Australians are much more satisfied with their healthcare system overall compared to Americans, new data shows.

Research by Compare the Market in Australia and the United States of America found the Land Down Under was much more likely to have a favourable view of their country’s healthcare, with affordability the biggest factor in determining favourability.

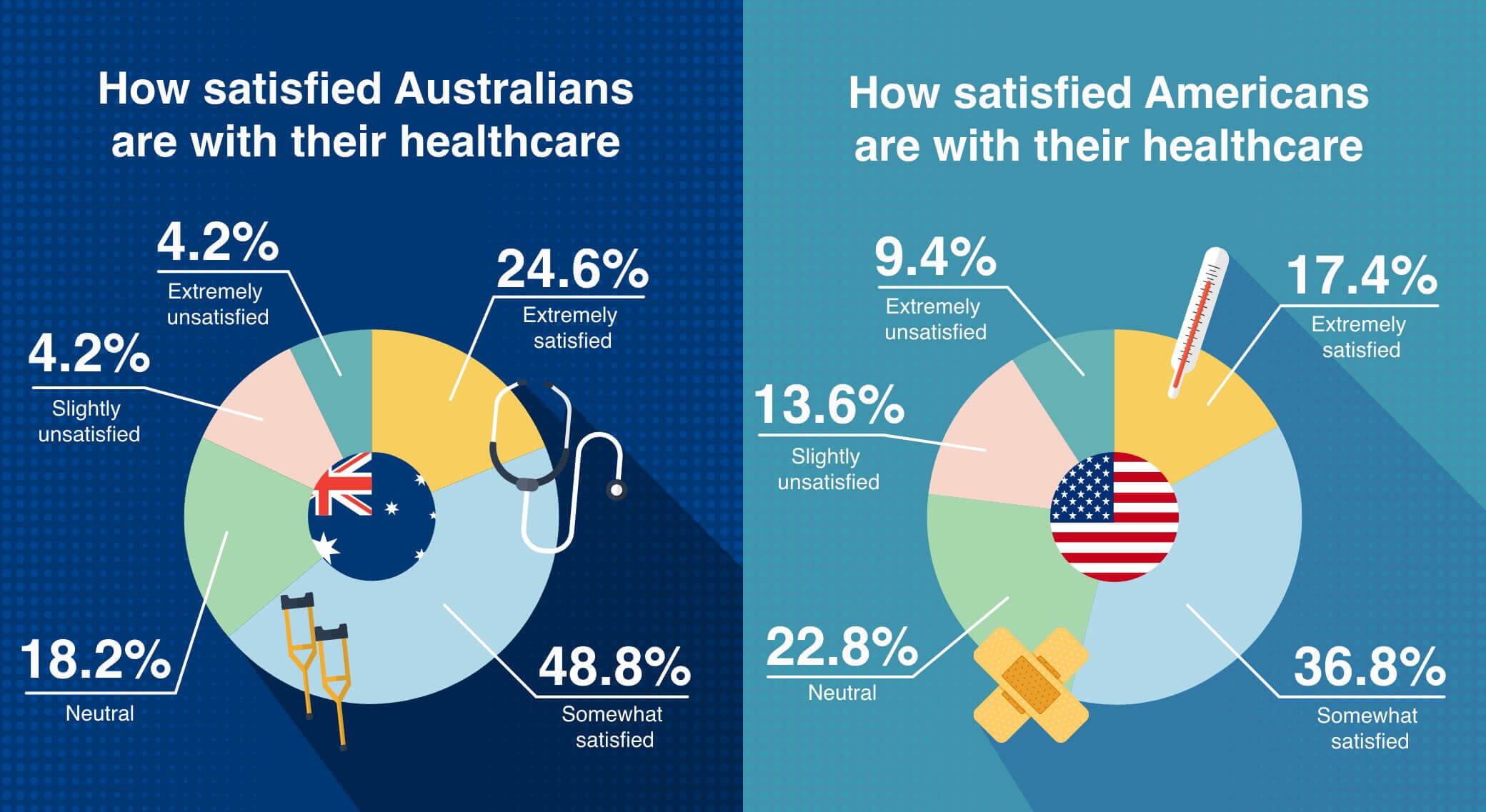

More than two-thirds (73.4%) of Australians reported being satisfied with their healthcare, while only a slight majority (54.2%) of Americans said the same.

The United States had more than twice the rate of respondents that were extremely unsatisfied with their healthcare systems (9.4%) compared to that of Australians (4.2%), and this was mostly down to the affordability of care.

