Compare the Market is warning Australians with private health insurance to pay careful attention to their fund’s no-gap schemes and agreement hospitals or risk being left with large bills for their health treatment.

The fresh warning comes as millions of Australians were hit with higher hospital cover premiums on 1 April.

Compare the Market’s General Manager of Health, Life & Energy, Steven Spicer, said while holding hospital cover can be a great investment, some people end up with high out-of-pocket costs because a little-known rule catches them out.

“A lot of people take out hospital cover and think they’ll only need to pay their premiums and excess, but the reality is this isn’t always the case,” Mr Spicer said. “In the same way that supermarkets or retailers can set their own price for the items or services they sell, certain health care professionals can do the same.

“When you seek treatment as a private patient, there can be a gap between what Medicare and your health fund cover and the doctors’ fees you incur. This is why it’s so important to pay attention to your fund’s no-gap scheme or agreement hospitals.”

Here’s how it works.

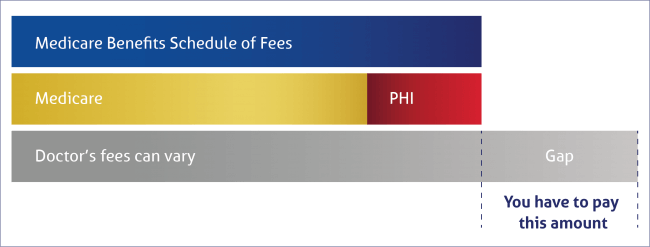

When claiming with a private health fund, Medicare covers 75% of the scheduled treatment fee outlined by the Medicare Benefits Schedule (MBS) and your insurer covers the remaining 25%. However, health professionals may charge more than the scheduled fee for their service, which is when you can incur an out-of-pocket expense or gap.

“Unfortunately, with no price cap in place, doctors are free to charge whatever they please, which could leave you hundreds or thousands of dollars out of pocket,” Mr Spicer said. “One potential way around this is being treated by an agreement hospital with your fund, where the hospital charges a set fee based on their agreement with your health fund. Depending on the agreement and the treatment you receive, you might pay a known gap or not have to pay any out-of-pocket expenses at all.

“The other option is to choose a provider who agrees to participate in your health funds no-gap scheme, which means they won’t charge fees above the fee Medicare and your health fund sets. You can typically find a list of no-gap providers on a health fund’s website or ask about a doctor’s fees upfront. Keep in mind that gap fees can apply to a range of services and health care professionals, including surgeons and anaesthetists.”

Example:

A 65-year-old man requires a hip replacement surgery, which can cost in excess of $30,000 or more, depending on what the surgeon and private hospital charges. This typically includes accommodation and meals, prosthetics, theatre fees, MBS amount item charges for doctors’ and anaesthetist fees. The man has several options to reduce or eliminate his out-of-pocket expenses.

- Be treated at an agreement hospital. If the man opts for surgery at a hospital that’s part of his health fund’s agreement hospital network, he will receive his care at a hospital that has a contract in place with his health fund, specifying the cost and benefits paid for the health fund’s member’s accommodation and other hospital expenses while he attends that hospital, potentially reducing his possible out-of-pocket expenses.

- Ask his surgeon to participate in his health fund’s no-gap or known-gap scheme. The surgeon can agree to participate in the man’s health fund’s no-gap scheme, which means their fees either won’t exceed the price of treatment that Medicare and the healthy fund will agree to pay (in this example, $30,000) or participate in the health fund’s known-gap scheme and pay a set “gap amount” for example up to $500 per doctor.

Please note: The above is an example only. Actual amounts may vary depending on your surgery and circumstances.

Health professionals aren’t required to participate in a gap scheme or agreement hospital network, so it’s important to check before you book your next appointment or treatment. It’s also possible for health professionals to participate on a case-by-case basis.

“Seeking health treatment can be quite complex and often involves more than one health care professional, so to avoid out-of-pocket expenses, you’d need to ensure all surgeons, anaesthetists and other health professionals involved in your treatment participate in your fund’s no-gap scheme,” Mr Spicer said. “Contact your insurer ahead of time for a list of doctors and specialists who have chosen to participate in their gap cover previously or hospitals that have agreements in place with your fund.

“While most health funds have gap schemes in place, they’re not all the same, so this is also worth keeping in mind if you have recently changed health funds.”

Mr Spicer’s top tips to avoid out-of-pocket expenses

Always contact your health fund before treatment for the following reasons:

- For a list of health professionals who have previously participated in their no-gap schemes. While this doesn’t guarantee that your treatment will be covered under a no-gap scheme, you can contact these health professionals individually to see if they will.

- To ensure the hospital you are looking to attend is part of their agreement hospital network.

- To understand the excess that applies to your policy for hospital admissions.

- To ensure you’ve met the required wait times as outlined by your health fund. If you receive treatment privately but haven’t served the applicable wait times, you will likely need to pay out of pocket for treatment.

Speak to your chosen surgeon and ensure you know:

- The total cost of the surgery.

- If they, any secondary surgeons and anaesthetists will participate in your health fund’s no-gap scheme. They choose this on a case-by-case basis, so you need to ask, as it could save you thousands, depending on the type of treatment you require.

For more information, please contact:

Phillip Portman | 0437 384 471 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.