The following is David Koch’s personal views, as published in his ‘Your Money Digest’ newsletter.

Good news. Australians who want to work can get a job and that’s despite a record level of migration coming into the country. Every employer knows that it’s tough to get staff and the latest August employment data shows it is still a tight labour market.

Employment increased by a stronger-than-expected 65,000 people and the number of unemployed only dropped slightly, by around 3000 people, with the jobless rate at 3.7 per cent.

No-one wants to see people who want to work out of a job… the financial and emotional strain on families is huge. But low unemployment can push up wages which, in turn, feeds into higher inflation. That’s what we don’t want.

So, while the low unemployment is good for families, the Reserve Bank would like it a bit higher to stop any big pay rises and that’s why, unfortunately, economists are now predicting one more interest rate increase towards the end of the year… probably in November.

Average consumers are still gloomy, although bosses are more positive

Remember, the last Reserve Bank Board meeting pointed out that the key economic indicators it is following for future interest rate decisions are the labour market (which, as we now know continues to be tight) and household confidence and consumption.

Well, Aussie consumers remain gloomy, with the Westpac and Melbourne Institute’s measure of consumer sentiment now 21 per cent below the long-run average. The index has now been below the neutral 100 mark since March 2022, the longest gloomy streak since the early 1990s recession.

A lot of economists, including CommSec, believe confidence is unlikely to improve until the inflation threat has receded, and interest rates start falling sometime next year.

But while consumers are gloomy, employers are getting a bit more positive, with business conditions above ‘normal’ levels; basically because the job market remains strong and migration continues to lift. So spending has continued, even if it’s at a more cautious pace.

Remember, last week I talked about how the huge migration levels are inflating our economic growth, with a lot of that through consumer spending. That’s why retailers are doing better than expected, because migration is boosting the sheer number of shoppers.

The Bureau of Statistics population data for the March quarter showed Australia’s population rose 563,205 over the year to March – the largest annual increase on record. Our population was 26.5 million people on 31 March 2023.

The quarterly growth was 181,600 people (0.7 per cent) and the annual growth was 563,205 people (2.17 per cent). Our annual natural increase was 108,800 and net overseas migration was 454,400.

In fact, at 108,800 the natural increase in Australia’s population over the past year (births less deaths) was the slowest annual growth since quarterly records were published 42 years ago.

This graph which AMP chief economist, Shane Oliver, posted on X (the rebranded Twitter) puts into perspective just how big this immigration boom is.

Source: @ShaneOliverAMP/ X

The issue then becomes… where do we accommodate them?

We have a massive immigration-led surge in population growth, but buildings commencements are falling. This graph alone sums up the residential property market and why a continuing shortage of new homes will underpin home values for the next couple of years at least.

Source: AMP

We’re just not building enough homes to meet the demand from migrants.

Interestingly, the Westpac-Melbourne Institute Consumer Sentiment survey also includes a question on the wisest place to put new savings. It’s a good barometer of how people are feeling and whether they are confident enough to come out of their bunker.

In the latest quarter, the proportion of people saying they ‘don’t know’ the best place for savings jumped to the third highest level in 26 years of records. On the back of higher deposit rates and borrowing costs, over half of all consumers nominated either ‘bank deposits’ (32.5 per cent) or ‘pay down debt’ (23.3 per cent) as the wisest place for savings. Conversely, very few consumers favoured “riskier” options. Just 7.4 per cent nominated real estate and 7.2 per cent shares.

So what’s worrying Aussies the most? And are we any different to other countries?

Research from Compare the Market’s new Household Budget Barometer has revealed the nation’s surprising financial fears for the next 12 months.

According to the report, the cost of groceries, energy and fuel are the bills that Australians believe will cause the most pain in the next year. In fact, a whopping 66.4 per cent of Aussies believe their grocery bills will worry them, two-thirds (61.2 per cent) think electricity and gas bills will cause pain at the hip pocket, while just over half (53.1 per cent) believe they’ll feel the pinch at the petrol bowser.