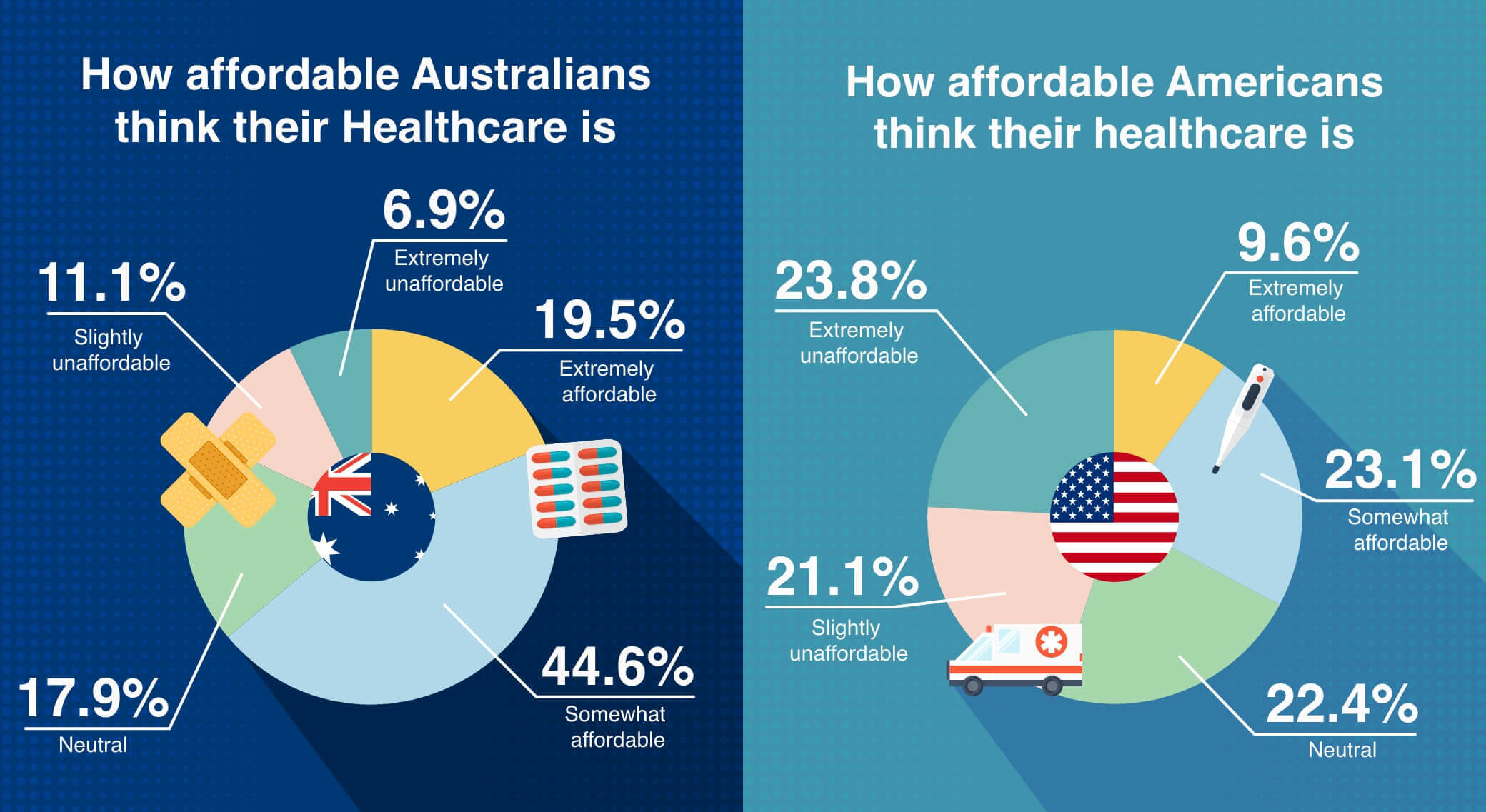

As many as 64% of Aussies found their healthcare affordable, and only 18% found it to be unaffordable.

Comparatively, a mere 33% of Americans found their healthcare to be affordable – a major 31% difference – and the portion of ‘unaffordable’ responses was more than two times greater in the States (44.8%).

