Home / Compare Health Insurance / How much does private he…

How much does private health insurance cost?

For a more detailed rundown of your health insurance costs, talk to one of our health insurance experts today.

- Australian owned and operated call centre

- Speak to an expert right away

- A quick call could save weeks of research

What are the different tiers of hospital cover?

This table illustrates the differences between Basic, Bronze, Silver and Gold tier hospital cover. While health funds are legally required to meet the minimum requirements for each tier, they can add additional clinical categories as part of a Plus policy (e.g. Silver Plus). The below information is only a guide and you should always check your policy documentation.

Basic

Basic is the lowest tier of hospital cover and offers 3 clinical categories on a restricted basis.

- Includes 3 restricted clinical categories in total

- Can be useful for tax purposes such as avoiding the Medicare Levy Surcharge

- Plus options available

Bronze

Bronze is the second lowest tier of hospital cover and includes 21 of the 38 clinical categories.

- Includes 3 restricted clinical categories

- Includes 18 unrestricted clinical categories

- Bronze plus policies include additional clinical categories

Silver

Silver tier policies include all the clinical categories included in Bronze policies, plus an additional 8 unrestricted categories.

- Include 3 restricted clinical categories

- Includes 26 unrestricted clinical categories

- Silver Plus policies include additional clinical categories

Gold

Gold tier policies are the highest level of hospital cover available and provide comprehensive cover.

- Cover for all 38 clinical categories

- Unrestricted cover for all categories

- Includes pregnancy and birth cover

- Includes joint replacement

Basic

Basic is the lowest tier of hospital cover and offers 3 clinical categories on a restricted basis. Often suitable for:

- Those looking to avoid LHC loading and MLS

Bronze

Bronze is the second lowest tier of hospital cover and includes 21 of the 38 clinical categories. Often suitable for:

- Young, healthy people

- Adults not planning a family soon

Silver

Silver tier policies include all the clinical categories included in Bronze policies, plus an additional 8 unrestricted categories. Often suitable for:

- Dental or podiatric surgery

- Hearing device implants

- Those with heart and vascular issues

- Those looking for a mid-range health cover

Gold

Gold tier policies are the highest level of hospital cover available and provide comprehensive cover. Often suitable for those:

- Needing extensive medical care

- Planning to start a family

- Needing joint replacements

A guide to the cost of private health insurance

Updated 2 April, 2024

Key takeaways

Many Australians seem to overestimate the true cost of private health insurance, and you could be too. We’ll take you through the average cost of private health insurance cover, and help you understand some of the costs associated with the private health system. Here are some key things to remember about the cost of health insurance:

- The total cost of your health insurance will depend on several factors like where you live, your level of cover and your chosen health insurance provider.

- Each year, Australian health funds submit their annual premium adjustments to the Department of Health for approval.

- The figures on this page don’t represent your total private healthcare costs. You’ll likely still have some out-of-pocket costs when you’re treated privately.

Is private health insurance worth it?

Whether or not a health insurance policy will suit you depends on your circumstances, lifestyle and priorities. Here are some of the common benefits of private health insurance that motivate people to take out cover:

- You may be able to choose your own doctor and surgery dates (on availability).

- You could receive treatment and recover in your own private room (on availability).

- You can avoid long public hospital waiting lists.

- With an extras policy, you can claim for a range of health care services that Medicare doesn’t fully cover (e.g. physiotherapy, dental, chiropractic).

Despite Australia having a strong public health system, a recent Compare the Market survey has shown that 12% of Australians have gone into debt due to medical expenses. This may be because of treatment costs for themselves or loved ones.1 Unexpected medical costs are a pet peeve for many Aussies, with 16.4% saying this is a source of dread for them.2 In fact, 14.7% of Aussies surveyed admit that they don’t seek professional help for medical issue due to the fear of the cost.3

Having private health cover can help prepare you for future medical expenses and provide peace of mind that you’ll have cover when you need it.

Expert tips for saving on your health insurance premiums

Our health insurance expert, Steven Spicer, has some tips on how to save money on your health insurance premiums without compromising on essential cover.

Couples cover may not be the best option for your needs

If you and your partner have substantially different health needs, consider taking out two singles policies, as this could save you money. While couples’ cover could be more convenient as you only have to maintain one policy and payment, the cost is equivalent to two individual policies and you’ll both be covered for the same medical services, meaning one of you may miss out on necessary cover.

