While Australia has already been battered by storms, cyclones and flooding in 2024, alarming new research from Compare the Market reveals that more than a quarter of Aussies don’t have home or contents insurance for where they reside.

In fact, new survey data reveals that 26.5% of Aussies surveyed say they have no home and/or contents insurance – a move that could leave them significantly out of pocket in the event of natural disasters, thefts and other events that cause damage to property or belongings.*

Home and contents insurance is intended to help pay for damages and incidents that impact your home or belongings from any listed or defined events such as fire, theft or storm damage. You can claim through your home and contents insurance provider, who can help pay for repairs, replacements and potentially even rebuild the home.

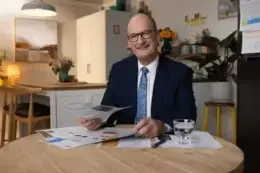

However, as Aussie households continue to battle the cost-of-living crisis, they’ve also been hit with higher premiums. According to Compare the Market’s Executive General Manager for General Insurance, Adrian Taylor, having no cover at all for your property or belongings isn’t a good idea.

“We’re not even far into 2024 and hundreds of thousands of Australians have already been impacted by torrential storms, damaging hail, flooding and cyclones,” Mr Taylor said. “While it may be tempting to cancel your cover altogether or reduce the amount of coverage for your home and belongings, the risk of natural disasters, theft and damage remains. There may be ways to save elsewhere so you can maintain cover for your home.

“For example, if you’ve been with the same electricity or gas retailer for more than a year, chances are you’ve been moved onto a more expensive plan and may be able to claw back cash by comparing and switching retailers and plans. Similarly, whenever you receive an insurance renewal letter, never just auto-renew. Put all your bills under the microscope and see if there are other ways to save. These savings could go towards your household insurance.”

According to Compare the Market’s data, those in New South Wales are most likely to not have home and/or contents insurance (33.1%) at their primary place of residence. In contrast, South Australians are most likely to have cover for their home (14.7%), followed by Victoria (24.3%) and Queensland (24.9%).

Meanwhile, Gen Zers are the least likely to have home and/or contents insurance 41.5%, while at the other end of the scale, Baby Boomers and Millennials are the most likely to have coverage (85.1% and 71.5%, respectively).

“The reality is that younger generations may have only just moved out of home and may not be aware of the risks that could leave them significantly out of pocket,” Mr Taylor said. “If you are moving out of home or to a new area, it’s vital that you do your research.

“Have an understanding of the crime rates in your area or the biggest natural disaster risks. If you wouldn’t be able to rebuild your home entirely out of your own pocket or replace your belongings if the worst were to happen, you may want to consider home and/or contents insurance.”

Homeowners typically need to consider both home and contents insurance, while renters only need to consider contents insurance for their belongings.

| What home insurance typically covers | What contents insurance typically covers |

| Home Garage Fences Solar panels Walls Carpets | Furniture Clothing Household items Electronics Appliances Toys |

Guide only. Exact coverage can differ between policies and insurance providers, while limits and additional exclusions may apply. Check the insurer’s PDS for full list of inclusions and exclusions.

Compare the Market’s data shows that the average Australian household with home and contents pays $1,741.30 a year. However, the amount you pay can be impacted by a variety of factors, including:

- Whether you live in a flood-prone area or not

- Crime rates in your area

- The sum insured

- If you’ve made previous claims

- Your excess amount

- Any optional extras on your policy.

“Unfortunately, even if you haven’t claimed on your home and contents policy in the last 12 months, it’s highly likely that you’ll be hit with higher premiums in 2024,” Mr Taylor said. “We’re continuing to experience these wild weather events, while the building industry has seen the cost skyrocket for materials and labour to repair or build homes. Similarly, inflation means the goods in our home will also cost more to replace. Unfortunately for everyday Aussies, this does come at the cost of higher premiums.”

Mr Taylor’s top tips for lowering your insurance premium.

- Never accept an auto-renewal. When your next renewal notice comes through, ensure that you compare it against others on the market. Pay close attention to the sum insured, excess and any optional cover you may have and always ensure you’re comparing apples for apples. You can also assess any optional cover that you may have on your policy that you no longer need. Removing these could help you realise even more savings.

- Opt for a different excess to lower premiums. By increasing your excess (the amount you’d pay if you need to make a claim), you can lower your premiums. However, always look at whether you’re setting an excess that you’d be able to pay in the event of a claim.

*Survey of 1,005 Australian adults. Conducted in January, 2024.

For more information, please contact:

Phillip Portman | 0437 384 471 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.