Baby Boomers are most likely to believe they’ll be stressed by the cost of groceries and energy bills, while it’s Gen Z who believe rising fuel prices could stop them in their tracks.

Australians aren’t the only ones fearing these everyday costs over the next 12 months. In Canada, 65.6 per cent of people believe grocery prices will worry them within the next 12 months, 46.7 per cent believe they’ll struggle with rising petrol prices and 40.3 per cent think they’ll be concerned by energy bills.

While in the US, it’s less severe, with 46.2 per cent anticipating concern around groceries, 40.3 per cent fearing rising energy bills and 39.7 per cent foreseeing financial issues around fuel costs.

The data also found that around a third of Australians believe their mortgage repayments (30.3 per cent), car insurance (30.3 per cent) and cost of healthcare (29.5 per cent) will cause them worry within the next 12 months.

The statistics show that it’s Australian Millennials who are the most concerned about mortgage repayments in the next 12 months. Baby Boomers most anticipate their car insurance premiums and the cost of healthcare will cause them financial stress over the next year.

Interestingly, just one in 10 Americans believe their mortgage repayments will cause them worry (because they can lock into 30-year fixed mortgages and not many are on variable rates), while around 15 per cent of Canadians feel mortgage pressure.

Fewer Americans anticipate health costs causing financial pain in the next 12 months (22.2 per cent compared to 29.5 per cent in Australia), while it’s lower again in Canada (at just 16.4 per cent). Remember in the US health insurance is mostly paid by employers.

The data also shows that a higher percentage of Australians anticipate concern around the rising cost of home and contents premiums, but North Americans are more likely to believe their phone and internet bills, cost of child activities and life insurance will be bigger stressors.

Compare The Market’s top tips to reduce household financial stress are:

Think outside the box when it comes to saving

While putting money aside for a rainy day is a great way to save, it’s not the only one. With electricity prices rising, you may be able to claw back cash by switching to a cheaper plan. Similarly, if you’ve been hit with an insurance renewal, don’t just accept it. Be sure to do your research and see if a better deal is available.

Maximise your rewards

See if you’re eligible for any rewards or offers from your insurance providers, energy retailers, takeaway outlets, telcos and supermarkets. For example, you may earn points for every dollar you spend, which can be redeemed for services and goods. You may also be eligible for discounted movie tickets, entertainment options, dining experiences and more.

Shop around

Whether it’s your weekly grocery shop, insurance products, beauty services or more, be aware that different businesses set their own prices for their goods and services. Before making a purchase or locking in your next appointment, check for the discounts available and don’t pay more than you need to.

Switch, don’t ditch

Rather than giving up things completely, see if you can save in other ways. For example, are there alternatives to your current services with a smaller price tag? When it comes to insurance, are you paying for a higher level of cover that you don’t need? If the answer is yes, there could be room to save.

Superannuation update

Now for our monthly check on how you superannuation fund has been doing over the past month.

After a positive start in July, super fund returns faced some headwinds in August. According to leading superannuation research house SuperRatings, the median balanced option went backwards with an estimated return of -0.1 per cent.

Inflation and interest rates continued to spook financial markets both here and overseas. Australian and global share markets reported small declines over the month, with diversification continuing to benefit members in reducing underperformance.

The median growth option fell by an estimated 0.3 per cent, while lower exposure to shares resulted in the median capital stable option delivering a small positive result, with an increase of 0.1 per cent for August.

Source: SuperRatings estimates

Pension returns followed a similar trend over the month, with the median balanced pension option falling an estimated 0.1 per cent. The median growth option is estimated to decline 0.2 per cent in August, while the more defensive median capital stable pension option is estimated to deliver a 0.1 per cent gain.

Source: SuperRatings estimates

Landlords have had enough and are simply getting out

The crisis in the rental market is being caused by a whole range of reasons. It’s complex and there is no silver bullet solution… but so-called “greedy” landlords are being unfairly targeted as the scapegoat.

The reality is many are now saying it’s simply not worth it and are selling up, which just adds to the problem.

