Home / Compare Health Insurance / What affects health insu…

What affects health insurance premiums?

Looking to reduce your health insurance premiums? Talk to one of our experts and they’ll help you look for a cheaper policy in just a few minutes.

- Australian owned and operated call centre

- Speak to an expert right away

- A quick call could save weeks of research

Key takeaways

Many Australians believe that health insurance cover is more expensive if they’re older or have a pre-existing condition. However, this isn’t necessarily true as numerous factors affect the way insurers calculate your health insurance premium.

- Your age may affect your total health insurance costs, but being older doesn’t necessarily mean you’ll pay a higher premium.

- The Private Health Insurance Rebate could significantly reduce your hospital insurance premiums depending on your age and income.

- Australian health funds submit their proposed premium increases for approval yearly, then the Department of Health and Aged Care announces the industry average premium increase.

Expert tips on health insurance premiums

Our health insurance expert, Steven Spicer, has some tips on how to keep your health insurance premiums low and get as much value as possible from your cover.

Review your health insurance regularly

The great thing about private health insurance is that you can upgrade or downgrade your policy at any time as your health needs change. Any waiting periods you have already served will be recognised by your new fund. Just keep in mind that you will need to serve any relevant waiting periods for any new or upgraded services or benefits. Anything you have paid in advance will be refunded to you as well, so review your health insurance regularly.

Choose your excess

While paying a lower premium may be tempting, cheaper doesn’t necessarily mean better. Instead of sacrificing inclusions on your cover, consider increasing your excess to lower costs. Just keep in mind that to be exempt from the Medicare Levy Surcharge, the excess must not exceed $750 for singles and $1,500 for couples/families.

Pay attention to your premium increases

Private health insurance premiums usually increase on the 1st of April every year. By paying your premiums annually, you may be able to save paying up to 12 months in advance to enjoy a lower premium price, provided you don’t make changes to your policy during the period you’ve pre-paid.

Your Age

Does age affect health insurance premiums?

The industry’s community rating system ensures that every person (regardless of age, medical history and claim history) can purchase the same health insurance policy at the same base price and can switch to a new policy without penalty.

The main effect that your age will have on your health insurance premiums is whether or not you have a Lifetime Health Cover (LHC) loading. If you intend to take out private hospital insurance, it may be best to purchase it when you’re younger to avoid this loading, or prevent it from accruing further.

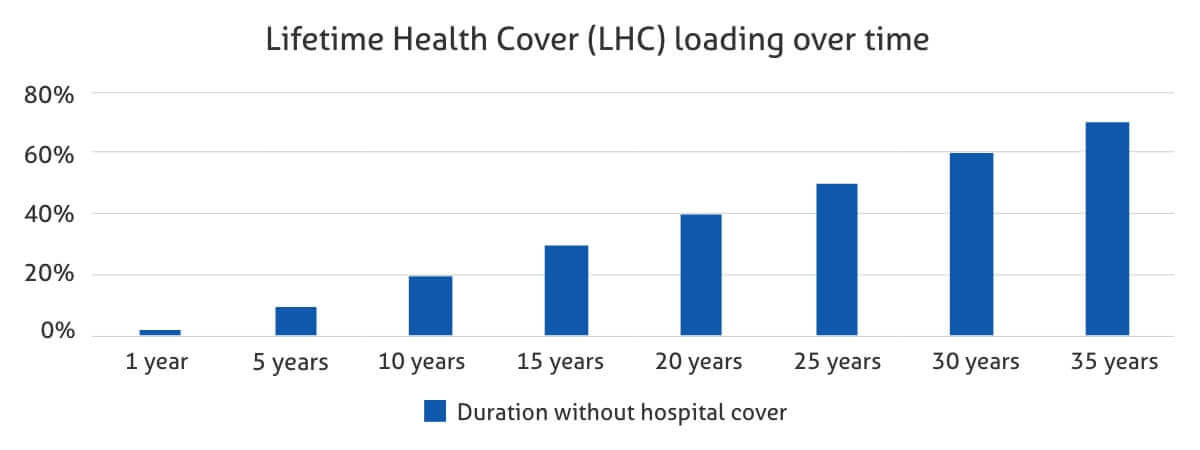

Lifetime Health Cover loading

The Australian Government introduced LHC loading as an incentive for Australians to take out private hospital cover at a younger age. The loading works by charging more in premiums to people who take out a private hospital policy after 1 July following their 31st birthday.