Consider a ‘Plus’ tiered policy

Private health insurers aren’t required to stick to only the minimum hospital policy inclusions. They can also offer additional coverage through ‘plus’ products. This means you could find a policy that suits your healthcare needs without needing to pay higher premiums for health services you don’t need on the next tier.

Get hospital cover before 31

If you’re over the age of 30 and don’t have hospital cover, it might be time to think about the Lifetime Health Cover loading, which increases your premium by 2% for every year over the age of 30 you don’t have private health insurance after 1 July following your 31st birthday. Depending on your age, you can either stop it from increasing or avoid it altogether by taking out cover.

How much does private health insurance cost?

The exact cost of your health insurance will depend on whether you take out hospital, extras or combined cover, as well as several other factors such as your health fund, level of cover, who’s covered, your excess, any loadings, rebates or discounts and more.

We’ve gone through hundreds of policies from every registered Australian insurer to provide you with an overview of the average cost of health insurance in Australia per state.2 Both hospital and extras cover include policies with an ambulance cover component.

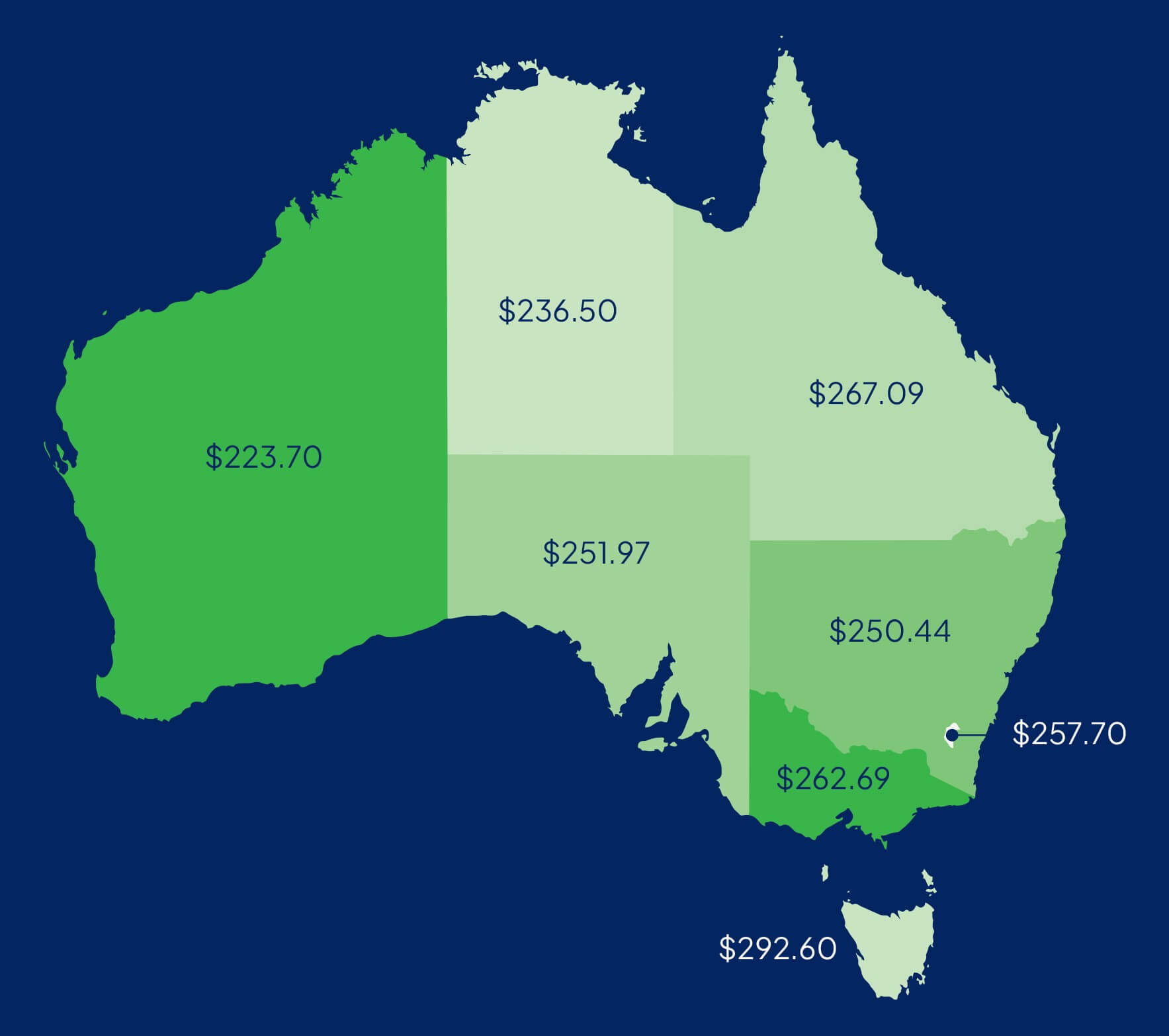

According to those surveyed for Compare the Market’s Household Budget Barometer, Australians spend on average $255.67 per month on health insurance.4 This average includes hospital policies, extras policies and combined hospital and extras policies.

On the below map, we can see the average monthly amount spent on health insurance by state.

Average cost of hospital insurance

| Tier | National | VIC | QLD | NSW | TAS | WA | NT | SA |

|---|---|---|---|---|---|---|---|---|

| Overall | $164.48 | $187.72 | $183.59 | $173.82 | $177.55 | $147.92 | $112.59 | $169.28 |

| Basic | $102.69 | $114.80 | $114.58 | $111.26 | $113.83 | $90.04 | $65.55 | $109.39 |

| Bronze | $122.86 | $138.73 | $136.41 | $127.61 | $135.06 | $107.39 | $84.84 | $130.28 |

| Silver | $186.06 | $211.44 | $206.00 | $194.92 | $201.36 | $168.63 | $129.69 | $191.39 |

| Gold | $272.45 | $320.78 | $310.36 | $293.11 | $283.03 | $250.93 | $185.56 | $268.22 |

| Source: Privatehealth.gov.au, current as of February 2024. | ||||||||

These figures are based on the monthly premium for single-only hospital policies with an excess of $750 that exempts you from the Medicare Levy Surcharge (MLS). They don’t include rebates, discounts or loadings. ‘Plus’ tiered policies have been included within the four main tiers (e.g. Bronze Plus policies are included in the Bronze tier, and Silver Plus policies are included in Silver). For more information on how ‘Plus’ policies work, refer to our guide to health insurance tiers.