The reason rents are going up is a combination of rising interest rates adding to costs of the property, a shortage of new developments coming on stream because of lack of land, delays in getting approvals, banks withdrawing financing and developers going broke. So there are a whole lot of reasons.

Added to this is a lack of commitment from Government at all levels to develop enough affordable low-cost rental housing.

But when it’s all said and done, the supply of rental property depends on investors buying a property and then renting it out. For that to happen the property must result in a return that makes it worthwhile for the investor to choose to put their money in property rather than shares, term deposits or any other alternative.

When it’s not worthwhile, then investors go somewhere else (as is their right to do so) and put their money where there are better returns or less hassle. And then that just adds to the rental property crisis.

And that is what’s happening.

Startling new research shows hundreds of thousands of rental properties have been stripped from rental markets around the country, with investors offloading properties in Victoria and Queensland in particular.

The ninth annual Property Investor Sentiment Survey by peak industry body the Property Investment Professionals of Australia (PIPA) shows a surge in the sale of rental dwellings.

Just over 12.1 per cent of investors sold one or more of their rental properties in the past 12 months. Last year’s survey found 16.7 per cent of investors had sold at least one property in the previous two years.

Using 2021 Census data as the baseline of 2.477 million private rental dwellings in Australia, it is estimated that hundreds of thousands of rental properties were sold in the past three years, with the majority of these bought by existing homeowners or first-home buyers.

Drilling down into this year’s survey data, 24.8 per cent of investors sold one or more properties in Melbourne over the past year, while 23.3 per cent sold in Brisbane. Outside of the capitals, 16.4 per cent sold in regional Queensland and 6.4 per cent sold in regional Victoria.

When asked to rank each state and territory from best to worst in terms of how positively they support property investors (ranked from one to eight, one being the most accommodating and eight being the least), 57.4 per cent scored Victoria an eight and 23.5 per cent scored Queensland a seven.

Property investors cited the following as major reasons for selling over the past year:

- Governments increasing or threatening to increase taxes, duties and levies that make property a less attractive asset to hold (47 per cent).

- Changing tenancy legislation (43 per cent).

- Talk of rental freezes (34.6 per cent).

- Rental increase limits or caps (27.7 per cent).

On top of that, other reasons were rising interest rates and higher loan repayment costs (40.1 per cent), negative cash flow due to higher mortgage costs (23.2 per cent), a need to reduce total borrowings (33.1 per cent) or offloading an underperforming asset (18.8 per cent).

Industrial property and hotels making strong returns

You only need to look at the deep discounts at which listed real estate investment trusts (REITS) are trading, to realise retail and commercial property are simply not performing.

People often say to me that REITS must be a bargain at the moment because so many are trading at a 20-30 per cent discount to the value of their assets. I explain the reason for the discount is that the market expects the managers of the REITS to devalue their properties in the future by that discount.

If the market is wrong then, yes, they could be a bargain. If they’re right, then there is more property pain to come, particularly in the commercial office space, as the shift to work-from-home leads to massive vacancies in existing office towers.

According to real estate giant, Ray White, the growing cost of finance and uncertainty across some investment classes resulted in listing numbers being down and the pool of buyers reduced. However, across the tourism sector, Ray White has seen a strong response to investment activity during the pandemic period, which has continued at an elevated level today.

With both domestic and international travel showing improvements, investment levels in hotel assets across the country has now increased. During 2022/23 volumes reached $4.1billion, a growth of 56.7 per cent on the prior year, highlighting the improved confidence across the tourism industry.

Most investment has been in the Sydney market while Gold Coast has been another key investment market, capitalising on strong occupancy due to both busy conference and holiday periods growing annual average daily room rate to over $270/night.

Private and institutional investors have become the biggest buyers, with foreign investors representing the largest seller group.

Looking ahead, the outlook for the hotel sector is strong. While inflationary pressures have been elevated, reducing discretionary spending levels, Ray White continue to see strong demand for domestic travel. The current low Australian dollar will make Australia cheaper for foreign tourists, improving the demand for accommodation, growing occupancy and returns for this commercial investment class.