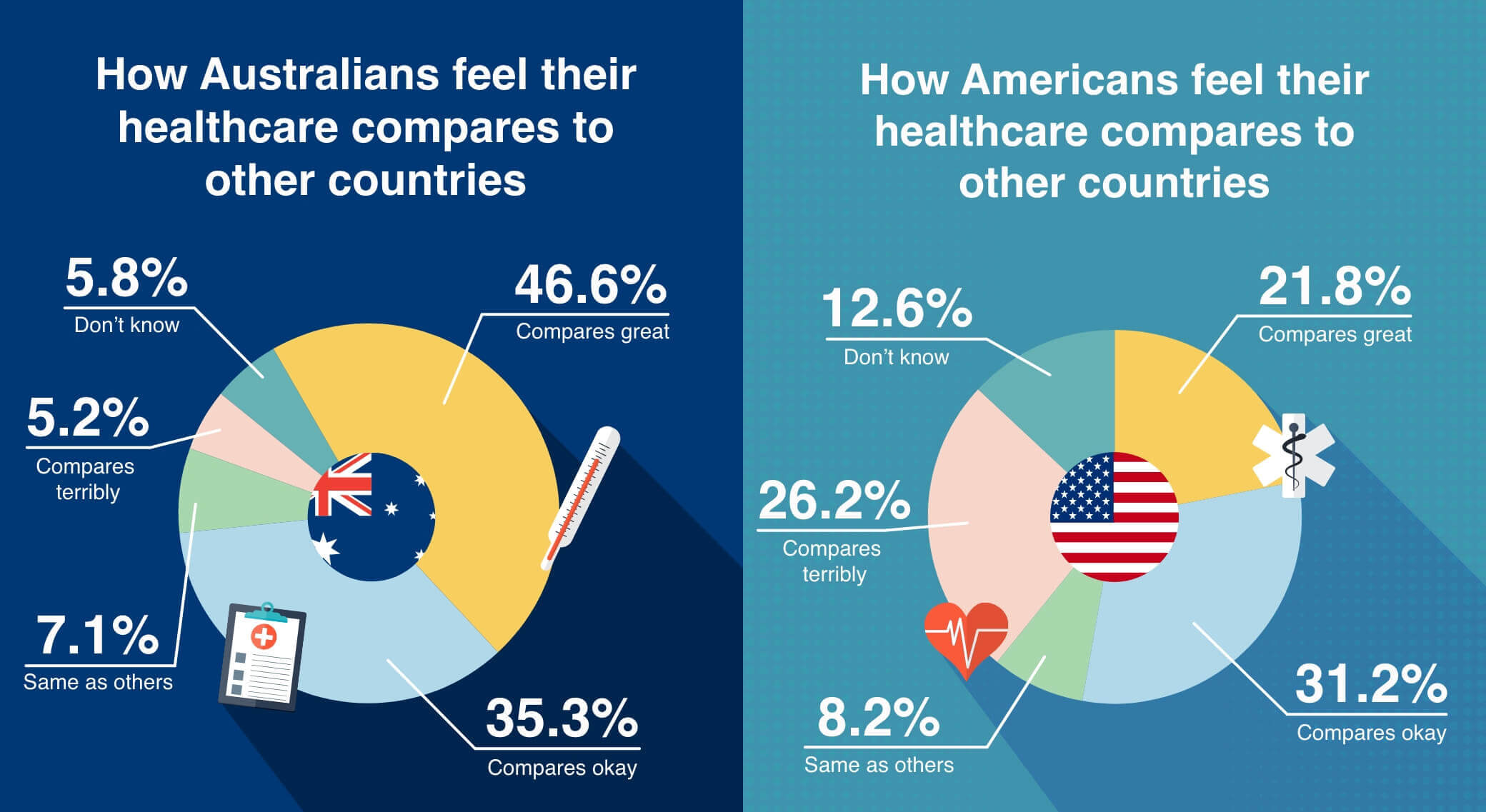

OECD data shows the United States spends roughly twice as much as Australia on healthcare as a percentage of GDP, and Compare the Market’s health insurance expert Anthony Fleming said these results demonstrate the strengths of Australia’s healthcare network.

“Australia’s combination of public and private health coverage makes it one of the very best systems in the world,” Mr Fleming said.

“The health system in the United States is more complex and can be much more expensive, often leaving many without the right level of cover or no cover at all.

“While the cost of a policy here will depend on a range of factors, it’s generally very affordable compared to other countries, and the rate of premium increases is shrinking every year.

“For example, depending on the level of cover, loadings and rebates, a combined hospital and extras health insurance plan for families could cost a few hundred dollars a month, and around a hundred dollars a month for a single person with no dependents.

“And for those who can’t afford private cover or need emergency treatment, Australia’s public system is an excellent safety net to complement private health insurance.”

Room for improvement still remains in Australian healthcare

Despite its overall high performance, Australia’s health system still isn’t perfect: the research finding 44% of Aussies had still delayed getting the treatment they needed at some point, almost on par with the United States (49%).

Besides cost, the reasons for delaying their healthcare needs were long wait times (19%), not getting time off work (11.5%), not trusting medical professionals (7.7%) and not having access to adequate healthcare (5%).

However, Australia scored better for each of these factors compared to America with the exception of long waits, with just 13.2% of Americans complaining about wait times.

Waiting periods on private health insurance in Australia generally range from two to twelve months depending on the benefit, but according to Mr Fleming, taking out the right policy early can help you avoid these waiting periods when you need treatment.

“In the public system, while emergency care will usually get you in front of a doctor right away, it can take a little longer for elective surgeries,” he said.

“The median wait time for public patients for non-essential surgeries in Queensland, for example, can range from as little as 16 to as long as 244 days. It can be a bit of a gamble.

“But with private health cover, you’ll know exactly how long you’ll need to wait, and you can drastically cut down on these wait times and have a greater selection of doctors to choose from if you plan ahead, giving you more flexibility and peace of mind.

“Finding the right policy could be the difference between getting the treatment you need right away and having to wait for months, and if you’ve already served your waiting periods, you don’t have to serve them again on a new policy unless you switch to a higher level of cover.

“To be prepared, consider your future health needs today based on your own circumstances, and take the time to compare private health insurance policies now based on their level of cover, the monthly premiums, discounts on offer and more.”

For more information, please contact:

William Jolly | 0405 968 369 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, travel and personal finance products from a range of providers. Our easy-to-use comparison tool enables consumers to find products that best suit their needs and back pocket.