We do not compare all health funds in the market, or all policies from our partner funds. Not all policies or special offers are available to all customers, and some may only be available over the phone or on the website. Learn more.

Private health insurance offers and deals from our partners

Not all offers are available to every customer, and some offers may only be available through our contact centre and not displayed online. Each offer is subject to the provider’s terms and conditions. Learn more about how offers are displayed or call us on 1800 338 253 for more information.

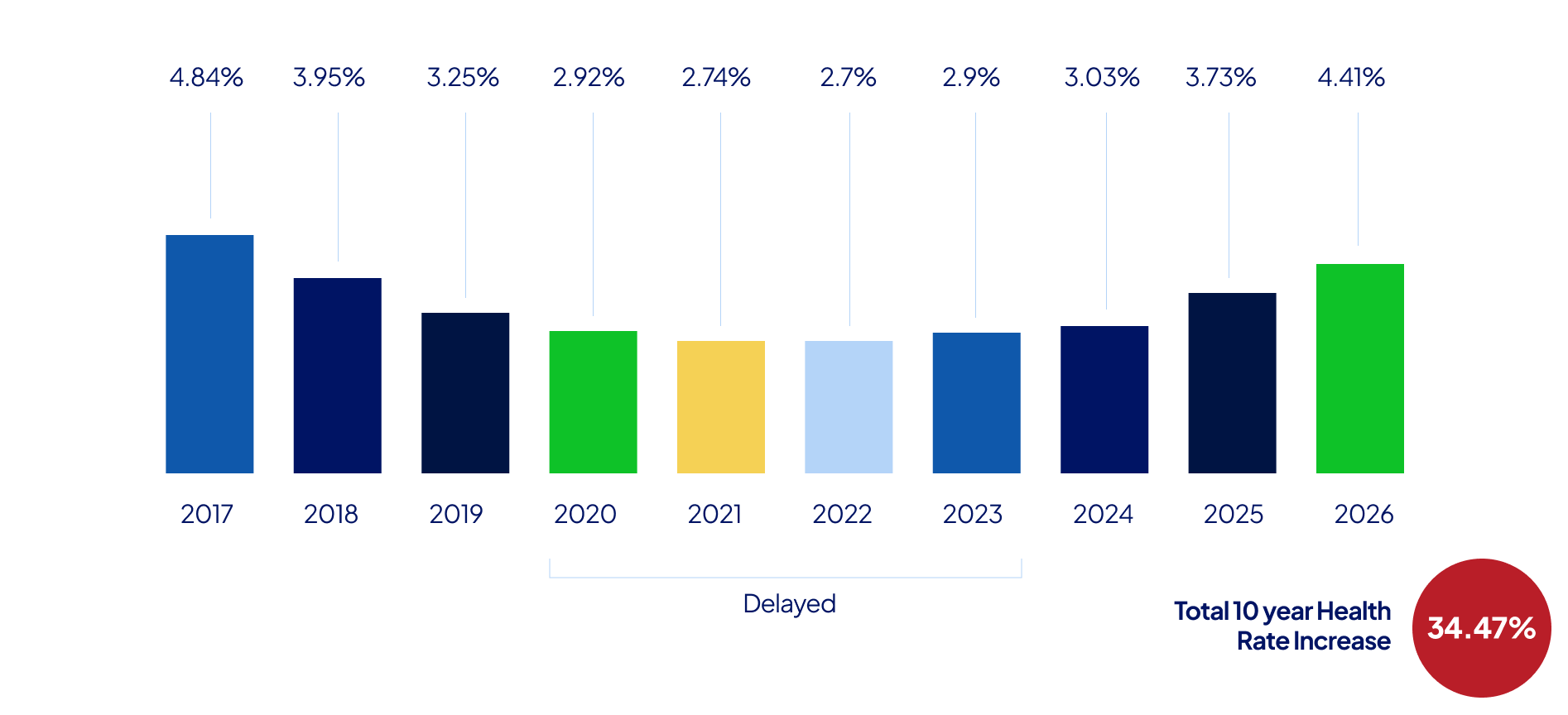

Premiums going up? Our customers are paying less

What are the different types of health insurance?

We’ve compiled this table to show the different types of health insurance and what services each one covers. This information should be used as a guide only and you should always check policy documents for specific details.

Top 5 things to know about health insurance

It pays to compare health insurance

Compare personalised health insurance quotes in minutes and start saving today.

Simple to use

Get started by answering a few quick questions to help us understand your health insurance needs.

Compare & save

Save time and money by easily comparing health insurance options from a range of providers side-by-side.

Switching is easy

Follow a few easy steps online to switch to a new health insurance policy that suits you and your budget.

Why compare with us?

Our smart comparison technology is trusted, free, safe and secure.

We believe the best decisions start with a comparison.

We’re proud to have helped millions of Aussies look for a better deal.

A guide to health insurance

Updated 18 February 2026Methodology of how the offers are displayed

Offers are displayed in the following order and preference:

- Weeks Free

- Cashback / Gift Card

- Waiting Period Waiver

- Cover Type

- Offer Expiry

- Alphabetical

Offer terms and conditions

Get up to 8 weeks free and waive 2 month waiting periods on extras when you join an eligible HCF hospital and extras policy by 20 April 2026. Get 4 weeks free after 90 days continuous cover, and another 4 weeks after maintaining the eligible policy for 12 months. Weeks free will be applied as extension of the paid to date, and may take 6 weeks to process. Must not have been insured under an RT Health or HCF insurance policy or received any promotional discount on an RT Health or HCF policy in the previous 12 months to be eligible. See full terms and conditions here.

