Looking for help? 1800 880 569

Let’s be honest – for most of us, going to work is a necessity. We may not have glamorous occupations, but working pays the bills, feeds our families and provides for the small luxuries in life like holidays, dinners out and school fees. We’re used to it. We go to work, we come home and we repeat it all the next day. Sometimes, it can feel a bit like Groundhog Day – there’s a reason it’s sometimes referred to as the ‘daily grind’! But what happens when something out of the ordinary happens at work – a workplace injury or related illness – and we’re no longer able to work?

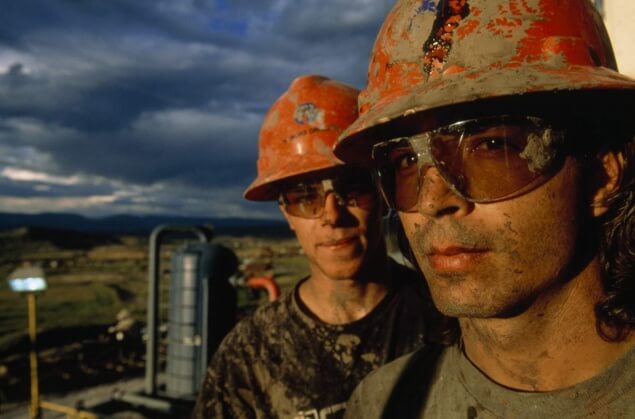

While some jobs are inherently risky, like construction and mining, most of us don’t expect to be injured in the workplace, however workplace injuries are more common that you think – more than 530,000 Australians are injured at work every year. Workplace injuries range from minor incidents to multiple fatalities and, each year, hundreds of Australian workers are killed on the job. In 2014 alone, 185 Australian workers were killed at work.

The impacts of workplace injury and illness are far-reaching. They don’t just take a physical toll; they have serious human, social, organisational and financial impacts too.

The human impact

Catastrophic workplace events may have a devastating effect on a worker’s life – you could be severely incapacitated or even killed, and although there may be financial compensation in the form of Worker’s Compensation or Income Protection insurance, your quality of life may suffer. Imagine not being able to drive, never running around with your kids or never being able to return to work at full capacity again?

Workplace injury often results in an ongoing disability which may affect the confidence of the worker and could lead to mental health challenges, including depression and post-traumatic stress. The financial impact can be as debilitating as the injury – according to this ABS report, the financial burden of workplace injury is predominantly borne by the worker (74%), followed by the community (21%) and then the employer (5%). The ongoing physical, emotional and financial stress of recovery and injury management can put strain on families and relationships, sometimes leading to marriage difficulties and even divorce.

The social impact

The social impact

Communities often bear a heavy burden of support for workplace injuries, providing rehabilitation and support for workers and their families. These services may include financial assistance, occupational rehabilitation, counselling and mental health services and/or in-home care. In cases where workers are permanently incapacitated, that worker will potentially be a draw on community resources as well as not having an ability to contribute to their community in the future.

The organisational impact

It’s estimated that in 2008-2009, $60.6 billion dollars in productivity is lost every year in Australia due to workplace health and safety failures. Injured employees may need to be replaced, which costs the company time and money in recruitment and training. Other workers may no longer feel confident in organisational safety procedures and time (and money) may need to be spent on creating a safer work environment.

The financial Impact

Workplace injury doesn’t just have a financial impact on the organisation, it can have a significant financial impact on the injured individual and/or their families. Medical bills, rehabilitation, ongoing care and loss of livelihood all add up. While worker’s compensation may cover workplace injuries, cover may be limited and ‘stepped down’ (decreased) over time. And if you’re among the 10% of Australians who are self-employed, you’re probably not covered by a worker’s compensation insurance scheme.

What is Workers’ Compensation?

What is Workers’ Compensation?

Worker’s compensation provides eligible workers with weekly payments, and may reimburse hospital and medical costs, depending on the type and severity of the injury. It can also provide lump sum payments for permanent disability or death in relation to incidents occurring at work.

However, workers’ compensation will not cover you for incidents or illness occurring outside the workplace. Consider this: how will you pay your financial obligations if you sustain an injury or suffer an illness and you need to spend time away from work? What if you are unable to return to work? That’s where Income Protection Insurance comes in.

Income protection insurance

Income protection insurance

Income Protection Insurance is a form of Life Insurance that will pay you a portion of your income if you are sick or injured and unable to work, usually up to 70% of your normal income.