As a result, your private hospital insurance base premiums will attract a 2% loading for every year you don’t hold hospital cover from the age of 30. However, you only need to pay it once you take out hospital cover and the loading won’t affect your extras cover premiums.

For example, someone aged 40 would have to pay 20% LHC loading (unless an exemption applies) on top of their base hospital premium if they purchase private hospital cover for the first time.

The maximum loading amount is 70%, and your loading will be dropped altogether once you’ve held hospital cover continuously for 10 years.

Once you take out hospital cover, you are allowed 1,094 Days of Absence (one day less than three years) without hospital cover before your loading starts increasing again.

The age-based discount

The age-based discount is available to Australians aged 18-29. This discount is part of an Australian Government incentive to encourage younger Australians to take out hospital cover earlier in life and help ease the strain on the public system.

If you take out an eligible policy from an insurer that offers this incentive, you could benefit from a discount of up to 10% on your hospital premiums each year. On some policies, you could even retain your eligible discount each year until you’re 41 if you hold your policy continuously.

Once you turn 41, your discount will decrease by 2% every year until it reaches zero; so, if you took a policy with an age-based discount at 25, you’d benefit from the discount until you turn 45.

Here’s how much the discount is worth, depending on your age:

| Discount | Age* | Discount on a $1,500 (per year) hospital policy |

|---|---|---|

| 10% | 18-25 | $150 |

| 8% | 26 | $120 |

| 6% | 27 | $90 |

| 4% | 28 | $60 |

| 2% | 29 | $30 |

| 0% | 30 | $0 |

|

Source: Private Health Insurance Ombudsman – Age-based Discount. Accessed January 2024. *Age when you first purchase a hospital policy offering discounts. |

||

Your Income

Depending on your taxable income and age, you may be eligible to receive the Australian Government’s Private Health Insurance Rebate. The rebate is currently tiered by income and age brackets, ranging from 8.095% to a maximum of 32.385%.

You’re eligible for the Private Health Insurance Rebate if:

- You have a Medicare card

- You’re insured through a registered health fund

- Your annual income is less than $158,000 as a single or $316,000 as a couple

- You’re an Australian citizen, permanent resident, or have a reciprocal Medicare card.

People in lower income tiers and higher age brackets will receive a more substantial rebate.

If you’re eligible for an Australian Government rebate, you can either claim it back at tax time or through a reduced premium. To claim the rebate as a reduced premium, you will need to supply your insurance provider with your age and predicted income bracket. Keep in mind that if you claim in the wrong tier, an adjustment will be made at tax time.

If you’re a high income earner who doesn’t have private hospital insurance you might have to pay the Medicare Levy Surcharge (MLS). This surcharge is intended to ease the pressure on the public system by incentivising higher earners to take out hospital insurance. The table below outlines the income tiers and the MLS percentage they’ll have to pay come tax time.

| Medicare Levy Surcharge – Tax Brackets (all ages) | ||||

|---|---|---|---|---|

| Surcharge | 0% | 1% | 1.25% | 1.5% |

| Single income thresholds |

$101,000 or less ($0 payable) |

$101,001 – $118,000 (~$1,010 – $1,180 payable) |

$118,001 – $158,000 (~$1,475 – $1,975 payable) |

$158,001+ ($2,370+ payable) |

| Family income thresholds^ |

$202,000 or less ($0 payable) |

$202,001 – $236,000 (~$2,020 – $2,360 payable) |

$236,001 – $316,000 ($2,950 – $3,950 payable) |

$316,001+ (~$4,740+ payable) |

|

Retrieved from the Australian Taxation Office | Information current from 1 July 2025. Dollar amounts payable are rounded up. ^For families with children, thresholds increase by $1,500 for each child after the first. Families include couples, de facto couples, and single parents. |

||||

Your chosen policy

The policy you select will be the greatest determinant of price, as policies can range from basic (budget policies) to comprehensive (most costly).