It is so important to understand the financial products you’re in

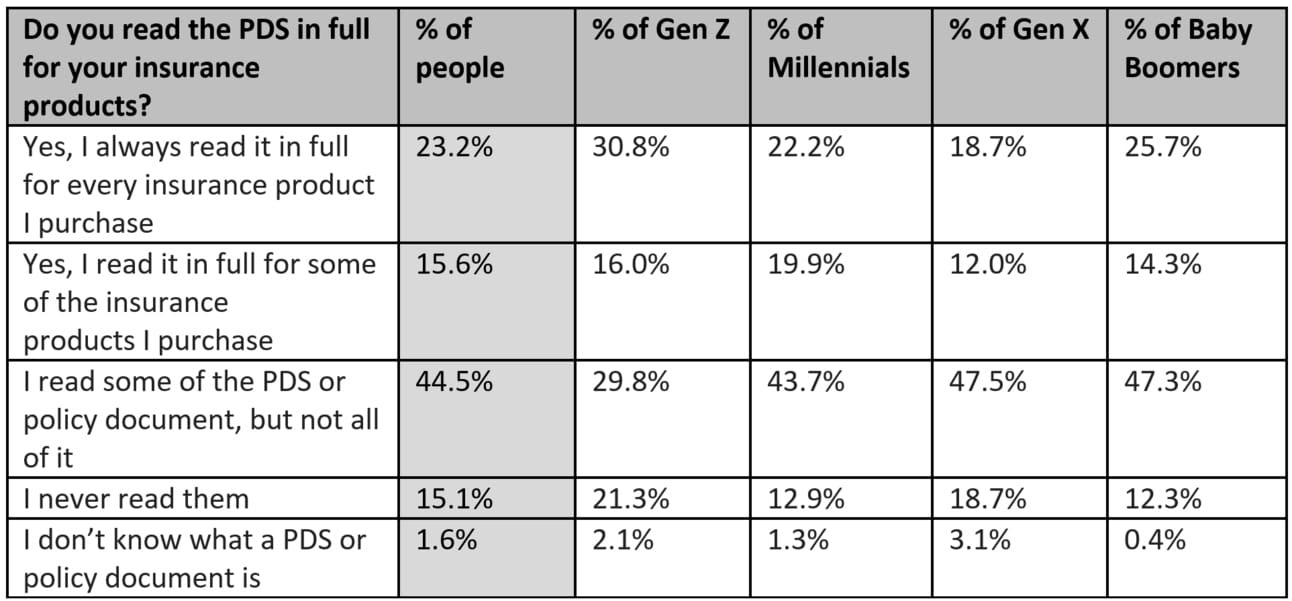

I was absolutely staggered at the latest research from Compare the Market which showed that 15.1 per cent of people never read their product disclaimer statement or insurance policy documents, leaving them unaware of policy exclusions and other conditions.

You wouldn’t sign a contract to purchase a house without looking it over or buy a car without reviewing the documents before you sign away. Yet 15.1 per cent of people don’t read their policy documents when buying insurance to protect their big investments.

Compare the Market’s research found that Gen Z (21.3 per cent) was the generation most likely to never read their Product Disclosure Statements (PDS), followed by Gen X (18.7 per cent). Perhaps even worse, Gen Z and Gen X were the most likely to admit that they didn’t know what an insurance policy document was.

In a surprising twist, despite being the most likely to never read the PDS, the Gen Z cohort also had the most people read their PDS cover to cover for all of their insurance products (30.8 per cent) than any other generation.

If people are already spending money on protecting their homes or cars, it’s worth knowing how and what they’re protected for. By not reading the PDS or policy documents that come with the insurance, they may be missing out on vital information relating to what their policy does or does not cover.

For example, it may surprise people that in most cases, home and contents doesn’t cover damage caused by termites, birds and other vermin, though some insurers may offer this cover as an optional extra and charge a higher premium.

Even if people switch from one insurer to another for relatively the same cover, it’s important for them to read through their new policy documents, as these will also vary between insurers.