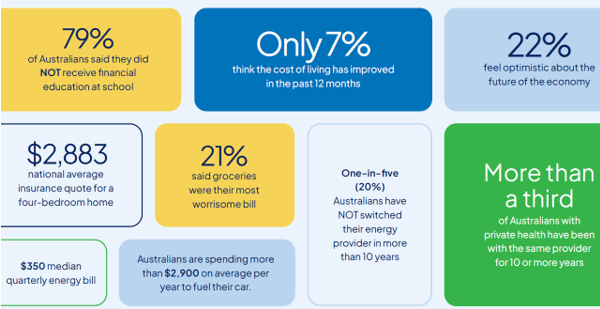

Just 7% of Australians believe the cost-of-living crisis has improved over the past year, despite months of financial resilience and government support, according to Compare the Market’s 2025 Household Budget Barometer.

Adding to the gloomy outlook, just 22% felt optimistic about the future of the economy, despite progress on wrangling inflation and a lower cash rate.

While budget pressures persist, the nationally representative report reveals that Australians are actively countering rising costs by seeking out greater savings.

Analysis found that nearly three-quarters of Australians surveyed (73%) had shopped around for a better deal in the past 12 months.

Household Budget Barometer report highlights

Year-on-year, there’s been a 2% increase in people searching for cheaper car insurance (up to 47% in 2025), a 4% jump in people comparing their home and contents cover (up to 32%) and 4% more people switching and saving on their electricity plans (up to 34%).

Meanwhile, the report boasts other insights around financial pressures, including:

- Average insurance premiums in Australia’s five largest capitals surging in the 12 months to September 2025, with the cost of covering a four-bedroom home up nearly 23%, and a typical car up almost 18%.

- Credit card debt among survey respondents increasing by 9% year on year and Buy Now, Pay Later use jumping 8%.

- The median quarterly electricity bill remaining steady at $350 ($1,400 per year) in 2025 – equal to median spend in 2024.

- One in five Australians surveyed (21%) rating groceries as their most worrisome household bill, with the average Aussie spending $10,304.32 on groceries annually.

Compare the Market’s Economic Director, David Koch, said comparing, switching and shopping smarter have become the ultimate tools in helping Australians navigate a tricky few years of financial strain.

“Prices aren’t coming down – we’re just getting better at looking for value,” Mr Koch said.

“Australians are comparing more than ever – whether it’s car insurance, electricity plans or grocery items. But that doesn’t mean life is getting easier.”

The report findings highlighted the important role of intergenerational support; from grandparents helping their adult children and young people providing a life raft for their ageing counterparts.

“While the government has chipped in with energy and childcare rebates, the most meaningful support has come from individuals supporting their families,” Koch said.

“Tough times bring out the best in our communities, but it shouldn’t be up to everyday Aussies to carry such a heavy load alone.

“We need stronger action from governments and regulators to step in and hold companies to account when price hikes go too far.

“In the meantime, we’ll keep empowering Aussies to push against high prices – by shopping around and switching where savings are available.”

Compare the Market’s Household Budget Barometer is an annual pulse check on how people are coping with the cost of living.

Compare the Market monitors spending trends, tracks insurance quote prices, and drills into personal goals and habits to understand the biggest pressures on household budgets.

More than 3,000 Australian adults from all walks of life participated in the 2025 survey.

When referencing the research, please link to the report here.

For information, interviews, or to line up photos with our case studies contact:

Phillip Portman | 0437 384 471 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.

For further insights, stats and analysis, view the report in full here. Compare the Market can also break down data at a state level, by generation, household size and gender.