The different levels of cover are generally determined by the services and procedures that are included or excluded, so it’s vital you regularly assess what you need cover for and tailor your policy accordingly.

For example, if you have a top-level health insurance policy (like a Gold policy), you will pay a higher premium than you would for a lower level of cover. This is because these comprehensive policies generally cover most services/treatments that Medicare pays a benefit towards, such as obstetrics, joint replacements, assisted reproductive services and many more.

Conversely, a Basic policy will cost less due to fewer of those treatments/services being available for you to claim on.

Your family status

Who your policy covers also affects the price of your premium. Here are the types of polices available, who they cover and how they will affect your total health insurance cost:

Singles policy

A singles policy covers only the policyholder.

These polices are typically cheaper as they only cover one person. One of the benefits of a singles policy is that you only need to organise cover for the healthcare services you personally need. You may still fall under the family income thresholds for the Private Health Insurance Rebate and MLS if you have a spouse, de facto partner or dependent child.

Couples policy

A couples policy covers two adults.

On a couples policy, you’re covered for the same services and procedures and may share some extras limits. Any applicable LHC loading or age-based discount will be averaged between both people included on the policy. If you share the policy with your spouse or de facto partner, you’ll likely fall under the family income thresholds for the Private Health Insurance Rebate and MLS.

Family policy

A family policy covers two adults and one or more children.

This is like a couples policy, except it includes your children or dependants. Your child might be covered on this policy up until they’re 21 or even 25+ if they meet the conditions of your insurer.

Single-parent policy

A single-parent policy covers one adult and one or more children.

Single-parent policies are like family polices that only cover a single adult. They’re typically more expensive than a Singles policy, and cheaper than a Family policy. If you’re paying any LHC loading, it won’t be averaged out between you and someone else, but your income for the Private Health Insurance Rebate will be tested against the family threshold.

Other factors

Along with the level of cover you select and who is covered by your policy, these other factors may impact your premium.

Excess

This is a set out-of-pocket cost you agree to pay your insurer when you’re admitted to hospital and claim on your cover. Your total excess is usually only charged once per person per year depending on your health fund and policy. You may have the choice to pay a higher excess in exchange for lower premiums, and vice versa.

Co-payments

You may need to pay these fees for every day you’re admitted as a private patient in a public or private hospital. So, if you agree to pay a $100 co-payment and you’re admitted for five days, you’ll pay $500. Some insurers cap the amount you’d need to pay per year or per admission.

Where you live

Where you live might affect how much your premiums are. Medical costs may vary between states, as can the rate of claims. As such, insurers may charge different premiums throughout Australia.

Annual premium increase

Private health insurance premiums are subject to change every year due to the annual rate rise. This happens through a review process where health insurance companies submit any premium changes to the Minister for Health for approval.

Once the proposed changes are reviewed and approved, they usually become effective on 1 April each year. In some unique circumstances, health funds will defer their rate rises until later in their year. An example of this is the Covid-19 pandemic where many funds chose to delay their premium increases to give back the savings they made due to a reduced number of claims.

Health insurers aim to keep premiums low. However, annual premium increases are required to cover the rising healthcare costs, often driven by:

- Increases in the number of claims by members

- Increases in the cost of health services by doctors and hospitals

- Increases in the cost of medical equipment and technology

- Costs of complex procedures completed through private hospitals.

Learn more about the health insurance premium rate rise and how it could affect you.

Meet our health insurance expert, Steven Spicer

As the Executive General Manager of Health, Life and Energy, Steven Spicer is a strong believer in the benefits of private cover and knows just how valuable the peace of mind that comes with cover can be. He is passionate about demystifying the health insurance industry and advocates for the benefits of comparison when it comes to saving money on your premiums.

Want to know more about health insurance?

Talk to an expert

At a time that suits you

Call now