The following is David Koch’s personal views, as published in his ‘Your Money Digest’ newsletter.

Not a huge amount of economic news this week, but there is an enormous amount of other crucial information coming out which affects your money.

The implications of a falling Australian dollar; the economic crisis in China; and whirlwind of annual profit announcements from our share market listed companies. So much to cover.

I reckon let’s start with China because it has a ripple effect on our economy and share market. Because China is our biggest trading partner, many overseas investors see Australia as a de facto bellwether of what is happening there. If China is going well, so will the Australian economy and share market through our big exporters. But if China is having problems, Australia will be affected negatively. Sort of makes sense.

Over the last couple of weeks, the economic slowdown in China is starting to alarm investors and political leaders. The Hong Kong stock market is down 20 per cent so far this year (the official definition of a bear market), which is against the strong trend of other international markets.

The Chinese yuan fell to its lowest level in 16 years and forced the central bank to support it by artificially pegging the value higher… while also cutting interest rates.

The country’s problems stem from its extended COVID lockdown, massive youth unemployment (which I covered here last week), and property developers going bust under the burden of huge debts and falling prices (deflation) while the rest of the world is battling rising inflationary pressures.

In the last two weeks, leading homebuilder Country Garden defaulted on loan repayments, as did investment company Zhongrong International Trust. That’s on top of the problems of China’s biggest property company, Evergrande, which just filed Chapter 15 bankruptcy.

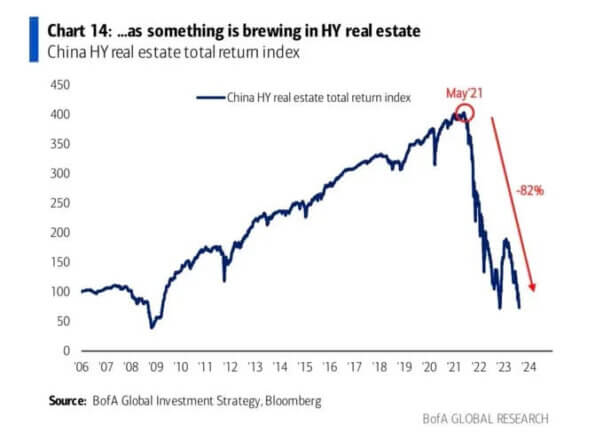

China’s HY real estate index is down a massive 82 per cent in just over two years. This puts the index back down to 2008 levels.

We are talking multi-billions of dollars of losses. And it is spooking markets.

So much so that many analysts are cutting their economic growth forecasts for China to below 5 per cent, which is unheard of.

China has rolled out an emergency stimulus package, but it is having little effect. These economic packages usually revolve around spending up big on infrastructure and housing (because this quickly creates jobs and consumer spending to furnish the new properties).

But China has already played that card in the past, to the extent that there is a glut of property (which is causing prices to fall and property developers to collapse) and there is no need for any new big infrastructure spending.

In other words, China has run out of levers to pull. Rather than create jobs, the current economic stimulus package is designed to save companies going under. Which is why they’ve cut interest rates.

It is serious. And as our major export customer, China is likely to cut back their orders as they battle their economic woes. The silver lining is that with prices falling, China will pass on those price falls which will reduce our import prices and bring down inflation here.

As China stumbles, so does the Australian dollar

As the default bellwether for China, our Australian dollar has dropped sharply over the last couple of weeks to a nine-month low. And the fact that our interest rate cycle is peaking while other countries are still raising rates is also dampening the value of the Aussie dollar.

Naturally it’s been getting a lot of media coverage – good for business, bad for online shoppers; great for tourism, terrible for petrol prices, etc. But the implications go a lot deeper.

Generally, a weak dollar is embraced by business and detested by consumers. Australian business loves it as it boosts competitiveness. Exporters, rural producers, manufacturers and tourism outfits are all more price competitive when our dollar is weak. Their offerings become cheaper compared to foreign alternatives.

Retailers also lap it up as Aussie shoppers turn their attention closer to home –both in-store and online – when those shoes and jeans from the US and UK no longer look as cheap. So, for consumers it’s these same reasons that a soft dollar is generally perceived as bad news. Imports and foreign travel start to get more expensive when the dollar falls.

As you can see there are winners and losers from a lower currency. So, lets translate that to your investments.

On the sharemarket, the losers will be those who get hit by higher import prices:

- Qantas, because fuel and aircraft purchases make up such a big part of its cost base. It’s also more expensive for Australians to travel overseas, but cheaper for foreign tourists to visit here.

- Retailers like Harvey Norman, Kogan, Myer, JB Hi-fi also lose because most of the electrical goods and clothing they sell are imported.

The winners are exporters and companies which generate a lot of their profits from overseas operations, because they’ll add value bringing that money back to Australia:

- Resource giants BHP and Rio are major commodity exporters and also have extensive offshore operations.

- News Corp earns the bulk of its profits offshore, as does ResMed, CSL, Cochlear, James Hardie and a raft of other companies.

- Our iron ore miners (like Fortescue and Mineral Resources) and gold miners (like Northern Star and Newcrest) sell in US dollars and get the benefit of the conversion back to Aussie when they get paid.

It’s worthwhile checking with your broker or financial planner about the specific impact on your portfolio and reviewing the extent of consequences. For example, the currency effect will vary depending on whether the company hedges against currency movements.

Also remember that while the Aussie dollar has been falling against the greenback, the change hasn’t been as significant against the currencies of our other trading partners.