Income Protection Insurance comes in many shapes and sizes. As with any type of insurance cover, it’s important for you to compare providers to find a policy that suits your needs based on lifestyle, income, family structure, current and projected expenses and so on. Always disclose any pre-existing medical conditions, as failure to disclose may void your insurance.

The peace of mind provided by Income Protection insurance aside, there’s also a tax incentive for people who purchase income protection insurance privately, making the cost of the premium tax deductible! Can you afford NOT to have income protection insurance?

Three Ps of workplace safety

Although Workers’ Compensation and Income Protection Insurance are important backstops if injury and/or illness do occur, creating and maintaining a safe workplace should help you and your colleagues avoid work related injury or illness from occurring at all.

Always remember the three Ps of safety: Prepare, Prevent, Protect.

Prepare. Prepare a safe working environment. Ensure that your workplace has safe work practices in place and detailed safety policies and procedures to assess and manage workplace risks.

Many larger companies have pre-start safety inductions for all employees and on-site contractors that walk you through the company’s safety policies. In some cases, jobs will have a set of step-by-step operational procedures that have been designed with safety in mind.

Even small companies and sole traders should consider implementing a hazard management and workplace safety programme in the workplace. Keep in mind that workplace safety is everyone’s job!

Prevent. Prevent workplace injury through maintaining a safe workspace, following set safety guidelines and workplace procedures, and undertaking routine hazard inspections. Pre-start safety checklists are a good way to assess for risks before starting a job; pre-start safety checklists are sometimes referred to as a ‘Take 5s’, Step-backs or SAMs. SAMs are one of the easy job assessment strategies and can be done by anyone in any job.

Remember S-A-M. If you Spot the hazard, Assess the risk and Make the change. If you identify a hazard don’t ignore it! If you are unable to make the necessary changes, bring the hazard to the attention of your supervisor/employer.

Protect. Protect yourself and your colleagues; always follow the set procedures, report hazards, wear appropriate Personal Protective Equipment (PPE) and maintain your tools and/or workspace.

Hazard & Risk

A workplace hazard is anything that has the potential to cause harm to a person. Hazards can be items in a workplace, such as machinery, or the working environment, such as working at heights. Hazards can also relate to the way in which work is performed, such as lifting, bending or fatigue. Hazards are usually broken down into five categories: biological (like influenza), physical (as in a broken leg), chemical (like a chlorine burn), ergonomic (such as RSI) and psychosocial (from harassment, for example). Although workplace hazards are more commonly associated with trade and manual labour related industries (like mining, agriculture, fishing, forestry and transport), most of these hazards have the potential to exist in all workplaces, meaning even the most clinical, robust environments have inherent risks.

Common hazards in the workplace include: falling objects, slips/trips and falls, working at heights, electrical shock, lifting and manual handling, machinery operation, confined spaces, handling chemicals, extreme temperatures (including working in the sun or cool room environments), noise, radiation, bacteria, bio-hazard exposure, dust and vapour inhalation, repetitive stress (RSI), workplace bullying and work-related fatigue. Some hazards are unavoidable – for example, electricians need to work with electricity – so once a hazard is identified, it’s important to assess the risk associated with the activity.

What, exactly, is risk? Risk is the likelihood of harm (death, injury or illness) occurring if a person is exposed to the hazard. Safe workplaces thoroughly manage the risks associated with their work.

Staying safe

Staying safe

Whether you work for a large corporation or a small organisation, workplace safety is everyone’s concern. You can help maintain a safe workplace by conducting ongoing safety assessments at work, volunteering as a safety officer and maintaining a safe workspace. If you’re unsure where to start, try this organisational safety checklist from Safework Australia. Consider implementing pre-start risk assessment tools like Take-5s, SAMs or Step-backs into your workplace routine. JSAs (or Job and Environment Safety Analysis) should be undertaken for any non-routine jobs.

Sometimes, it’s the simplest tasks that cause the most serious injuries. Sprains and strains account for over 41% of all workplace injuries and, gentlemen, you’re 25% more likely to incur an injury at work. Everyone should take care, whether they are performing routine or non-routine tasks. Even lifting a box of photocopier paper incorrectly could cause injury.

The Final Word

Despite the rate of workplace fatalities marginally decreasing over the past few years, in 2015 there have already been 20 on-the-job deaths across the country (as at 16 February 2015). Safety is everyone’s responsibility so always remember the three Safety P’s: Prepare, Prevent and Protect; and remember that an Income Protection Insurance policy that suits your lifestyle and needs can add an extra level of protection for you and your family. Stay safe!