Yes, it can! The reason colour affects the cost of car insurance is some colours and paints, like metallic and pearl shades, can be costly for the insurer to replace or repair. They also cost more and affect the value of your vehicle.

That being said, the answer isn’t entirely black and white.

We dig into detail about:

- which factors affect your premium,

- how safe certain car colours are, and

- six of the stranger reasons why prices go up or down!

How does car colour affect your insurance?

There’s a host of factors that can hike up your car insurance premiums. It could be that you drive V8-powered beast, or you’re simply a driver under the age of 25. How much you drive, where you park overnight and your driving record can also all play a part.

If you think that’s a lot to wrap your head around, you’ve only just scratched the surface into what goes into your car insurance premium.

What you might not have expected is that something innocuous like the colour of your car can have an impact on your insurance premiums.

Compare the Market’s Head of Banking Rod Attrill explains, “Some insurers will take the colour of the car into consideration. This is mainly around the type of paint. For example, metallic paint can be more expensive than a standard colour and therefore the car may be more expensive to replace.”

“Essentially, the colour of your car can affect the value of the vehicle, thus changing the premium.”

Beyond paying more for a specific colour or metallic paint job when buying your vehicle from a dealership, the shade of the paint can be more expensive to repaint if scratched or damaged in an incident, and this can increase the price of your insurance.

What is the safest car colour?

Are some car colours safer than others?

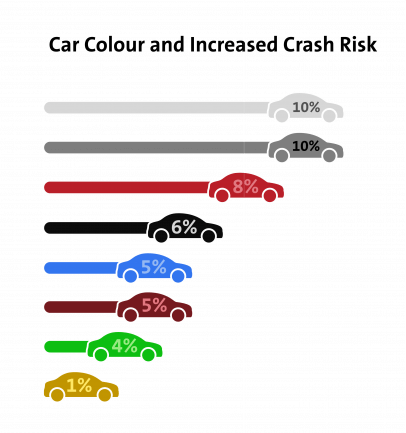

To find out, researchers Stuart Newstead and Angelo D’elia from Monash University pored over the data and produced these results in their paper An Investigation into the Relationship between Vehicle Colour and Crash Risk.

Compared to white cars which, according to the report, are statistically safer in terms of crash risk, the following colours had their overall risk factor measured in percentages.

Source: An Investigation into the Relationship between Vehicle Colour and Crash Risk. Stuart Newstead, Angelo D’Elia, Monash University Accident Research Centre, Monash University. 2007

According to the data, silver and grey cars statistically pose the most risk of a crash overall, based on colour, compared to white cars.

The colour orange, however, was a safer choice than white, though Newstead and D’Elia note that there was more variation in the data for orange than some of the other colours. Additionally, different car colours that also posed less of a risk than white, such as yellow, cream and mauve, only made a small difference that wasn’t deemed significant.[1]

Perhaps unsurprisingly, silver and grey cars are the most likely to be in an accident, possibly because they have less visibility on road.

How much does the colour of your car affect your premiums?

To take a look at just how much more different you could pay on insurance based on car colour, let’s do some good ol’ fashioned comparison.

The table below shows quotes* for the exact same make and model of car; a 2014 automatic Toyota Camry, driven by a 25-year-old male who parks it in the garage. All the details of the car and owner were kept the same – the only difference being colour.

| Colour | Insurer #1 | Insurer #2 | Insurer #3 | Insurer #4 |

| White | $613.43 | $637.97 | $644.10 | $711.86 |

| Silver | $625.34 | $650.35 | $656.61 | $725.65 |

| Red | $625.34 | $650.35 | $656.61 | $725.65 |

| Grey | $637.24 | $662.73 | $669.09 | $739.42 |

| Black | $637.24 | $662.73 | $669.09 | $739.42 |

* Quotes sourced from Compare the Market’s free comparison service on 19 June 2019.

Each of the insurance companies in the table above charged more for silver, red, grey and black compared to white. Depending on which colour the car is you could be paying over $10 or $20 a year more.

Bear in mind, as we have already mentioned, different factors will affect the cost of your car insurance premiums.

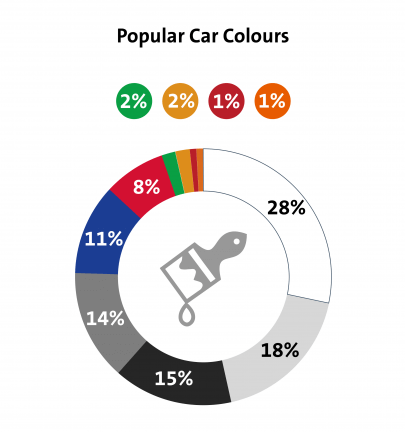

Top 10 popular car colours in Australia

Compared to the data above, what are the most popular car colours – based on those who used our comparison service? In 2018, the top 10 car colours* were:

* Based on car insurance quotes made through Compare the Market in 2018.

While the most popular car colour was white, with over one in four Aussies having chosen it for their set of wheels, the majority of our customer’s other favourite shades were the colours which increase the risk of an accident and cost more to insure.

Other bizarre factors that affect car insurance

So, now you know that the colour of your car does affect your insurance, you might be wondering what else could change the cost of your premiums. You wouldn’t be the only one.

This question came up as part of a Senate Inquiry into the general insurance industry in 2017, where it was revealed a variety of factors can affect the cost of car insurance. Some of these included:

- the colour of the car,

- your marital status,

- when you fill up your fuel tank,

- what groceries you buy,

- when you go shopping, and

- your address[2]

You might think that what you cooked for dinner or when you went shopping shouldn’t matter, but it all provides information which can be matched to data gathered by the insurer to determine the risks involved and how much they will charge for cover.

Will this benefit your finances or hurt them? It could go either way. As noted by the Financial Rights Legal Centre in their submission to the 2017 Senate Inquiry, “The use of granular data may lead to more targeted (and lower) pricing for some consumers, but others will be left underinsured or uninsured.”[3]

There can be trillions[4] of different premiums for car insurance policies based on how much data insurers can gather.

You can influence some of these factors, and doing so can help reduce your car insurance premium, which you can learn about in our handy guide.

Sources:

[1] An Investigation into the Relationship between Vehicle Colour and Crash Risk. Stuart Newstead, Angelo D’Elia, Monash University Accident Research Centre, Monash University. 2007

[2] Inquiry into Australia’s General Insurance Industry: Submission to the Senate Standing Committees on Economics. CHOICE, Parliament of Australia, Australian Government. 2017.

[3] Submission by the Financial Rights Legal Centre. Financial Rights Legal Centre, Parliament of Australia, Australian Government. 2017.

[4] Senate Economics References Committee: Inquiry into Australia’s General Insurance Industry. Allianz Australia Insurance Limited, Parliament of Australia, Australian Government. Page 14. 2017.