Offer terms and conditions

Join Australian Unity by 31 March 2026 and get up to 8 weeks free on eligible hospital and extras cover. Excludes Extras and Hospital-Only. Must not have held Australian Unity health insurance within 90 days prior to 5 January 2026. Must complete 60 days of continuous paid membership, with no suspension or arrears, before being eligible for up to 8 weeks free, and will need to complete 12 months of continuous paid membership to receive the additional 2 weeks free. The initial 6 weeks free will be applied after 60 days of continuous paid membership. Offer fulfilled by extending paid-to date and can take up to 90 days from joining date for the weeks free to be applied provided payment has been maintained during this time. See full terms and conditions here.

Offer terms and conditions

Join NIB & get 6 weeks free and waive 2&6 month waiting periods on extras when you join eligible combined hospital and extras cover by 28 February 2026 and maintain it until 29 April 2026. “6 weeks free” will be applied by adjusting the “paid up to date” on the qualifying policy to reflect the weeks free period. Eligible members who join an Eligible product during the Offer period, which has a start date outside of the Offer Period can qualify for the offer subject to their compliance with NIB’s terms and conditions. Ineligible products are Basic Kickstarter, Basic Accident Hospital combined with Value Extras. Not available to members transferring from a product issued by nib, or have cancelled any of these policies 6 months before or during the Offer Period.

Product issued by nib include: Qantas Health Insurance, Suncorp Health Insurance, GU Health Insurance, AAMI Health Insurance, Apia Health Insurance, ING, Priceline Health Insurance, Real Health Insurance, Seniors Health Insurance, nib International Workers Health Insurance, nib Overseas Students Health Insurance or nib Corporate Health Insurance. Eligible members who join an Eligible product during the Offer period, which has a start date outside of the Offer Period can qualify for the offer subject to their compliance with NIB’s terms and conditions. See full terms and conditions here.

Offer terms and conditions

New HIF Members who take out Combined Hospital and Extras cover by 30 April 2026 and pay by direct debit (excl annual payments) will receive 6 weeks free cover and have 2-month waiting periods waived. 6 weeks free will be applied after 90 consecutive days paid membership from the eligible policy start date. See full terms and conditions here.

Offer terms and conditions

New Eligible AIA Customers who take out Combined Hospital & Extras Policy or Hospital-Only Policy between 1 February and 28 February 2026 and maintain it until 1 June 2026, get 4 weeks premiums reimbursed as cashback to your nominated account. For Combined Hospital & Extras Policies only, maintain the Eligible Policy for a continuous period up to 1 March 2027 and have an AIA Vitality Silver Status or above for an extra 2 weeks refunded.

Eligible customers do not hold and are not insured under a health insurance policy issued by AIA Health as at 1 February 2026, and have not held or been insured under the same in the 2 months prior to 1 February 2026. Eligible Customers have also not utilised any other discount or promotion issued or provided by AIA Health within the last 12 months. See full terms and conditions here.

Offer terms and conditions

Join Bupa by 31 March 2026 and get 6 weeks free on eligible hospital and extras cover. Excludes Extras and Hospital-Only. Must not have held Bupa health insurance within 60 days prior to join date. Policy must commence by 30 April 2026, maintain that cover and meet all payment obligations for 28 consecutive days from the join date and be financial to receive the 6 weeks free offer. Must pay by direct debit. In most cases your 6 weeks free will be applied to your policy, extending the date you are “paid to.” Excludes any hospital product when combined with Freedom 50 and Freedom 60 Extras products. See full terms and conditions here.

Offer terms and conditions

Get 4 weeks free when you join an Eligible combined policy by 31 March 2026. Weeks free will be applied after 8 weeks of continuous cover, provided full payment has been received, and the policy is set to direct debit. Not available for Hospital-only or Extras only policies, policies not purchased in a single transaction, to current See-u members or those who have received a See-u promo in the last 18 months. See full terms and conditions here.

Offer terms and conditions

New HIF Members who take out Hospital-Only cover by 30 April 2026 and pay by direct debit (excl annual payments) will receive 4 weeks free cover. Weeks free will be applied after 90 consecutive days paid membership from the eligible policy start date. See full terms and conditions here.

Offer terms and conditions

For new members who have not been a GMHBA member in the last 12 months, pay on direct debit. Must pay first month to start claiming. 12 month waits, annual and sub limits apply. Extras claims made with a previous fund count towards your annual limits. Not available with any other offer. Offer valid from 1 October 2025 to 31 August 2026.

Offer terms and conditions

For new members who have not been a Frank member in the last 12 months, pay on direct debit. Must pay first month to start claiming. 12 month waits, annual and sub limits apply. Extras claims made with a previous fund count towards your annual limits. Not available with any other offer. Offer valid from 17 February 2026 to 31 August 2026.

Offer terms and conditions

New members that take out and start extras only cover with HIF and pay by direct debit (excl annual payments) by 30 June 2026 will have the 2-month extras waits waived, including optical, which means you can start claiming on any available limits and benefits straight away. Must maintain cover for 60 days to remain eligible, or HIF may withhold the claim value from the premium refund. If the premium refund does not cover the full cost, the member may be required to reimburse the remainder. Offer valid from 1 January to 30 June 2026. See full terms and conditions here.