Our record savings cushion is drying up fast

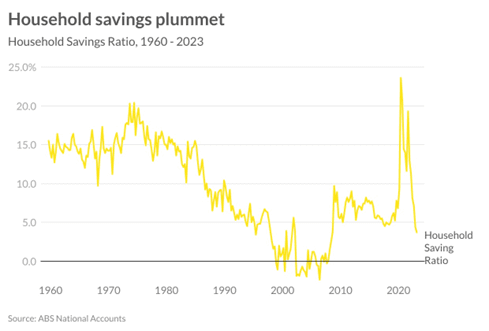

Australians built a huge savings war chest during COVID (lockdowns prevented us going out and spending) which has helped us fight inflation and rising mortgage repayments. We’ve dipped into our savings to cover the cost increases and still maintain our spending.

But those savings are drying up fast. In fact, savings have now reached lows not seen for more than 15 years.

According to Ray White chief economist Nerida Conisbee, we’re not yet spending more than we earn, as happened in the Global Financial Crisis. But one more interest rate rise, energy price rises continuing or even a slight rise in unemployment could tip us into negative territory.

High savings rates had a number of impacts on property, according to Nerida. Despite Australia seeing negative net migration overseas, rents grew rapidly, increasing by 13 per cent between March 2020 and December 2021.

Although difficult to explain at the time, it has since been shown that average household size declined during the time and the number of single person households hit a record high. Rental demand jumped as more people decided they liked living alone or in smaller households. This trend is now reversing as rents rise sharply.

It was also a major driver of house price growth. Higher savings rates meant more to spend on other things when restrictions began to ease and it became apparent that the pandemic would at some point end. Extremely low interest rates and lots of saved cash meant strong demand from buyers, pushing up prices across Australia.

With savings rates now plummeting, what does this mean for property?

Interest rates remained on hold in August and markets are currently predicting a 93 per cent chance of another hold in September. With retail trade falling for the third straight quarter, savings rates plummeting and inflation trending down, Nerida thinks it is looking more like we are now at peak rates.

With more property coming onto the market, this greater certainty about the outlook is likely to make this a much better spring selling season than last year

Successful share investing is time-in, rather than timing, the market

The dream of every share investor is to buy at the bottom of the market, sell at the top and make a huge windfall. But as everyone knows, getting that timing right is a lot harder than it sounds.

In fact, there is an old investment mantra that time-in the market is more profitable than timing the market.

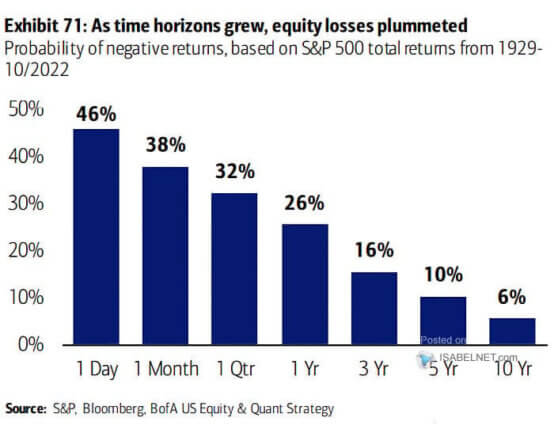

I know there are a lot of outside factors at play, such as the number of stocks in a portfolio and the quality of those stocks, but this research from Bank of America on the S&P500 Index seems to validate the theory.

Short-term investing – a day, a month, a quarter or a year – comes with a much higher risk of losing money. That risk reduces significantly the longer the portfolio is invested.

Please don’t automatically renew your insurance policy

As I’ve mentioned so many times in the past, you’re a mug if you automatically renew any sort of insurance under the misguided belief your loyalty will ensure the deal.

My household budgeting whiz, Libby, never ever automatically renews. She always checks around and inevitably finds a better deal. It has saved us tens of thousands of dollars over the years… I’m not joking.

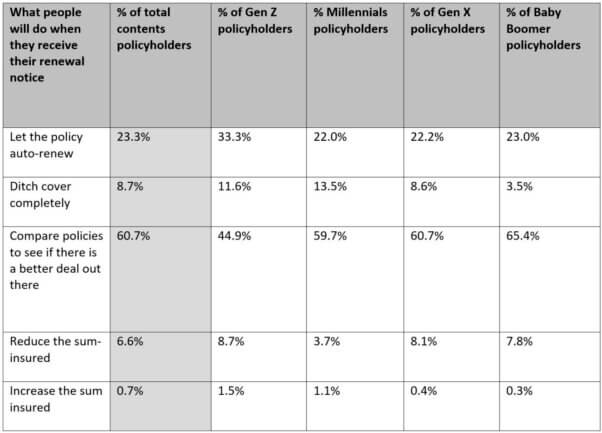

That’s why I was dumbfounded by new research from comparison website Compare The Market (of which I’m Economic Director) which found that as many as one in four Australians who hold a contents insurance policy for their belongings let it auto-renew without checking if a better deal is available.

Gen Z was the most likely to let their contents insurance auto-renew, with a third of the cohort admitting to doing nothing when their renewal arrives in the mail. Millennials were the most trigger-happy to completely ditch their contents cover, while almost two-thirds of Baby Boomers (the biggest cohort out of all the generations) were prepared to compare policies to find a better deal and then switch to another insurer.

Earnings season observations

As usual, the current annual profit reporting season has been fast and furious. A couple of observations:

- Retailers have performed better than the market expected. The top retailers like Premier Investments, Lovisa and JB Hi-Fi have really shone. Consumers have kept shopping despite the interest rate and inflation issues, but I wonder whether this will continue with household savings running down.

- Tech companies which are profitable have been loved by investors – Audinate, Altium and TechnologyOne. Those not profitable are being shunned.

- Resource stocks have disappointed due to falling commodity prices, currency issues and production problems. But dividend yields will still be attractive.

- Inflation is putting pressure on the margins of supermarkets and food groups.