More than three-in-four Australians plan to pass on property to their children, according to Compare the Market’s latest Household Budget Barometer report.

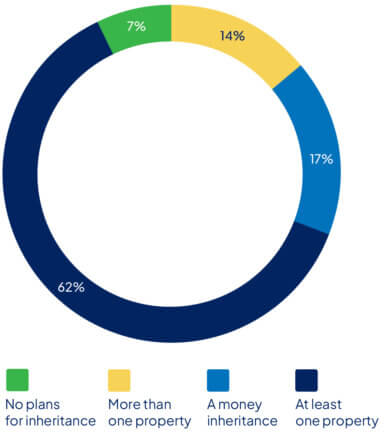

The consumer comparison experts’ annual economic report revealed 62% of Australians surveyed who said they had children plan to transfer on at least one property to their children, while a further 14% said they will transfer more than one property when they pass away.

Almost one-in-five (17%) intend to pass on inheritance money to their offspring, with a median amount of $250,000.

The report also found 42% of Australians surveyed have created a will.

However, further research from Compare the Market shows intergenerational help has gone beyond money alone in 2025.

Around 93% of Australian parents and grandparents say they have supported their adult children in some way – a 20% increase from last year – from cooking meals, purchasing clothes, toys and essentials, and providing free childcare.

Source: 2025 Household Budget Barometer Report | Compare the Market

Compare the Market’s Economic Director David Koch said the findings signalled issues with Australia’s broader economic climate.

“As some lucky young Australians benefit from the passing intergenerational wealth, we are seeing the socioeconomic gap widen between the haves and have nots,” Mr Koch said.

“While the government has chipped in with energy and childcare rebates, the most meaningful support has come from individuals supporting their families.

“Baby Boomers are often blamed for fuelling inflation – yet are a key helping hand for younger generations to get ahead in life, from being able to get in the property market, to having more savings in the bank.

“Even looking after the kids a day here and there could save thousands in childcare fees per year for families, while saving time in the process.

“But it shouldn’t be up to everyday Aussies to carry such a heavy load alone. We need stronger action from governments and regulators to step in and hold companies to account when price hikes go too far.

“This isn’t a fight we can afford to lose.”

When referencing the report, please attribute: https://www.comparethemarket.com.au/home-loans/features/household-budget-barometer-report-2025/

Compare the Market commissioned PureProfile to survey a nationally representative sample of 3,006 Australians in August 2025, as part of the 2025 Household Budget Barometer report.

-END-

For more information, please contact:

Henry Man | [email protected] | +61 474 368 908

About comparethemarket.com.au

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.