Average cost of extras cover

| National | VIC | QLD | NSW | TAS | WA | NT | SA |

|---|---|---|---|---|---|---|---|

| $73.42 | $76.03 | $75.44 | $77.59 | $70.43 | $72.73 | $66.56 | $75.80 |

| Source: Privatehealth.gov.au, current as of February 2024. | |||||||

These figures are based on the monthly premium for single-only policies and don’t account for different dollar and percentage limits or the services provided.

Unlike private hospital cover, which is divided into tiers based on the hospital treatments covered, extras insurance policies vary in the general treatments covered (e.g. physio or dental) and how much they will pay toward them.

How health insurance premiums works

What affects your health insurance premiums?

Unlike many other insurance products, health insurance is community-rated. This means your age, gender, health status and other risk factors do not influence the base premium you pay.

However, several other factors can influence the amount you’ll pay for your health insurance cover, such as:

- Your excess

- Where you live

- The level of cover you choose

- The private health insurance rebate

- The age-based discount

- Lifetime Health Cover (LHC) loading.

Read more about what influences the cost of health insurance.

When do health insurance premiums increase?

Traditionally, every year on 1 April, many insurers increase their private health insurance premiums. In recent years, many health funds have deferred these increases to give COVID-19 savings back to members. These private health insurance premium increases adjust for:

- Increased health care costs (i.e. hospital and doctor’s fees)

- An increase in claims made

- More complex and expensive medical equipment

- Higher costs for complex medical treatments.

Before increasing their premiums, insurers must seek approval from the Australian Department of Health to ensure any cost changes are necessary, reasonable and fair.

As shown below, whether it occurs on April 1 or has been delayed, rates do historically increase each year.6 Keep in mind, these are average rates and individual premiums may have risen more or less than these amounts.

|

Health insurance industry average rate increase by year6 |

|

|---|---|

|

Year |

Average rate rise |

| 2025 | 3.73% |

| 2024 | 3.03% |

| 2023 (delayed) | 2.9% |

| 2022 (delayed) | 2.7% |

| 2021 (delayed) | 2.74% |

| 2020 (delayed) | 2.92% |

| 2019 | 3.25% |

| 2018 | 3.95% |

| 2017 | 4.84% |

| 2016 | 5.59% |

| 2015 | 6.18% |

| 2014 | 6.2% |

| 2013 | 5.6% |

| 2012 | 5.06% |

Is joint cover cheaper than singles health insurance?

