You’ve taken it for a test drive, saved a deposit, and decided on colour. But do you know how much your new car will cost to insure?

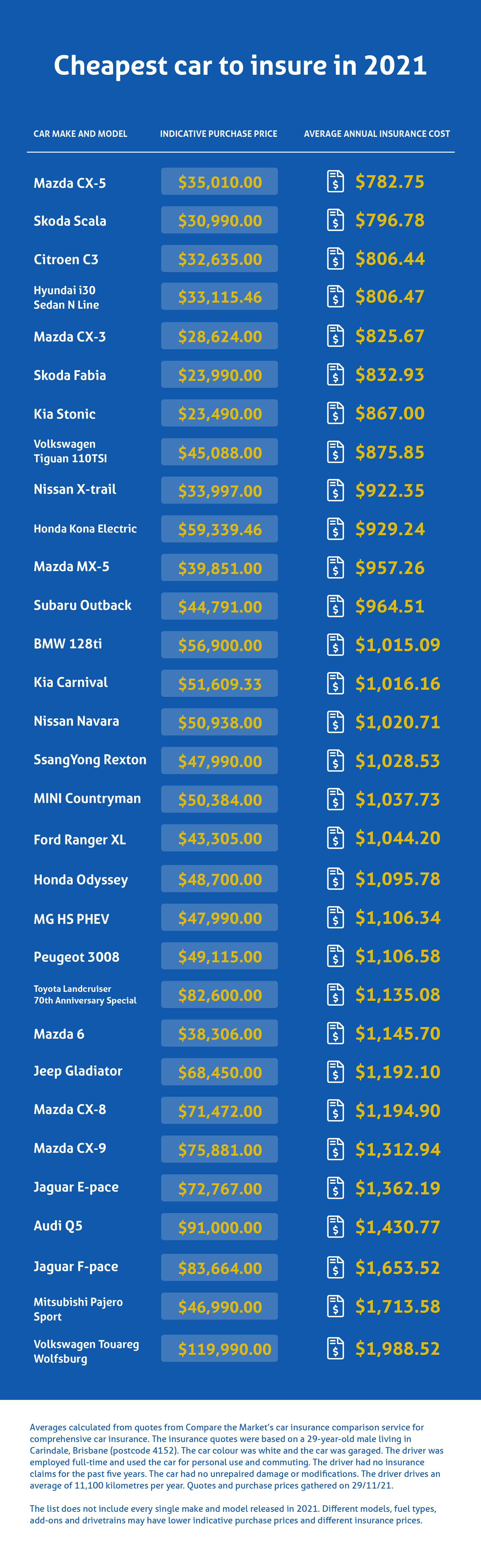

New analysis by Compare the Market has uncovered the cheapest cars to insure from 2021, revealing a difference of hundreds between the lowest and most expensive premiums.

The comparator generated quotes for 32 car models released during the past year to determine which received the lowest premium, regardless of other impacting factors like driver age and gender.

The Mazda CX-5 came out on top as the cheapest model to insure with an average annual premium of $782.75.

The findings show the cheapest cars to buy are not always the cheapest to insure. Priced at $35,010, the 2021 CX-5 was more expensive than seven other models at the point of purchase.

So what makes a car cheaper to insure?

Compare the Market’s General Manager of General Insurance Stephen Zeller notes that there are a several factors that can make one car cheaper to insure than another – assuming factors related to the driver remain the same.

“While the market value of the car is one of the determining factors, insurance companies also factor in the ease of repairs, safety ratings, the availability of parts and their familiarity with a make and model based on data for previous editions,” Mr Zeller said.

“The popularity of your car’s make and model can have a big impact as well. If there were a big run on a new specific model, it would be easier to replace if your car was badly damaged or written off.

“Mazda is a highly popular brand, with numerous models selling well in the last few decades. Insurance companies are very familiar with Mazda’s like the CX-5, plus it’s very easy to get parts and servicing should they need repairs.”

“Typically, new models come with higher premiums unless insurers have a good sample of data about their performance. Even though the 2021 version of the CX-5 is brand new, insurance companies have a lot of data on the previous models and other Mazda’s,” said Mr Zeller. Mr Zeller explains that the driver is an equally important consideration when it comes to car insurance. Information about the primary driver could also be considered more important than the car itself when it comes to influencing car insurance premiums.

“There is a huge variety of factors related to the driver that can impact the cost of car insurance. These factors include, the driver’s age, gender, driving history, the age they received their licence, the address the car is kept overnight, whether it’s parked in a garage or not. All of this can make a big difference to your car premium.”

Notes to editor:

The insurance quotes were based on a 29-year-old male living in Carindale, Brisbane (postcode 4152). The car colour was white and the car was garaged. The driver was employed full-time and used the car for personal use and commuting. The driver had no insurance claims for the past five years. The car had no unrepaired damage or modifications. The driver drives an average of 11,100 kilometres per year. Quotes and purchase prices gathered on 29/11/21.

The list does not include every single make and model released in 2021. Different models, fuel types, add-ons and drivetrains may have lower indicative purchase prices and different insurance prices.