The average Australian kid is getting $26 per week* in pocket money but Compare the Market Economic Director David Koch said parents could turn this into $50,000 by the time they turn 21 with one simple trick.

A survey of 1,010 Australians in March 2024 found the average Aussie child had a weekly allowance of $26 a week – roughly $1352 a year.

Mr Koch said that assuming you start as soon as the child is born, putting that money into a savings account with an interest rate of 5.5% could see their savings grow by $50,000 by the time they turn 21.

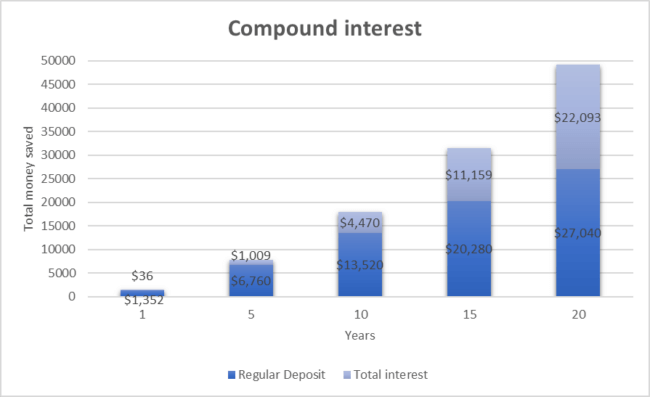

Compare the Market crunched numbers, and after 10 years, would have $13,520 in regular deposits and $4,470 in interest but this money accumulates and grows exponentially.

In 20 years, you could have $28,392 in regular deposits and $24,900 in interest.

“The cost of living crisis has opened our eyes to the importance of early education in financial literacy,” Mr Koch said.

Pocket money is a great way to teach kids about the importance of saving up for their future and demonstrating the impact of compound interest can be a great incentive.

Figures in the graph were found via the government’s money smart calculator.

“I like to think of compound interest as free money because it’s when the interest you earn on savings begins to earn interest on itself,” Mr Koch said.

“Whereas if you put $26 per week into a piggy bank – it’s not going to compound and accumulate interest; it’s going to be devalued.

Kochie’s top tips for parents teaching kids about money

- Educate them on the difference between want and need. Sometimes it can be hard to differentiate between what people need, such as healthy food or sensible shoes, or want, such as snacks at the movies and a pair of fancy shoes.

- Teach them how to budget.Once they have an allowance or a job that is coming in regularly, sit down with them and help them budget that amount. A simple budget that they can get started is a version of the 50/40/10 budget rule, where they save 50% of their income, spend 40% on necessities and spend 10% on things they want. With our kids we had a rule where 50% of pocket money had to be saved for a particular goal (savings for savings sake is pretty boring), 40 per cent could be spent and 10 per cent had to be donated to a charity of their choice (which we usually matched dollar for dollar) to make them aware of all our responsibility to community.

- Don’t be hard on them when they make mistakes. Everything is an opportunity to learn and grow. The only thing you need to make sure is that they know where they went wrong and find ways to make sure it doesn’t happen repeatedly.

*A Compare the Market survey of 1010 adult Australians was conducted in March 2024.

For more information, please contact:

Natasha Innes | 0416 705 514 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, travel and personal finance products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.