In simple terms, taking out a joint couples health insurance policy is the same as taking out two identical single policies, except that you only pay one premium. Because of this, the most significant benefit of couples’ health insurance is convenience, not cost.

While a couples policy might not lower your total base premiums, depending on the age and income of you and your partner, it is possible that a couples policy would affect your eligibility for the Australian Government rebate.

For example, the singles income threshold for the rebate is $158,000, and the family threshold is $316,000, so if you earn $160,000 annually you might not qualify for a rebate as a single. However, if your partner earns less than $142,000, you might qualify for a rebate on your combined family income.

Other private healthcare costs

Will I have out-of-pocket costs with private health insurance?

When you’re treated through the private health care system, you may still have to pay some of the medical costs out of pocket, even if your health insurance policy helps to cover your treatment.

When you’re admitted to hospital as a private patient for a treatment listed on the Medicare Benefits Schedule (MBS) and covered by your insurance policy, Medicare will typically pay for 75% of the MBS fee, and your health fund will pay 25%. However, because the hospital and doctors are allowed to charge above the MBS fee, you may have to pay the difference between the MBS fee and the total cost of your treatment; this difference is commonly referred to as ‘the gap’.

You may be able to avoid or minimise the gap through your health funds gap cover scheme. For more information on how the gap works, see our guide to gap payments here.

What is an excess or co-payment?

The excess is an amount you pay upfront when you’re treated as a private patient for a condition covered by your private health insurance hospital policy. Depending on your policy, you will usually only have to pay the excess on your first hospital admission for the year.

When you take out a health insurance policy, you can typically elect to pay a higher premium in exchange for a lower excess. Or, if you think it’s unlikely that you’ll be admitted to hospital, you could choose a higher excess and pay less in premiums.

Unlike an excess, a co-payment is a fixed amount you pay for every day you’re in hospital. The amount payable is usually capped up to a maximum amount payable annually or per admission.

It’s vital that you’re aware of any excess and/or co-payments on your policy when you sign up for private health insurance to help you avoid unexpected expenses when you’re admitted to hospital. Talk to your health fund or refer to the relevant policy documents for more information.

Can comparing health insurance lower costs?

Comparing your health insurance options regularly is a quick and easy way to ensure you’re getting the best deal for the cover you need. Simply use our online comparison tool to get a quote in minutes, or give us a call to have a chat with one of our friendly comparison experts.

When you compare, it’s also a great opportunity to check if your current policy is the best cover for you. For example, if you have a major life event on the horizon, such as pregnancy or an elective surgery, you may need to upgrade your policy to ensure you’re covered. Alternatively, you may have clinical categories or inclusions you no longer really need and you may be able to save some cash by downgrading your cover.

Here’s what our friend Kochie has to say on the matter:6

“A common one I see is people paying for extras on their policy that they don’t even use. You may be able to switch to a policy that offers fewer services, but it could be more bang for your buck if you are utilising the extras that are included. Have a tinker around to see if there are ways to save or don’t be afraid to pick up the phone and speak to health insurance professionals at places like Compare the Market, who can help you understand what can otherwise be a complex topic.”

Meet our health insurance expert, Steven Spicer

As the Executive General Manager of Health, Life and Energy, Steven Spicer is a strong believer in the benefits of private cover and knows just how valuable the peace of mind that comes with cover can be. He is passionate about demystifying the health insurance industry and advocates for the benefits of comparison when it comes to saving money on your premiums.

Want to know more about health insurance?

1 Compare the Market – One-in-ten Australians are in debt for medical expenses. Published June 2025. Accessed October 2025.

2 Compare the Market – Bill shock: Australians’ biggest health “icks” exposed. Published October 2025. Accessed October 2025.

3 Compare the Market – Half of Australians are avoiding seeking professional help for health issues. Updated 29 October 2025. Accessed October 2025.

4 Compare the Market – Household Budget Barometer 2025. Accessed October 2025.

5 Commonwealth Ombudsman, Privatehealth.gov Data. Released February 2024.

6 Compare the Market – ‘It’s going to hurt’: Government confirms another round of private health insurance premium increases. Updated 26 February 2025. Accessed October 2025.

Talk to an expert

At a time that suits you

Call now