The Black Friday and Christmas shopping wave is upon us – but Australians continue to grow their money debt in credit cards, according to Compare the Market’s 2025 Household Budget Barometer report.

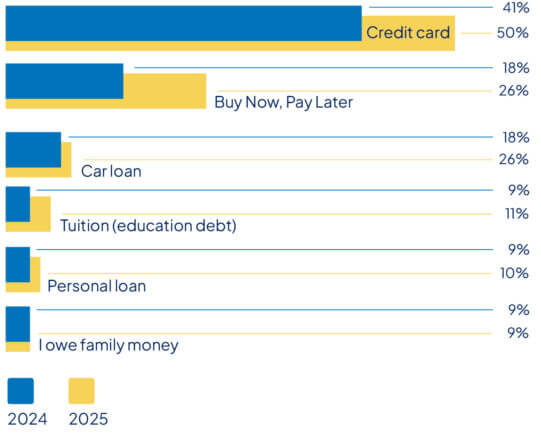

Despite the rise in Buy Now, Pay Later schemes, half of Australians surveyed (50%) said they have credit card debt in 2025 – a 9% increase compared to last year. Generation X were most likely to carry credit card debt (31%).

Meanwhile, more than a quarter of Australians (26%) had Buy Now, Pay Later debt – representing an 8% increase versus 2024. Millennials were the most likely to use Buy Now, Pay Later schemes (40%)

Car loans (13%), personal loans (10%) and education debt (11%) also saw minor increases this year.

Source: 2025 Household Budget Barometer Report | Compare the Market

Compare the Market’s Economic Director David Koch said these findings indicated that Australians were combatting high cost-of-living by increasing their personal debt.

“When the bills and everyday life expenses continue to pile up, Australians are unfortunately resorting to credit cards, Buy Now, Pay Later, and personal loans in order to fulfill their lifestyles,” Mr Koch said.

“Whether it’s shopping for Christmas presents or trying to pay high medical bills, money is tight for many. People can’t afford to wait and save up; they need the money now.

“Only 7% of Australians surveyed think the cost-of-living has improved in the past year, as part of Compare the Market’s Household Budget Barometer report.

“But building up money debt is an unhealthy habit. It’s important to be honest with your finances and not overreach more than necessary. This is why financial education is so important and the federal government should make it compulsory in the school curriculum.”

@comparethemarketauDoes your credit card get a workout? For 50% of Aussies, credit cards are reported to be their biggest form of debt. We want to empower Australians to make better decisions Comparing through us will always be free of charge and we don’t play favourites with the brands we compare. We let you compare great options from a range of trusted brands. It pays to compare Compare quotes in minutes and start saving today. Simple to use Get started by answering a few quick questions to help us understand your needs. Compare & save Save time and money by easily comparing quotes from a range of providers side-by-side. Switching is easy Follow a few easy steps online to switch to a new deal that suits you and your budget. Compare Today! #SmartChoices #savings #Budget #PersonalFinance♬ original sound – ComparethemarketAU

When referencing the report, please attribute: https://www.comparethemarket.com.au/home-loans/features/household-budget-barometer-report-2025/

Compare the Market commissioned PureProfile to survey a nationally representative sample of 3,006 Australians in August 2025, as part of the 2025 Household Budget Barometer report.

-END-

For more information, please contact:

Henry Man | [email protected] | +61 474 368 908

About comparethemarket.com.au

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.