1,552 more each month than they were at the start of May 2022, following a 4.25 per cent jump in just 12 months.

Reading the RBA tea leaves… is the hard-line softening?

There were a couple of important changes in the statement the RBA always attaches to a rate decision announcement.

The RBA Board retained their forecast for inflation to be at the top of the target range of 2‑3 per cent by the end of 2025. But the end‑2024 inflation forecast was upwardly revised to 3.5 per cent (from 3.25 per cent previously). It also downwardly revised their forecast for the unemployment rate which is now expected to rise gradually to around 4.25 per cent (from 4.5 per cent previously).

While the RBA is still threatening to raise rates again if the inflation, jobs and spending data doesn’t go the way it wants, the wording has softened a bit.

In the Governor’s statement accompanying the October Board meeting it was noted that, “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.”

This month that line was modified to, “whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.”

I know you’ll laugh at why replacing ‘some’ with ‘whether’ is significant, but analysts see this as a bit of a smoke signal that the RBA is starting to consider that this is as far as they need to go in lifting rates. Let’s hope so.

This sums up your household budget pain

Most Australian families are feeling the pinch at the moment, crushed by rising interest rates and high inflation.

Our average cost of living is up 20 per cent since 2018 and a lot more if you have a mortgage.

Most households have been coping by dipping into their savings, which reached record levels during the pandemic because lockdowns stopped us from going out and spending. But as you can see, we’ve spent most of those savings and the safety net is no longer there.

Curbing spending is the only option left for many and that has a significant ripple effect across the economy.

But to help your food bill, meat looks to be a bargain

A couple of weeks ago I showed you the slump in cattle prices. Well, the same thing is happening with lamb. As I said back then, I hope the supermarkets are passing on these price reductions to consumers.

Aussie mutton prices have plunged 75 per cent over the past year to near 16-year lows. Sheep prices have also slumped. Government plans to phase out live exports have deepened concerns about oversupply.

The real impact of our record migration numbers

Over the last couple of months I’ve been talking about the impact of Australia’s record migration levels on the housing and rental markets.

This week I received a fascinating report from CoreLogic’s Head of Research, Eliza Owen, who had five key insights about overseas migration and the housing market:

- Migrant housing demand skews toward the rental market

Around 60 per cent of permanent migrants and 70 per cent of temporary migrants are renters in the short term. Home ownership for permanent migrants is higher the longer they are in the country. Home ownership rates are over 70 per cent for permanent migrants who arrived in Australia before 2012.

- Net overseas migration is at record highs, but partly because it was temporarily restricted

Without the temporary migration restrictions between March 2020 and July 2022, net overseas migration would be much lower over the latest reporting period. Part of the reason net overseas migration is so high right now, is because departures are low (because fewer temporary migrants arrived through COVID), and arrivals represent new and postponed moves to Australia. If it weren’t for COVID, we still would have had more overseas arrivals in the past few years than what we’ve seen since March 2020.

- Temporary migration ban made the rental market volatile

COVID taught us that temporary caps on migration are not a good idea. They create extreme fluctuations in overseas migration, which in turn has put a lot of pressure on some rental markets. Investor interest may also drop off in these markets when the migration tap is turned off, worsening the demand shock when temporary caps are lifted.

- Migration is not the only demand-side factor pushing up housing costs

Lower household sizes, an ageing population and lower rates of marriage have meant that even if there was no change in Australia’s population, demand for housing is going to rise. Rental market pressures have also increased from a long-term decline in social housing as a part of Australian dwelling stock. Even though international border restrictions were in play between March 2020 and July 2022, rents rose 16.4 per cent nationally.

- Reducing the migration intake would have trade-offs

Creating a net overseas migration target can help Australia plan out housing supply, but overseas migration also helps to grow the economy, and grow economic capacity. Migration is also being looked at to help with the housing crisis, by targeting migrants skilled in construction.

State of play in the property market

There is a lot of talk about the impact of this week’s interest rate rise on the housing market, so it’s worthwhile looking at the current state of play in property. The latest report from SQM Research came out this week which showed:

Listings are dropping: A modest 0.9 per cent decline in nationwide residential property listings was seen during October. This marginal decrease can be attributed to a substantial reduction in older listings across all major cities offsetting the increase in new listings.

Melbourne recorded a 1.6 per cent increase in total listings for the month of October, driven by a 7.6 per cent increase in new listings. Canberra recorded a 4.7 per cent increase in total listings, driven by a 4.5 per cent increase in new listings.

Conversely, Perth marked the most significant percentage decrease among capital cities, showing a 6.7 per cent decline in total listings, primarily driven by a 13.9 per cent decrease in older listings for the month.

Distressed sales are on the rise: As of October, the number of residential properties being sold under distressed conditions in Australia has risen to 5,521 – an increase of 5.2 per cent compared to September. The uptick in distressed selling activity was primarily driven by increases in New South Wales (8.9 per cent), Western Australia (7.6 per cent) and a substantial 35 per cent increase in the Australian Capital Territory compared to the previous month.

Conversely, South Australia and Northern Territory have recorded a decrease in distressed listings.

Asking prices are at record highs: In October, the national combined dwelling asking price rose by 1.2 per cent to reach a record high of $805,680. Asking prices for capital cities also increased by 0.7 per cent, marking a 7.5 per cent rise compared to October 2022. Sydney’s units asking price saw an increase of 2.2 per cent, while Adelaide’s units asking price showed a more cautious rise of 2.4 per cent.

Listings dropping, asking prices rising and distressed sales up… but does your house earn more than you?

Ray White’s chief economist, Nerida Conisbee, puts out some fun research papers. I love her work.

This week she posed the question: is your house earning more than you?

Naturally it depends on where you live, but on a big picture level Nerida found the answer is “no” over the last year…. the average income of Australian households was nearly double the increase in the median value of their homes.

Right now, the average Australian annual household income is $90,792. In comparison, Australian median house prices rose by $46,744 over the past 12 months. The average household earned $44,048 more from their incomes than from the increase in the median value of their homes.

This was consistent across all capital cities. Household incomes exceeded median house price growth in all capital cities, with Sydney having the smallest difference and Darwin the greatest.

Another down month for your superannuation fund

According to research house SuperRatings, in October super funds posted negative investment performances for the third consecutive month, with the median balanced option posting a negative return of 1.6 per cent for October.

Continued poor sharemarket performance undermined returns.

The median growth option similarly experienced a negative return of an estimated 1.9 per cent, while the median capital stable option experienced a more modest decline of 0.8 per cent owing to a lower exposure to shares.

October also saw pension returns fall, with the median balanced pension option returning an estimated negative 1.8 per cent. The median growth option is also estimated to see a decline 2.2 per cent for the month, while the median capital stable pension option is estimated to deliver a fall of 0.9 per cent.

Thankfully global sharemarkets have improved in November and this should lead to an improved return from super funds.